Mini Drives Market to Surpass USD 10.1 billion by 2035

The global Mini Drives Market is entering a pivotal growth phase, supported by accelerated automation adoption and rising demand for compact motion control solutions across manufacturing, HVAC, packaging, and building systems. As industries modernize and shift toward decentralized architectures, mini drives known for their space efficiency, energy optimization, and programmable control—are becoming foundational components in next-generation industrial equipment.

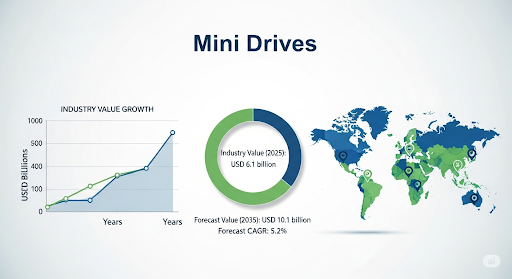

Valued at USD 6.1 billion in 2025, the market is forecast to reach USD 10.1 billion by 2035, reflecting an absolute gain of USD 4.0 billion and a CAGR of 5.2%. Much of this momentum is tied to increased deployment of compact VFDs in robotic systems, conveyor lines, decentralized motor control units, and energy-efficient commercial HVAC installations.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23254

From 2025 to 2030, the industry is expected to add USD 1.6 billion in new growth, driven by SMEs accelerating automation adoption. Compact servo and stepper drives are increasingly deployed in lightweight robotic arms, packaging equipment, and small-scale conveyors—offering precise torque control, reduced wiring, and enhanced machine responsiveness.

Between 2030 and 2035, the sector is projected to expand further by USD 2.4 billion, fueled by the global transition toward modular manufacturing. Smart mini drives, embedded with diagnostics, safety relays, and IoT telemetry, are enabling predictive maintenance and edge-level machine control across food & beverage, pharmaceuticals, and consumer goods industries.

Energy efficiency regulations are also reshaping the market. With global initiatives pushing compliance toward IE3 and IE4 motor standards, mini drives are becoming essential for optimizing airflow, pump operations, and motor speed control in HVAC-R and water facilities. As a result, facility managers are prioritizing compact drives that offer rapid performance tuning and long-term energy savings.

Regional Dynamics: Where Growth Is Accelerating

Asia remains the global growth engine. India leads with a projected CAGR of 6.3%, supported by industrial corridor development, Make in India incentives, and widespread SME automation. Compact drives are increasingly seen in textile machinery, packaging clusters, and building systems across Tier 2 and Tier 3 cities.

China, with a CAGR of 6.0%, is expanding its use of mini drives in packaging, printing, and consumer goods machinery. Local manufacturers are boosting exports to Southeast Asia and Africa while integrating compact drive technology into domestic light industrial equipment.

In North America, the United States is expected to advance at 5.1% CAGR, mainly from retrofit demand in HVAC systems and modernization of warehouse automation. EV manufacturing and laboratory automation are emerging high-value application segments.

Europe holds a significant share, expected to rise from USD 1.3 billion in 2025 to USD 2.1 billion by 2035. Germany, France, the UK, Italy, and Spain are focusing on energy-efficient retrofits, robotics, and precision machinery upgrades in line with Industry 4.0 initiatives.

Segment Highlights

Servo drives, holding 42% of the 2025 share, continue to lead due to their high accuracy, closed-loop control, and compatibility with complex automation environments.

DC motor drives, with 48% revenue share, dominate portable, low-noise, compact machinery applications and remain widely adopted across medical devices, conveyors, and handheld tools.

Automotive manufacturing, capturing 28% share, is using mini drives extensively across welding lines, paint shops, assembly robots, and EV component production.

Key Market Trends

- Energy Optimization Becomes Central – Rising electricity costs and global sustainability mandates are pushing industries to replace fixed-speed motors with variable-speed mini drives.

- Decentralized Automation Gains Traction – Plug-and-play compact drives are enabling modular production lines, reducing wiring complexity and installation costs.

- Enhanced Communication Protocols – Ethernet/IP, EtherCAT, and Modbus-enabled mini drives are empowering real-time system diagnostics in smart factories.

- Cost Barriers in Developing Markets – Small manufacturers in South Asia and Latin America continue to face adoption challenges due to initial investment costs and limited integration expertise.

Competitive Landscape

Leading players—including SEW-Eurodrive, Siemens, ABB, Rockwell Automation, Baumüller, Nidec, and Maxon Motor—are focusing on high-precision drives, compact linear motor stages, and energy-efficient, low-voltage drive OEM solutions.

Recent developments include PI’s 2025 launch of the V-141 precision linear motor stage series and ABB India’s rollout of new IE3 and IE4 high-efficiency motors aligned with domestic manufacturing ambitions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness