Mexico Mobile Health Market Size, Share, Industry Trends, Growth Factors and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Mobile Health Market Size, Share, Trends and Forecast by Component, Service, Participant, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

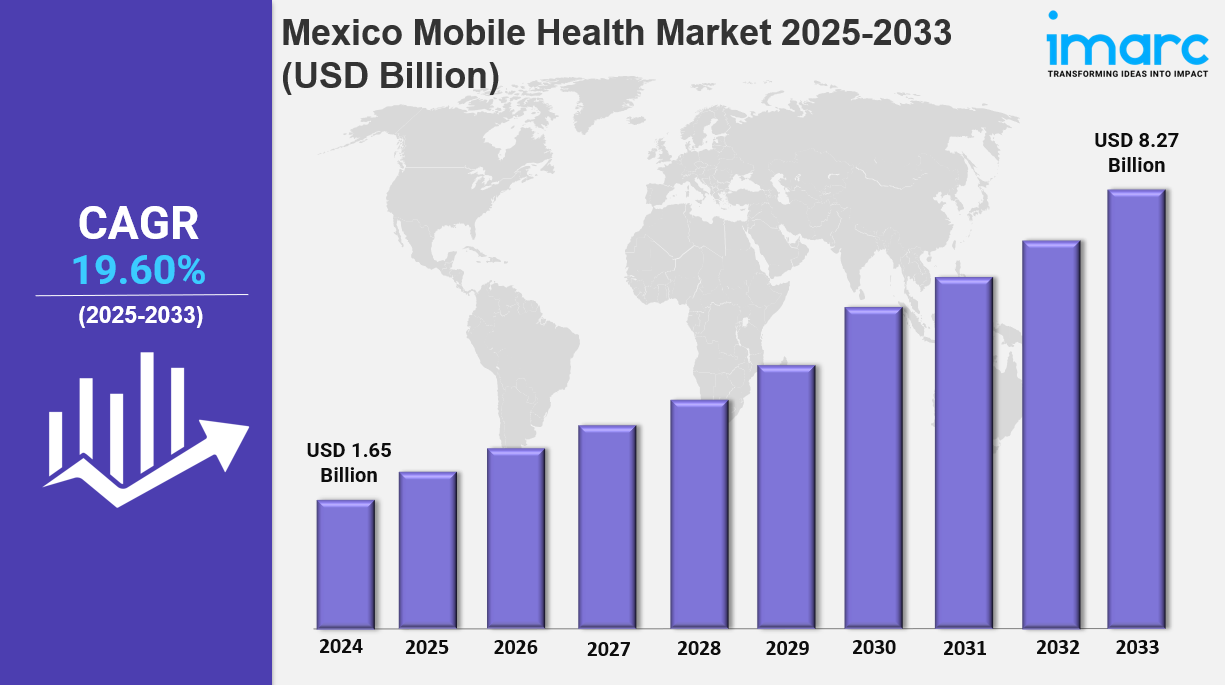

The Mexico mobile health market size reached USD 1.65 Billion in 2024 and is projected to grow to USD 8.27 Billion by 2033. This reflects a robust CAGR of 19.60% over the forecast period from 2025 to 2033. The market growth is driven primarily by rising smartphone penetration and enhanced internet connectivity, which have improved access to telemedicine and mobile health applications especially in underserved regions. Additional growth factors include increasing adoption of wearable health technologies supported by incentives from employers and insurers, alongside government digital health initiatives and private-sector collaborations.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Mexico Mobile Health Market Key Takeaways

-

Current Market Size: USD 1.65 Billion in 2024

-

CAGR: 19.60% during 2025-2033

-

Forecast Period: 2025-2033

-

Rapid adoption of telemedicine services is fueling market expansion, supported by high internet and smartphone penetration.

-

In 2023, 81.4% of Mexicans aged six and above use the internet, with 97.2 million smartphone users, making mobile connectivity essential.

-

The COVID-19 pandemic accelerated the use of mobile health solutions, including virtual consultations and AI symptom checkers.

-

Wearable health devices, such as smartwatches and connected glucose monitors, are increasingly used, with 23.2% of Mexico's population owning an Apple Watch in 2024.

-

Employers and insurance companies promote wearable technology adoption through incentives like discounted premiums and wellness programs.

-

The report segments the market by component, service, participant, and region, covering key market dynamics and competitive landscape.

Sample Request Link: https://www.imarcgroup.com/mexico-mobile-health-market/requestsample

Market Growth Factors

The market for telemedicine in Mexico has been fueled by the increase in smartphone penetration in the country and the improvement in internet connectivity. In 2023, 81.4% of Mexicans aged six and older were using the internet, according to the report. High internet access via smartphones (97% of the Mexican population) and 97.2 million smartphone users in the country create avenues to utilize mobile health apps and remote consultations. The COVID-19 pandemic has contributed to a boom in contactless, convenient telemedicine technologies, such as AI-based symptom checkers and virtual visits, as well as e-prescribing. These technologies, and telemedicine, in general, may be helpful for rural areas that lack many medical facilities.

The increasing adoption of smart watches, connected fitness bands and glucose monitors for chronic disease patients and health-conscious consumers is driving revenue growth in the wearable health technologies market. Wearable health technologies allow users to continuously monitor vital signs such as heart rate and blood pressure as well as physical activity to promote preventive health management. As of 2024, 23.2% of the population of Mexico owned an Apple Watch. Its 66% recommendation rate for online purchase supports the wearables trend. Insurance companies and employers have begun offering incentives to their customers and employees to drive the use of wearables, such as discounts on insurance premiums or wellness programs.

Digital health projects and government-private partnerships are driving innovation in the Mexico mobile health market. Collaboration between healthcare organizations and technology firms is resulting in the establishment of digital health programs to improve the efficiency of the healthcare system as well as service delivery in the market. The wearable tech segment is mainly driven by the use of mobile health application to pass data to a healthcare professional, and for chronic disease prevention and management, a trend increasingly being seen globally. This is expected to see steady growth until 2033.

Mexico Mobile Health Market Segmentation

Component Insights:

-

Wearables

-

Blood Pressure Monitors: Devices that help users track blood pressure continuously for health monitoring.

-

Blood Glucometers: Devices for measuring blood glucose levels in diabetic patients.

-

Pulse Oximeters: Tools for monitoring oxygen saturation in the blood.

-

Neurological Monitors: Equipment for tracking neurological health metrics.

-

Others: Additional wearable devices used for health monitoring.

-

mHealth Apps

-

Medical Apps: Applications designed for medical consultations, diagnosis, and healthcare management.

-

Fitness Apps: Applications focused on fitness tracking and physical wellness.

Service Insights:

-

Monitoring Services: Services that track health parameters remotely.

-

Diagnosis Services: Remote services providing medical diagnoses.

-

Healthcare Systems Strengthening Services: Services aimed at enhancing healthcare infrastructure and capabilities.

-

Treatment Services: Services involving mobile health interventions for treatment.

-

Others: Additional health services offered via mobile platforms.

Participant Insights:

-

mHealth Application Companies: Firms developing mobile health software and applications.

-

Pharmaceuticals Companies: Pharma companies involved in mobile health market.

-

Hospitals: Healthcare institutions participating in mobile health delivery.

-

Health Insurance Companies: Insurers promoting mobile health through incentives.

-

Others: Other stakeholders contributing to the mobile health ecosystem.

Regional Insights

The report divides the Mexico mobile health market into Northern Mexico, Central Mexico, Southern Mexico, and Others. The source does not specify the dominant region or provide exact statistics related to regional market shares or CAGR. Therefore, the dominant region and regional-specific statistics are not provided in source.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=36572&flag=C

Recent Developments & News

On April 04, 2025, 19Labs launched a telemedicine program in Yucatán, Mexico, using GALE clinics to connect ten remote communities with quality healthcare services. Funded by USTDA, the program incorporates mobile health technology such as Zoom and EchoNous to facilitate virtual consultations and advanced diagnostics, emphasizing chronic care management. Plans are underway to expand the program to enhance healthcare access and outcomes for underserved populations in the region.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness