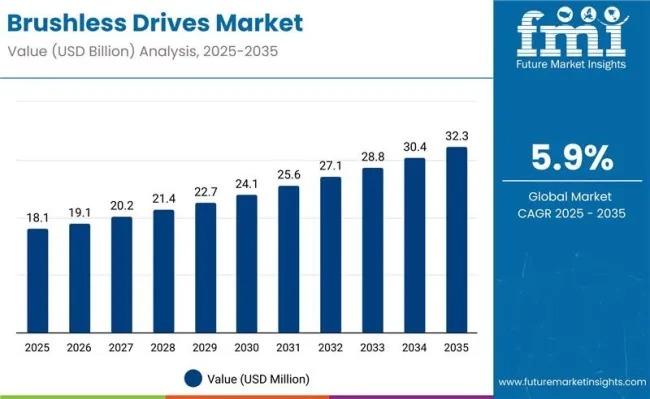

Brushless Drives Market to Surpass USD 32.3 billion by 2035

The global Brushless Drives Market is entering a decade of transformative expansion, with valuation expected to rise from USD 18.1 billion in 2025 to USD 32.3 billion by 2035. This 78.5% absolute growth reflects a CAGR of 5.9%, driven by rapid EV platform deployment, automation-led manufacturing upgrades, and new efficiency benchmarks enabled by SiC and GaN power semiconductors. Demand is intensifying across automotive, industrial machinery, healthcare, and consumer electronics, supported by strong adoption of inner-rotor drive architectures (68% share) and expanding penetration of low-voltage solutions in robotics and mobility applications.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-23373

Between 2025 and 2030, the market is poised to add USD 6 billion in new value as EV manufacturers standardize brushless drives for traction auxiliaries, thermal management, steering, and ADAS actuation. Concurrently, factories across North America, Europe, China, and India are scaling robotics, AMRs, packaging automation, and CNC systems—applications where brushless drives deliver decisive advantages in torque density, response time, and lifecycle durability. From 2030–2035, the rollout of wide-bandgap inverters, sensorless FOC, and integrated motor-drive units is expected to unlock an additional USD 8.2 billion in market expansion.

From 2020 to 2024, steady advancement in EVs, machine tools, and premium appliances pushed market value from USD 14.1 billion to USD 17.3 billion. This foundation of accelerated adoption—supported by improved magnet supply, localized semiconductor ecosystems, and long-life servo drive designs—sets the stage for the faster growth expected during the next decade.

Core Drivers of the Global Market

Electrification Across Mobility:

Automotive applications will represent approximately 38% of global demand in 2025, with growth supported by EV architectures adopting brushless drives for steering, pumps, compressors, and drivetrain subsystems. The sector is projected to expand at a CAGR of 6.3% through 2035.

Industrial Automation & Robotics:

Manufacturers are transitioning to brushless servo drives for their energy efficiency, control bandwidth, and predictive-maintenance capabilities. Integrated motor-controller packages, gaining strong traction in Europe and Japan, shorten commissioning cycles and improve reliability.

Wide-Bandgap Semiconductor Adoption:

SiC and GaN inverters are enabling step-change efficiency improvements through higher switching frequencies, reduced thermal losses, and more compact IP-rated drive enclosures.

Sensorless FOC & Software-Defined Drives:

Advanced algorithms reduce BOM cost, enhance precision at low speeds, and support remote diagnostics, digital twins, and rapid parameter deployment in global factories.

Localized Supply Chains:

Market leaders are diversifying magnet sourcing and PCB assembly across the USA, Europe, China, and Southeast Asia to minimize logistics volatility and ensure compliance.

Regional Growth Outlook

United States:

Growing at 5.5% CAGR, the U.S. market benefits from EV manufacturing expansion, aerospace-grade servo adoption, and the onshoring of automation programs. Low- and medium-voltage drives dominate new warehouse, medical device, and automotive subsystem deployments.

China:

The fastest-growing region (7.0% CAGR), China’s momentum is anchored in NEV production, high robot density, and the scale of its consumer electronics and appliance sectors. Localized SiC-based medium-voltage drives are set to elevate efficiency across industrial segments.

Germany:

At 5.5% CAGR, Germany continues to shape the high-precision segment of the market. Machine-tool clusters, packaging lines, and energy-efficient retrofits continue to adopt SiC-driven, STO-certified servo platforms.

India:

With projected growth of 6.8% annually, India’s two/three-wheeler EV ecosystem and surge in FMCG/pharma manufacturing reinforce demand for low-voltage and medium-voltage drive portfolios.

Japan:

Known for precision robotics and high-spec medical equipment, Japan shows strong preference for inner-rotor drives (≈60%), driven by needs for quiet operation, compactness, and ultra-smooth torque control.

Market Segmentation Highlights

- Motor Type: Inner rotor dominates with 68% share due to its superiority in torque density and bandwidth.

- Voltage Class: Low voltage leads globally at 54%, aligned with battery-driven systems, AMRs, drones, and EV auxiliaries.

- Applications: Automotive, industrial machinery, and consumer electronics remain the largest segments, with aerospace, defense, and healthcare expanding steadily.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness