South Korea Cryptocurrency Market Size, Growth, Key Players, Latest Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “South Korea Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Cryptocurrency Market Overview

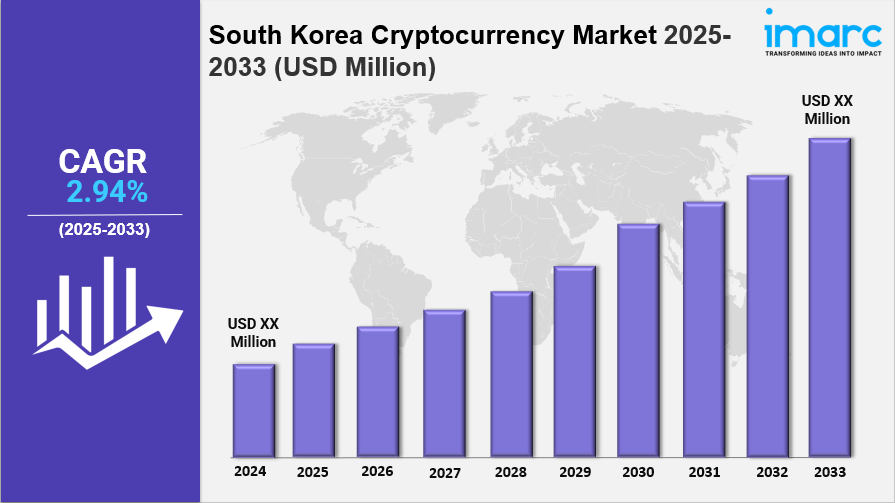

The South Korea cryptocurrency market size is projected to grow at a CAGR of 2.94% during 2025-2033. The market’s expansion is driven by rising adoption of decentralized finance (DeFi) platforms, increasing participation from retail investors, and continuous advancements in blockchain technology. Growing interest in digital payments, trading activities, and crypto-based financial services is further accelerating market development across the country.

STUDY ASSUMPTION YEARS

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

SOUTH KOREA CRYPTOCURRENCY MARKET KEY TAKEAWAYS

- The market is expected to grow at 2.94% CAGR during 2025-2033.

- Strong retail participation, with millions of active cryptocurrency account holders nationwide.

- Regulatory reforms in virtual asset monitoring are shaping the future ecosystem.

- Broader use of cryptocurrencies across trading, payments, remittances, and DeFi.

- Increasing interest in stablecoin development and crypto-linked financial products.

- Technological advancements in blockchain and distributed ledger infrastructure continue to strengthen market adoption.

- Regional growth supported by urban centers like the Seoul Capital Area and emerging participation from other regions.

Sample Request Link- https://www.imarcgroup.com/south-korea-cryptocurrency-market/requestsample

MARKET GROWTH FACTORS

1. Rising Retail Adoption

South Korea continues to witness rapid growth in the number of retail cryptocurrency users. Increased awareness, easy access to mobile trading apps, and a strong digital economy are key forces attracting new investors to the crypto ecosystem.

2. Regulatory Maturation

The regulatory framework for virtual assets is evolving and becoming more structured. Upcoming compliance requirements for cross-border transactions and exchange operations aim to enhance transparency, reduce fraud, and build greater trust among users and institutions.

3. Technological Advancements

Advancements in blockchain, distributed ledger technologies, and crypto security solutions are improving transaction reliability, scalability, and privacy. These enhancements reinforce confidence among both consumers and enterprises.

4. Stablecoin and Digital Asset Innovation

There is rising interest in developing won-backed stablecoins and expanding the use of tokenized financial products. Although debates continue around issuance guidelines, stablecoins are expected to play a larger role in payments and financial services.

5. Broader Use-Case Expansion

Beyond trading and speculation, cryptocurrencies are increasingly used for payments, cross-border remittances, peer-to-peer transfers, and emerging DeFi applications. This diversification of use cases supports market stability and long-term growth.

MARKET SEGMENTATION

By Component

- Hardware

- Software

By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

By Process

- Mining

- Transaction

By Application

- Trading

- Remittance

- Payment

- Others

By Region

- Seoul Capital Area

- Yeongnam

- Honam

- Hoseo

- Others

Speak to Analyst- https://www.imarcgroup.com/request?type=report&id=21885&flag=C

REGIONAL INSIGHTS

The Seoul Capital Area leads the South Korea cryptocurrency market due to its advanced digital infrastructure, high internet penetration, and concentration of fintech and tech-savvy users. Other regions, including Yeongnam, Honam, and Hoseo, are experiencing steady growth as awareness of digital assets increases and financial institutions explore new crypto-related services.

RECENT DEVELOPMENTS & NEWS

- Upcoming regulatory requirements are expected to improve oversight of cross-border virtual asset transactions beginning in 2025.

- Discussions continue around the development and issuance of won-pegged stablecoins, supported by fintech firms and monitored closely by policymakers.

- Research efforts exploring the use of surplus electricity for cryptocurrency mining highlight emerging opportunities for energy-efficient mining strategies.

KEY PLAYERS

- Upbit

- Regional banks exploring stablecoin initiatives

- Fintech companies developing crypto wallets and payment solutions

- Emerging blockchain and DeFi service providers

- Crypto infrastructure and mining technology firms

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness