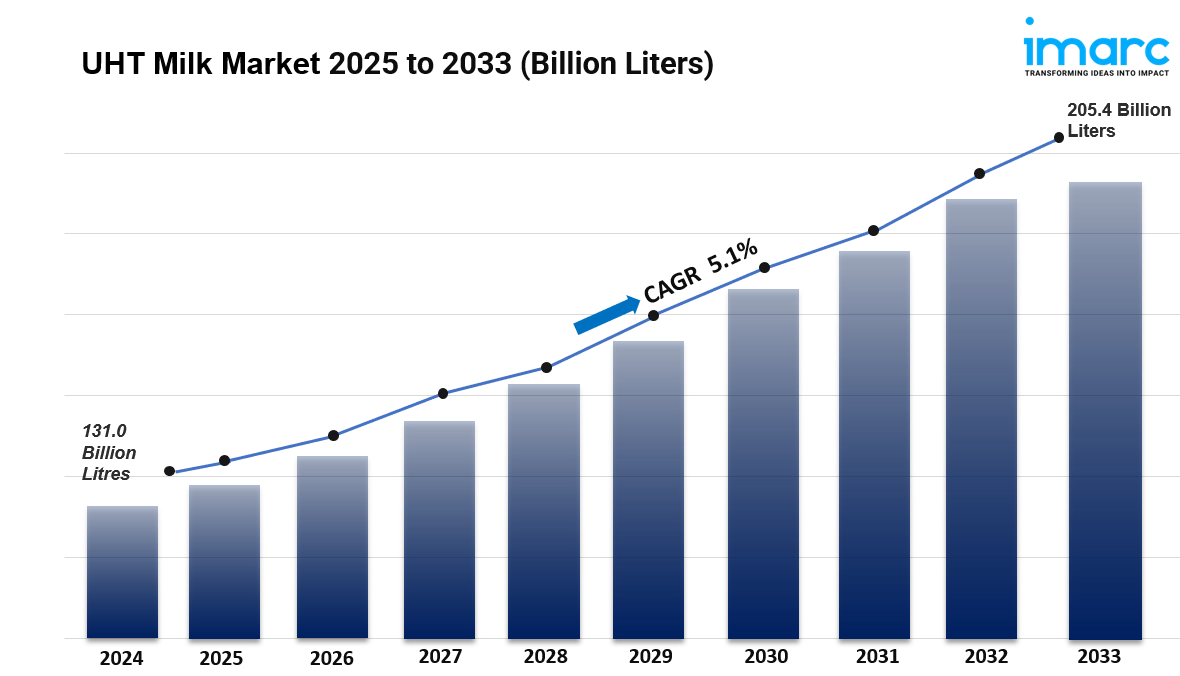

Global UHT Milk Market is Expected to Grow 205.42 Billion Litres by 2033 | CAGR 5.10%

The global UHT milk market was valued at 130.97 Billion Litres in 2024 and is projected to reach 205.42 Billion Litres by 2033, exhibiting a CAGR of 5.10% during the 2025-2033 forecast period. Rising demand for convenience foods with long shelf-life, inflating disposable incomes, and advancements in processing technologies are driving this growth. The UHT milk market size is expanding rapidly due to increasing consumer preference for shelf-stable dairy products and growing awareness about food safety, convenience, and nutritional value. UHT (Ultra-High Temperature) milk undergoes heat treatment that extends shelf life without refrigeration, making it widely recognized for its convenience, safety, and versatility in both household and commercial applications. Rising urbanization, busy lifestyles, and limited cold chain infrastructure in developing regions are fueling global demand. Manufacturers are introducing organic, lactose-free, and fortified UHT milk variants to attract a wider audience. Additionally, the expansion of retail distribution networks, including supermarkets and e-commerce platforms, and the growing adoption of ambient dairy products worldwide are expected to further boost the global UHT milk market size over the forecast period.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

UHT Milk Market Key Takeaways

- Current Market Size: 130.97 Billion Litres (2024)

- CAGR: 5.10% (2025-2033)

- Forecast Period: 2025-2033

- The market is estimated to reach 205.42 Billion Litres by 2033.

- Asia dominates as the largest consumer with 42.00% market share, driven by rapid urbanization and growing demand for convenient dairy products.

- Whole milk is the leading product type, while supermarkets and hypermarkets serve as the top distribution channel.

- Households are the largest application segment, with increasing adoption in foodservice and institutional sectors.

- Market growth is supported by expanding urbanization, technological innovations in processing, and broader retail accessibility.

Grab a sample PDF of this report: https://www.imarcgroup.com/uht-milk-processing-plant/requestsample

Market Growth Factors

The UHT milk market is being propelled by rising urbanization, changing consumer lifestyles, and increasing demand for convenient, shelf-stable dairy solutions. Consumers are increasingly shifting to UHT milk as a practical alternative to fresh milk, particularly in regions with limited refrigeration infrastructure and in urban areas where busy schedules demand convenient food options. According to the United Nations, 68% of the global population is expected to reside in urban areas by 2050. UHT milk's long shelf life, ambient storage capability, and extended usability make it a preferred choice for working professionals, nuclear families, and consumers seeking low-maintenance dairy products without compromising on nutrition and safety.

The introduction of diverse UHT milk variants—organic, lactose-free, fortified, low-fat, and high-protein—caters to evolving consumer preferences and is expanding the demographic reach of UHT products globally. Health-conscious consumers are particularly drawn to functional dairy products fortified with added nutrients, probiotics, and vitamins that support immune and digestive health. The pandemic accelerated interest in nutritional and immune-supportive foods, leading to increased innovation in probiotic and fortified UHT milk options. For instance, in March 2023, Good Culture and the largest US dairy co-op collaborated to introduce Good Culture Probiotic Milk, a long-lasting, lactose-free milk product enhanced with the BC30 probiotic.

Technological advancements in UHT processing and aseptic packaging have greatly enhanced product quality, safety, and consumer appeal. Modern UHT methods ensure milk is heat-treated without compromising taste or nutrients, making it more competitive with fresh milk. Aseptic, tamper-proof packaging extends shelf life and supports easy storage and transportation. Eco-friendly packaging innovations also attract environmentally aware consumers. For instance, in April 2025, the French company Malo Dairy launched ultra-high-temperature milk in Pure-Pak cartons made by Elopak, utilizing aseptic filling technology. These technological improvements allow for wider distribution, even in remote areas, and reduce dependence on cold storage, enabling producers to meet rising global demand and penetrate new markets across regions.

Another contributor is the expanding retail infrastructure and the rise of e-commerce platforms that make UHT milk more accessible to consumers. The growth of organized retail, including supermarkets, hypermarkets, convenience stores, and online grocery platforms, has enhanced product visibility and availability. As more consumers shift to digital grocery platforms, UHT milk is increasingly favored for its durability during transport and longer usability once delivered. The foodservice sector's reliance on UHT milk for its extended shelf life and ease of storage also contributes significantly to market expansion, particularly in hotels, restaurants, catering services, and institutional settings.

Market Segmentation

- Type:

- Whole: Dominates the market with approximately 47.5% share due to its rich taste, creamy texture, and higher nutritional value; contains essential fats and vitamins like A and D, making it a preferred choice for families and health-conscious consumers.

- Semi-Skimmed: Offers a balanced option between whole and skimmed milk, catering to consumers seeking moderate fat content while maintaining flavor and nutrition.

- Skimmed: Appeals to calorie-conscious and weight-management-focused consumers, providing high protein with minimal fat content.

- Distribution Channel:

- Supermarkets and Hypermarkets: Leads the market with around 41.5% share in 2024, offering wide product variety, competitive pricing, and convenient one-stop shopping experiences with strong in-store promotions.

- Convenience Stores: Provides quick shopping options for everyday UHT milk purchases, particularly popular in urban areas.

- Specialty Stores: Dedicated outlets selling organic, premium, and health-oriented UHT milk products.

- Online Retail: E-commerce platforms enabling broad access, home delivery, and contactless shopping, experiencing rapid growth especially post-pandemic.

- Others: Additional retail formats including direct sales to institutions and foodservice establishments.

- Application:

- Household: The largest segment, reflecting UHT milk's popularity in home consumption for drinking, cooking, and beverage preparation across global cuisines.

- Hotels, Restaurants and Catering: Commercial kitchens utilize UHT milk for its convenience, consistent quality, and extended shelf life in high-volume operations.

- Food Processing: Incorporated into packaged foods, beverages, dairy products, and ready-to-eat meal options.

- Institutional: Schools, hospitals, military, and emergency services rely on UHT milk for nutrition programs and food aid.

Regional Insights

Asia currently dominates the market with over 42.00% market share in 2024, driven by rapid urbanization, rising disposable incomes, and increasing consumer demand for convenient and hygienic dairy products. Many Asian countries face challenges with cold chain infrastructure, making UHT milk ideal due to its long shelf life without refrigeration. The growing awareness of food safety and nutrition is boosting preference for processed and packaged milk over loose milk. Busy urban lifestyles and the popularity of on-the-go consumption further contribute to UHT milk's appeal in countries such as China, India, Indonesia, and Vietnam. Government initiatives promoting food quality and expanding retail and e-commerce networks make UHT milk more accessible across the region.

North America, particularly the United States (which accounts for 89.50% of the regional market), is experiencing steady growth driven by consumers' preference for long shelf-life dairy products that align with busy lifestyles. The rise in e-commerce grocery sales has facilitated access to UHT milk, making it popular among urban households and institutions. Demand for lactose-free and organic UHT milk variants caters to health-conscious consumers, while innovations in eco-friendly packaging enhance product appeal. Rising interest in emergency preparedness and pantry stocking has also led to increased adoption of UHT milk as a dependable, non-perishable dairy option.

Europe demonstrates significant market presence due to long-standing consumer familiarity with shelf-stable dairy, particularly in France, Germany, Italy, and Spain. Strong distribution infrastructure and the product's alignment with convenience-oriented lifestyles support market growth. Cross-border trade within the European Union benefits from streamlined regulations and harmonized standards, facilitating efficient movement throughout the region. Innovation in organic, lactose-free, and fortified UHT milk options is expanding the consumer base.

Latin America is influenced by growing e-commerce penetration and changing consumption patterns driven by urbanization. The rise of single-person households and busy urban lifestyles is driving demand for convenient, ready-to-store dairy products. For instance, e-commerce growth in Brazil is projected to surpass USD 200 Billion by 2026.

The Middle East and Africa market is propelled by rising urbanization, limited cold chain infrastructure, and growing demand for long-lasting, hygienic dairy options. In many parts of the region, inconsistent refrigeration and high ambient temperatures make UHT milk a practical alternative. Rapid population growth in urban centers is increasing consumption of packaged foods. The urban population in Africa reached 698,148,943 individuals in 2025, accounting for 45% of the total population, supporting continued market expansion.

Recent Developments & News

- April 2025: Malo Dairy (SILL Enterprises) launched ultra-high-temperature milk in Pure-Pak cartons made by Elopak, utilizing the aseptic filling line installed in 2024.

- March 2023: Good Culture and the largest US dairy co-op collaborated to introduce Good Culture Probiotic Milk, a long-lasting, lactose-free milk product enhanced with BC30 probiotic supporting immune and digestive health.

- July 2023: Akshayakalpa Organic, India's first certified organic dairy company, announced expansion into 42 cities nationwide with new UHT milk packaging designed to enhance convenience for organic milk consumers.

Key Players

- Amul (GCMMF)

- Arla Foods amba

- China Mengniu Dairy Company Limited

- Dairy Group South Africa

- Dana Dairy Group

- FrieslandCampina

- Hochwald Foods GmbH

- Lactalis International

- Saputo Dairy Australia Pty Ltd.

- Sodiaal

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=636&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness