Avoiding Data Breaches: Cybersecurity in Offshore Accounting

As more businesses embrace global talent and cost-effective financial operations, offshore accounting has become a strategic advantage. But while outsourcing brings efficiency and scalability, it also raises a critical question many business owners worry about: Is my financial data safe overseas?

In today’s digital-first environment, cybersecurity threats are rising faster than ever. That’s why secure offshoring accounting services play an essential role in protecting sensitive financial information and preventing data breaches.

Let’s break down the risks, best practices, and strategies companies can use to ensure their offshore accounting operations remain safe, compliant, and resilient.

Why Cybersecurity in Offshore Accounting Matters More Than Ever

Financial data—bank statements, payroll files, invoices, tax documents—is one of the most valuable assets a company holds. For cybercriminals, this information is a goldmine.

Businesses outsourcing bookkeeping, tax preparation, accounts payable, or payroll overseas must ensure their partners have strong cybersecurity practices because:

-

Offshore teams access sensitive financial records

-

Work is conducted across global networks and cloud platforms

-

Data flows through multiple systems and devices

-

Weak security practices increase breach vulnerability

As cyberattacks grow more sophisticated, a single breach can cost millions, damage customer trust, and trigger compliance penalties.

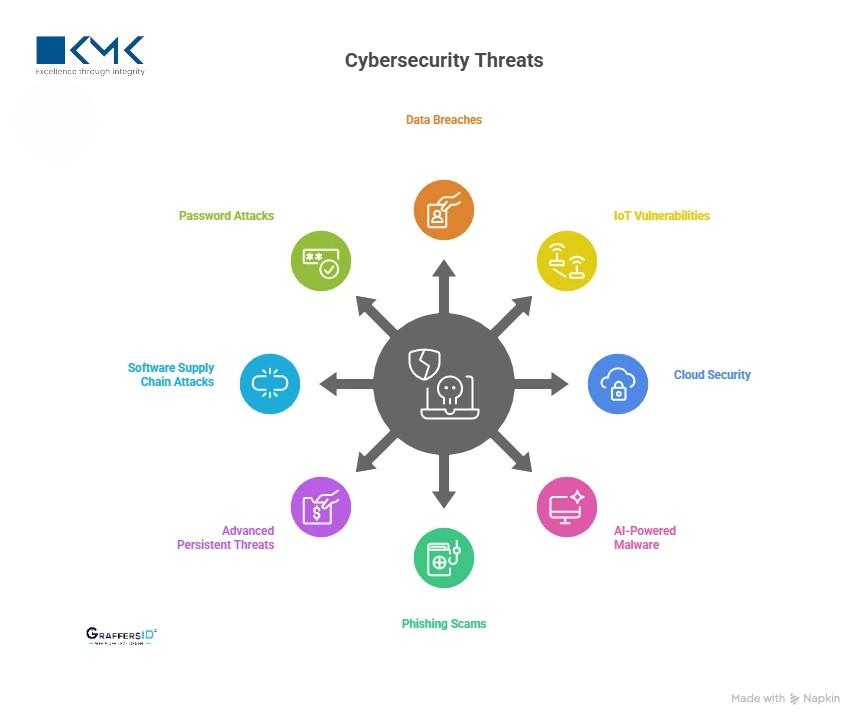

Common Cybersecurity Risks in Offshore Accounting

To protect data, businesses must first understand the common risks in global accounting operations:

1. Unauthorized Access

Weak passwords, unsecured devices, or improper access controls can allow unauthorized individuals to view or manipulate financial data.

2. Phishing and Social Engineering

Cybercriminals frequently target offshore teams with fake emails, posing as managers, vendors, or platform providers.

3. Unsecured Networks

Public Wi-Fi, outdated routers, or remote work setups create vulnerabilities where data can be intercepted.

4. Insider Threats

Both intentional and accidental insider actions—such as mis-sent files or improper data handling—can trigger breaches.

5. Outdated Software

Legacy systems or unpatched tools make it easy for hackers to exploit known vulnerabilities.

To mitigate these risks, strong cybersecurity controls must be built into the offshoring workflow from day one.

How Secure Offshore Accounting Partners Protect Your Data

A reliable offshore accounting provider invests heavily in cybersecurity because financial trust is non-negotiable. Here are the key security practices top offshore firms follow:

1. Role-Based Access Controls

Only authorized team members can access specific files, tools, or client accounts. This ensures:

-

No sharing of credentials

-

No unnecessary access

-

Full accountability for every action

2. Encrypted Data Storage and Transfer

Data encryption protects files during:

-

Upload

-

Transfer

-

Storage

-

Backup

Even if intercepted, encrypted data cannot be read or used.

3. Secure Cloud Systems

Modern offshore accounting relies on trusted platforms like QuickBooks Online, Xero, NetSuite, and secure document portals. These tools ensure:

-

Continuous backups

-

Multi-factor authentication

-

Controlled sharing permissions

-

Data residency compliance

4. Regular Audits and Compliance Standards

Top offshore firms follow international standards like:

-

SOC 2

-

ISO 27001

-

GDPR

-

US-based financial compliance rules

Routine security audits ensure vulnerabilities are detected and fixed early.

5. Employee Training and Certifications

Human error causes nearly 80% of data breaches. Offshore teams reduce this risk by:

-

Ongoing cybersecurity training

-

Anti-phishing drills

-

Data handling protocols

-

Confidentiality agreements and NDAs

An educated team is a strong line of defense.

Technology That Strengthens Offshore Accounting Security

Today’s offshore accounting is powered by cloud automation and digital workflows, making cybersecurity more advanced than ever. Some of the powerful tools that reduce breach risks include:

AI-Powered Fraud Detection

AI tools scan financial transactions to detect suspicious activities or inconsistencies.

Multi-Factor Authentication (MFA)

MFA ensures only verified individuals can log into accounting platforms.

VPNs and Zero-Trust Networks

These tools secure remote access and verify every login attempt, even from trusted users.

Secure Document Portals

Encrypted portals for file exchange eliminate the risks associated with email attachments.

Technology doesn’t just improve accuracy—it builds a digital security shield around offshore operations.

Best Practices to Keep Your Offshore Accounting Secure

Even with a strong partner, businesses should follow these cybersecurity best practices for added protection:

✔ Use Strong Password Policies

Encourage 12+ character passwords with symbols and periodic resets.

✔ Limit Access to Essential Users

Give offshore teams only the permissions they need—not more.

✔ Enable MFA on All Accounting Software

This blocks unauthorized logins even if a password is compromised.

✔ Conduct Regular Data Backups

Backups ensure business continuity during cyber incidents.

✔ Review Vendor Security Policies

Ask about compliance, infrastructure, and security certifications.

When both the business and the offshore partner work together, cybersecurity becomes a shared responsibility.

The Real Cost of a Data Breach

Many businesses underestimate the financial and reputational consequences of a breach. A single incident can result in:

-

Loss of customer trust

-

Regulatory penalties

-

Legal action

-

Operational downtime

-

Damage to brand reputation

For small and mid-sized businesses, the impact can be devastating. That’s why choosing a secure offshore partner isn’t optional—it’s critical.

Why Businesses Trust Secure Offshore Accounting Providers

A dependable offshore accounting provider doesn’t just process numbers—they protect your financial ecosystem. By combining technology, compliance, trained experts, and secure infrastructure, they make offshoring a safe and scalable choice.

Businesses that choose secure partners experience:

-

Faster processes

-

Reduced operational costs

-

Lower fraud risks

-

Stronger compliance

-

Better financial accuracy

When cybersecurity is built into the foundation, offshore accounting becomes a powerful asset rather than a risk.

Final Thoughts

Avoiding data breaches is one of the biggest priorities in today’s digital business landscape. With the right systems, technology, and security protocols, offshore accounting can be just as safe—if not safer—than in-house operations.

By partnering with a trusted provider offering secure offshoring accounting services, businesses gain efficiency, accuracy, and peace of mind. With strong cybersecurity practices in place, your financial data stays protected, compliant, and ready to support long-term growth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness