Saudi Arabia Cement Clinker Market Size & Trends Forecast 2025-2033

Saudi Arabia Cement Clinker Market Overview

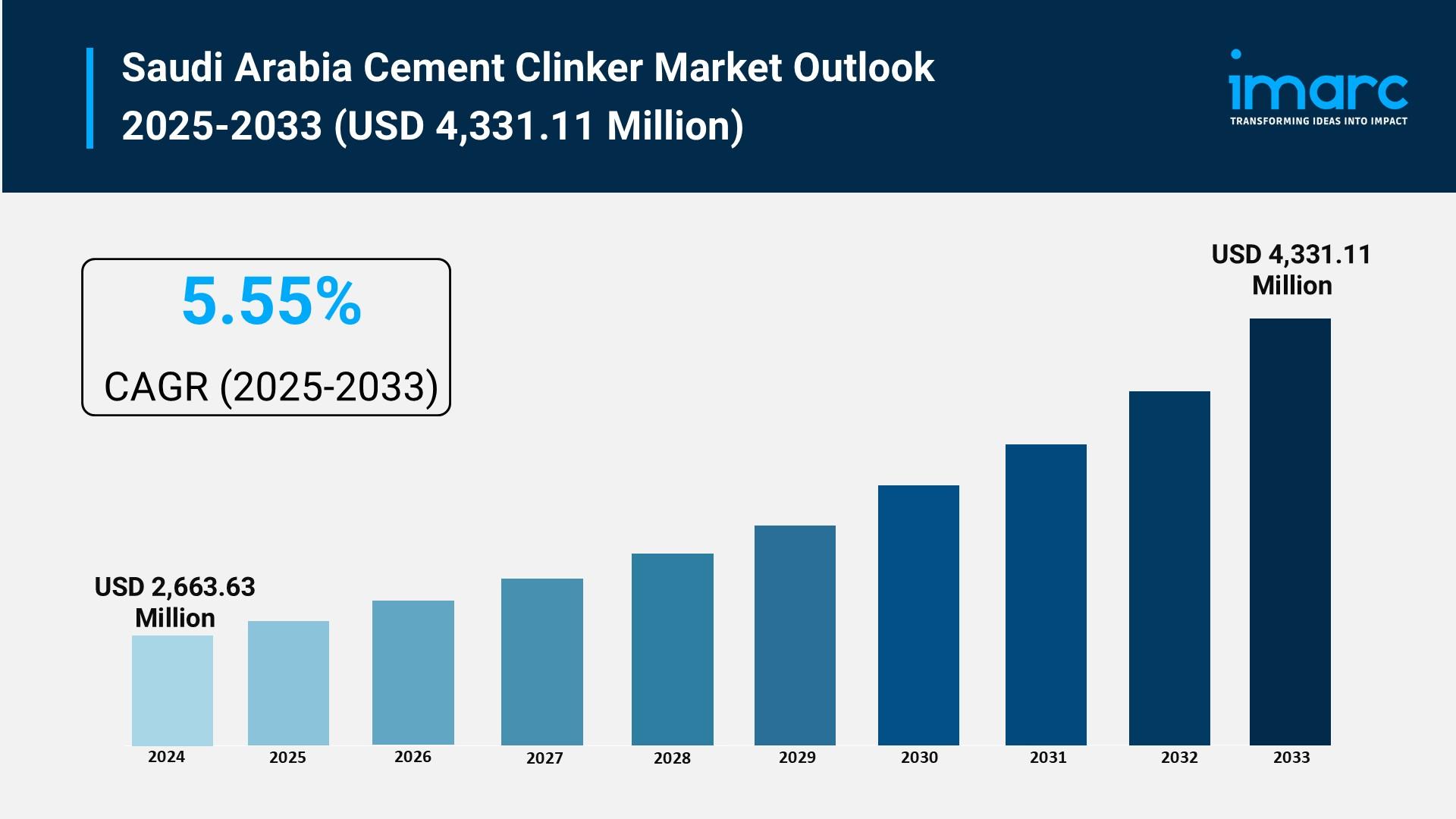

Market Size in 2024: USD 2,663.63 Million

Market Size in 2033: USD 4,331.11 Million

Market Growth Rate 2025-2033: 5.55%

According to IMARC Group's latest research publication, "Saudi Arabia Cement Clinker Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia cement clinker market size reached USD 2,663.63 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,331.11 Million by 2033, exhibiting a growth rate of 5.55% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Cement Clinker Market

- Optimizing Production Efficiency: AI-powered systems are being deployed across Saudi cement plants to reduce energy consumption by 5-20% through real-time kiln optimization. Companies like Carbon Re are implementing predictive maintenance and digital fuel mix optimization, with major producers adopting automated emissions tracking to improve operational compliance and cut production costs.

- Accelerating Green Cement Innovation: Artificial intelligence is helping develop next-generation low-clinker cements, with firms like alcemy deploying AI-powered quality control to create blends that reduce emissions by up to 65%. The technology enables manufacturers to test and optimize supplementary cementitious materials like fly ash and slag, supporting Saudi Arabia's carbon neutrality goals by 2060.

- Enhancing Smart Manufacturing: The Kingdom's cement sector is embracing digital transformation through programs like "Future Factories," where AI automates plant operations and minimizes manual processes. This shift is streamlining production workflows at facilities across Riyadh and the Eastern Region, making plants more responsive to demand fluctuations from megaprojects.

- Improving Supply Chain Intelligence: AI-driven analytics are helping cement producers forecast demand patterns from Vision 2030 projects like NEOM and The Line. With machine learning algorithms analyzing construction timelines and material requirements, manufacturers can better manage their inventory of 135 million tonnes of clinker stock and optimize distribution across the Kingdom's four regions.

- Supporting Alternative Fuel Integration: AI systems are enabling Saudi cement plants to safely incorporate alternative fuels like shredded tires and processed municipal waste into kilns. Companies such as City Cement are using smart monitoring to burn these materials without harmful emissions, reducing fossil fuel dependency while tackling waste management challenges.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-cement-clinker-market/requestsample

Saudi Arabia Cement Clinker Market Trends & Drivers:

Saudi Arabia's cement clinker market is riding a wave of unprecedented infrastructure spending driven by Vision 2030. The Roads General Authority alone allocated SAR 3 billion (around $798 million) for road infrastructure in the Riyadh area, covering 516 km of new roads and 2,500 km of road maintenance. These massive infrastructure pushes are creating steady demand for high-strength clinker-based cement. The Kingdom's 17 cement producers are responding to this surge, with clinker production reaching 14.89 million tonnes in Q4 2024—a 7% jump from the previous year. What's driving this isn't just roads and bridges. Megaprojects like NEOM, ROSHN, and Diriyah are pulling in large cement volumes, particularly in the Tabuk, Riyadh, and Eastern regions. The result? Cement sales jumped 21% in Q2, with local demand accounting for 97% of dispatches. This kind of sustained government commitment through the Public Investment Fund is giving producers long-term volume certainty, even as they navigate regional overcapacity challenges.

The renewable energy transition is becoming a major growth catalyst for cement clinker in Saudi Arabia. The Kingdom has committed to generating 50% of its energy from renewable sources as part of Vision 2030, with $150 billion earmarked for renewable investments. Solar farms, wind turbine bases, and green hydrogen facilities all require durable cement that can handle environmental stress—and that means more clinker. These energy infrastructure projects demand specialized cement formulations with specific strength and setting characteristics, directly driving clinker consumption. Beyond just the sheer volume, renewable projects are also influencing where production happens. Facilities near project sites in the Western and Central regions are seeing increased activity as producers optimize their supply chains for project-based demand. Companies are positioning themselves strategically to service major initiatives like those planned for NEOM, where energy infrastructure is being built from the ground up. This intersection of clean energy ambitions and construction material needs is creating a new demand stream that's expected to sustain clinker production well into the next decade.

Prefabricated and modular construction is gaining serious traction in Saudi Arabia, and it's reshaping clinker demand patterns. The Saudi modular construction market was valued at $833.5 million in 2024, and developers are increasingly choosing these methods to cut construction timelines and labor costs. Prefab construction requires consistent, high-quality cement—which puts pressure on clinker specifications. Elements like walls, beams, and floor panels produced off-site need cement that meets strict strength and setting time criteria, making quality control critical throughout the clinker production process. This shift toward modular methods isn't just a passing trend. With developers under pressure to deliver projects faster, especially for Vision 2030 initiatives, the adoption of prefab is accelerating. The Eastern Province Cement Company recently secured 300 million Saudi riyals in financing to build a new 10,000-ton-per-day clinker line, partly to meet the exacting standards prefab construction demands. Companies that can deliver consistent clinker quality are finding themselves better positioned to capture this growing segment. The rise of modular construction is also driving innovation in clinker formulations, as manufacturers work to develop products specifically tailored to the speed and precision requirements of factory-based building component production.

Saudi Arabia Cement Clinker Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Ordinary Portland Cement (OPC)

- Blended Cement

Distribution Channel Insights:

- Direct Sales

- Distributors/Wholesalers

- Online Sales

Application Insights:

- Residential

- Commercial

- Infrastructure

End-Use Industry Insights:

- Construction

- Manufacturing

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Cement Clinker Market

- January 2024: Eastern Province Cement Company signed a 1.01 billion Saudi riyal contract with China National Materials International Engineering Co., Ltd. to build a new production line with 10,000 tons daily capacity, funded by a 300 million riyal financing agreement with the Saudi Industrial Development Fund to modernize facilities and improve efficiency.

- July 2025: Hoffmann Green Cement Technologies achieved ASTM C1157 certification for its H-UKR 0% clinker cement in both the US and Saudi Arabia, marking the first time a clinker-free cement has received this international recognition, opening doors for roads, bridges, and precast applications in the Kingdom.

- August 2025: Cement sales in Q2 reached 13.13 million tonnes, up 21% year-over-year, driven by megaprojects like NEOM, ROSHN, and The Line. Al Yamama Cement captured 15.2% market share with 1.93 million tonnes sold locally, benefiting from accelerated Vision 2030 infrastructure spending in the Tabuk and Riyadh regions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness