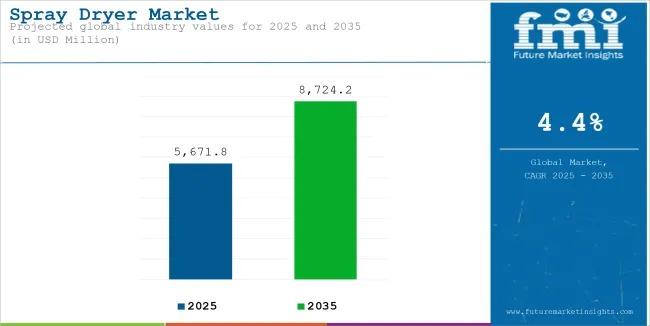

Spray Dryer Market to Surpass USD 8,724.2 million by 2035

The global Spray Dryer Market is entering a new era of expansion as industries accelerate the shift toward high-efficiency drying systems, advanced automation, and sustainable processing technologies. Valued at USD 5,671.8 million in 2025, the market is projected to reach USD 8,724.2 million by 2035, reflecting a steady CAGR of 4.4%. Growth is particularly strong across food & beverage, nutraceuticals, pharmaceuticals, and specialty chemicals—industries where spray drying ensures quality, stability, and precise particle engineering.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-5547

The demand surge is closely linked to rapid urbanization, expanding middle-income populations, and rising processed food consumption across Asia-Pacific, Europe, and North America. Moreover, global pharmaceutical manufacturers are increasing investments in spray drying to support advanced formulations, biologics, and high-performance APIs. Emerging markets like India and China are witnessing heightened installation of processing plants due to supportive regulatory frameworks and rising FDI in food processing.

Technology Evolution and Sustainability Are Reshaping Global Adoption

A major shift is underway as manufacturers prioritize eco-friendly and energy-efficient spray drying solutions. Advanced models now incorporate heat recovery, insulation, and hybrid renewable energy systems capable of reducing energy consumption by up to 30%. Growing global emphasis on low-emission manufacturing—especially in Europe and North America—is accelerating the adoption of these next-generation systems.

The integration of IoT and automation is revolutionizing operational performance. Real-time monitoring of pressure, airflow, and temperature allows precise control, consistent powder quality, and predictive maintenance. Industries adopting IoT-enabled spray dryers are projected to grow at over 8% CAGR through the next decade, supported by rising investments in R&D and AI-driven production optimization.

Food & Beverage and Nutraceuticals Remain the Core Demand Engines

The food & beverage segment is expected to grow at 5.4% CAGR in 2024, making it the largest contributor to global spray dryer revenues. Rapid expansion in ready-to-eat products, instant beverages, dairy powders, and functional nutrition is directly boosting demand for large-scale drying equipment. Spray drying ensures improved shelf life, uniformity, and long-term stability—attributes essential for high-volume packaged goods.

Nutraceuticals, protein supplements, fortified foods, and dietary powders continue to gain momentum as health and wellness spending rises globally. With the global processed food market expected to surpass USD 8 trillion by 2035, spray dryers are set to remain an indispensable part of production infrastructure.

Pharmaceutical and Biotech Applications Accelerate Strongly

Spray drying is increasingly integral to drug manufacturing, particularly for biologics, inhalation therapies, and temperature-sensitive formulations. By enabling controlled particle morphology and stability, spray dryers help enhance drug efficacy and bioavailability. With global biologics sales expected to exceed USD 400 billion by 2035, demand for precision-engineered drying systems will continue to climb across the United States, Europe, China, and India.

Regional Outlook: USA Leads; Asia-Pacific Emerges as Fastest Growing

- United States: Holding 72.7% share of the North America market by 2035, the country leads due to advanced food processing and pharmaceutical infrastructure.

- India: Expected growth at 3.9% CAGR, boosted by high milk production, a USD 600-billion processed food market, and rising pharma exports.

- China: Industrial expansion and rising adoption of modern food technologies push CAGR to 3.6%.

- Germany & Japan: Strong regulatory environments and precision engineering capabilities support steady adoption.

Competitive Landscape

The global market is moderately fragmented, with Tier-1 players including GEA Group, SPX Flow, BUCHI Labortechnik, Acmefil Engineering Systems, and Saka Engineering Systems commanding nearly 50% market share. These companies focus heavily on process optimization, automation, and customized solutions.

Tier-2 players cater to local and niche markets, offering specialized drying systems for dairy, nutraceuticals, and specialty chemicals. Mergers, product innovations, and strategic collaborations remain key competitive strategies across the sector.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness