GCC Car Rental Market Size & Trends Forecast 2025-2033

Market Overview

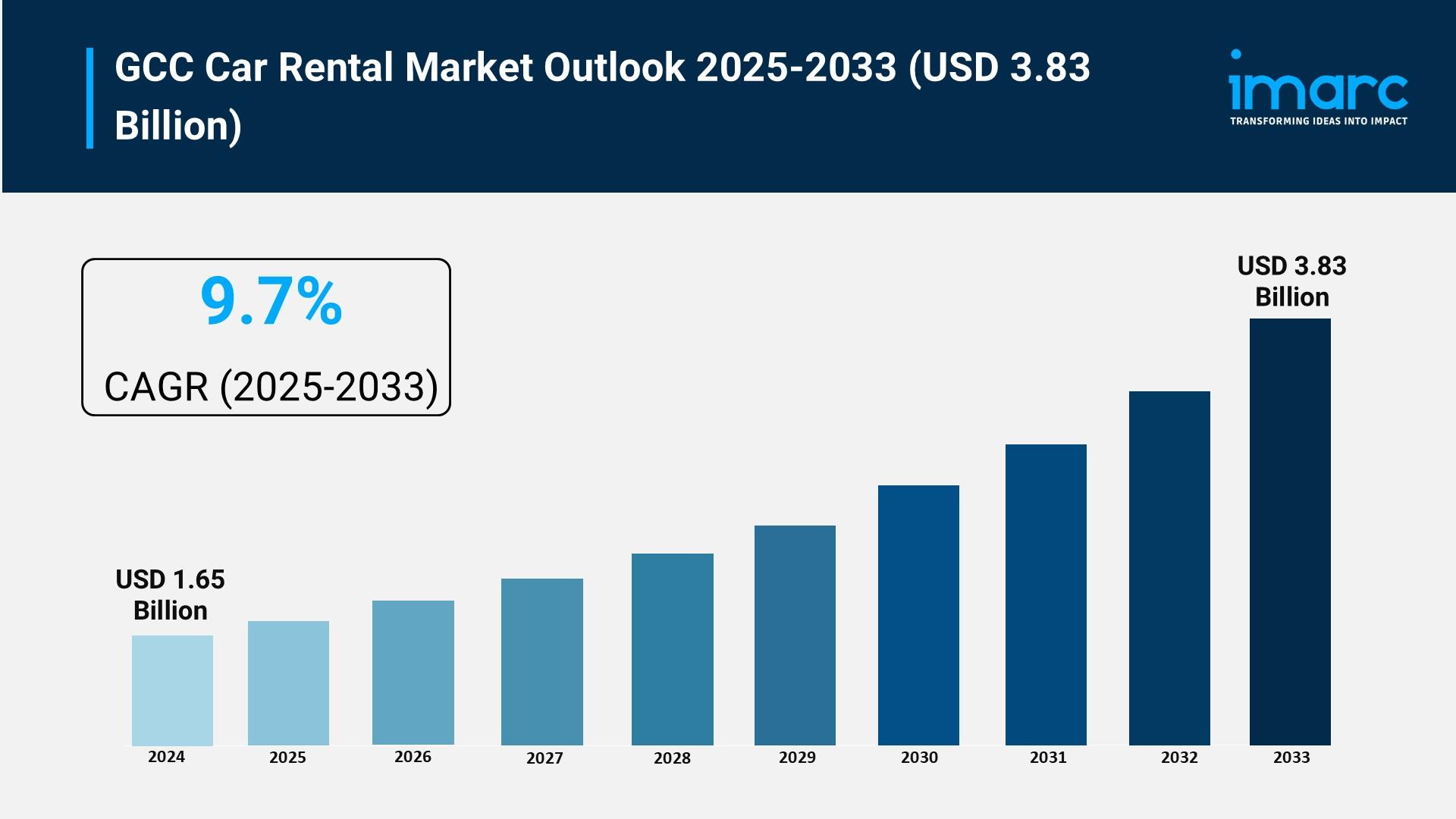

The GCC car rental market size was valued at USD 1.65 Billion in 2024 and is projected to reach USD 3.83 Billion by 2033. The market growth is vigorous, propelled by increased tourism, booming business travel, a rising expatriate population, and ongoing infrastructure advancements. Government initiatives, such as Saudi Arabia's Vision 2030, and technological integrations enhance rental accessibility and convenience. Business hubs like Dubai, Riyadh, and Doha further contribute to demand for flexible mobility solutions.

How AI is Reshaping the Future of GCC Car Rental Market:

- AI-enabled digital booking platforms enhance convenience, enabling real-time price comparison and seamless reservations that increase online booking adoption.

- Implementation of AI-powered fleet management improves vehicle utilization, maintenance scheduling, and reduces downtime, helping companies optimize operational efficiency.

- AI-based predictive analytics assist companies in demand forecasting and dynamic pricing strategies, matching supply with fluctuating market needs.

- Government smart city initiatives, such as Saudi Arabia’s Vision 2030, incorporate AI-driven transport services, integrating car rentals with broader mobility ecosystems.

- Partnerships between rental companies and AI-powered ride-sharing platforms like Careem and Uber broaden service offerings and accessibility.

- AI-driven personalized customer experiences, through chatbots and recommendation engines, improve customer satisfaction and loyalty.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-car-rental-market/requestsample

Market Growth Factors

The GCC car rental market is driven significantly by rising tourism, with countries including the UAE, Saudi Arabia, and Qatar hosting major events like the Dubai Expo and FIFA World Cup. Over 9.3 million tourists visited Dubai in the first half of 2024 alone, marking a growth rate exceeding 9%. Religious tourism in Saudi Arabia, particularly for Hajj and Umrah pilgrimages, fuels the demand for short-term rentals, as pilgrims prefer renting vehicles for transit between holy sites. This sustained tourism influx ensures continuous demand growth in the car rental sector.

Infrastructure development is another critical accelerator for market growth. The GCC countries are investing heavily in building world-class roads, highways, and airports, making road travel increasingly accessible. Initiatives like Saudi Arabia's Vision 2030 focus on smart city development, while Dubai’s vast, sophisticated road networks include vehicle rental services directly at busy airports ensuring visitors can immediately obtain transportation upon arrival. Such infrastructure improvements enhance rental convenience and increase market appeal.

The expanding expatriate population also plays a crucial role. With expatriates forming significant proportions of populations—such as 88.5% in the UAE and 87.9% in Qatar—they often prefer car rentals over ownership due to flexibility and cost-effectiveness, especially for temporary assignments or visitors. Businesses offering long-term leasing options respond to this need, providing hassle-free solutions inclusive of maintenance and insurance. This trend favors the growth and diversification of the car rental market in the GCC.

Market Segmentation

Booking Type:

- Offline Booking

- Online Booking

Rental Length:

- Short Term

- Long Term

Vehicle Type:

- Luxury

- Executive

- Economy

- SUVs

- Others

Application:

- Leisure/Tourism

- Business

End User:

- Self-Driven

- Chauffeur-Driven

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- October 2024: Strong Rent a Car partnered with Skyline Automotive in Qatar, securing a fleet deal of 150 new Geely vehicles, enhancing fleet capacity and service offerings.

- September 2024: Finalrentals expanded Middle East operations by partnering with Key Rent A Car in Saudi Arabia, enabling client access to vehicles at 51 sites across 15 Saudi regions, strengthening market presence.

- October 2025: Government collaboration with car rental firms under smart city programs increased digital integration and enhanced customer experience, reflecting in higher rentals at major hubs including Riyadh and Dubai.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness