Egypt E-Invoicing Market Size & Trends Forecast 2025-2033

Market Overview

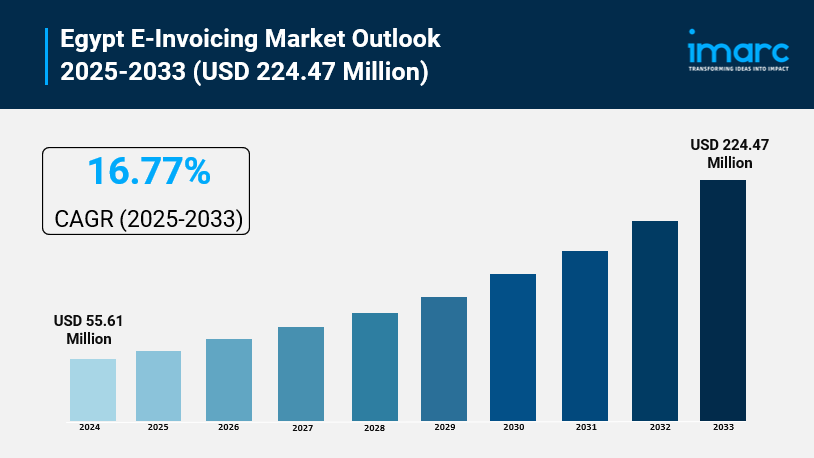

The Egypt e-invoicing market size reached USD 55.61 Million in 2024 and is expected to expand to USD 224.47 Million by 2033. The market is growing strongly due to Egypt’s push towards digitalization, mandatory e-tax compliance, and the rising need for transparency in financial transactions. Cloud-based platforms enhance scalability and integrate with enterprise systems for operational efficiency, while widespread sectoral adoption signifies Egypt's fiscal modernization efforts.

How AI is Reshaping the Future of Egypt E Invoicing Market:

- AI-driven automation enhances invoice processing accuracy and speeds up transaction recording, improving overall financial transparency.

- Integration with cloud-based e-invoicing platforms allows AI to enable dynamic scaling and faster data retrieval across multiple industries.

- The Egyptian Tax Authority's use of AI to streamline Investor Support and Tax Complaints units promotes transparency and eases tax compliance.

- AI-powered analytics facilitate real-time tracking and audit preparedness helping organizations comply with uniform digital standards.

- AI assists interoperability and real-time data exchange between systems, promoting fiscal responsibility across multisector and multiregional invoicing networks.

- AI advances disaster recovery and business continuity by securing data within cloud platforms, thus supporting organizations' uninterrupted operations.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-e-invoicing-market/requestsample

Market Growth Factors

Egypt's strategic digital governance agenda is accelerating e-invoicing adoption nationwide among public and private sectors. The integration of electronic invoicing into national tax systems enables precise real-time transaction records. In May 2025, the Egyptian Tax Authority launched Investor Support, Advance Tax Rulings, and Tax Complaints units to simplify tax procedures, increase transparency, and build business confidence by facilitating easier compliance. This approach fosters reduced paperwork, strengthens reporting compliance, and improves financial data traceability, helping organizations achieve standardized, systematized financial reporting.

The rising preference for cloud-based e-invoicing platforms is driving the market by providing scalability, flexibility, and extensive system integration capabilities. These platforms lower IT infrastructure costs for organizations, automate tax data transmission by integrating with ERP and accounting software, and eliminate delays in financial declarations. Features such as centralized data storage, smooth updates, and rapid retrieval simplify compliance and reporting processes. Cloud-based billing also supports improved disaster recovery and business continuity, enabling companies to focus on expansion and adherence without the limitations of traditional systems.

E-invoicing adoption in Egypt is expanding beyond major cities like Cairo to other economic hubs including Alexandria, the Delta, and the Suez Canal, supported by growing digital infrastructure and regulatory harmonization. Multiple industries including FMCG, e-commerce, BFSI, energy, and government services are deploying e-invoicing to enhance compliance and operational efficiency. This broad multisector and multiregional implementation fosters a transparent and scalable invoicing ecosystem. These shifts align with Egypt’s long-term economic modernization vision and contribute to a resilient, data-driven financial ecosystem encompassing all transaction layers.

Market Segmentation

Channel Insights:

- B2B

- B2C

- Others

Deployment Type Insights:

- Cloud-based

- On-premises

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- May 2025: The Egyptian Tax Authority implemented Investor Support, Advance Tax Rulings, and Tax Complaints divisions to improve tax compliance transparency, streamline procedures, and raise business confidence, accelerating national e-invoicing adoption.

- July 2025: Key e-invoicing platform providers expanded their cloud service offerings in Egypt, promoting flexible deployment models that allowed SMEs and large enterprises to access scalable digital invoicing solutions.

- September 2025: Market reports highlighted a surge in sectoral adoption of e-invoicing across FMCG, BFSI, and government sectors in Egypt's major economic zones, reflecting enhanced operational efficiencies and compliance.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness