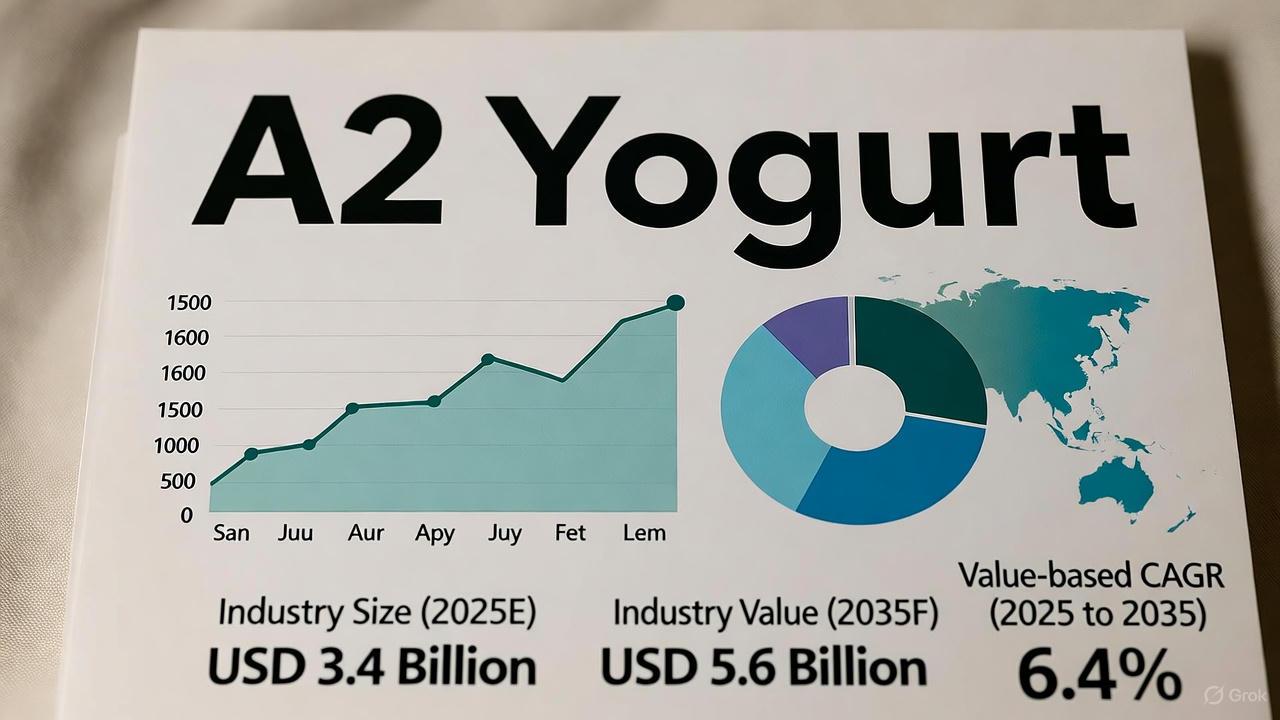

A2 Yogurt Market to Surpass USD 5.6 Billion by 2035

The global A2 yogurt market is witnessing a dynamic shift as health-conscious consumers increasingly favor easily digestible and natural dairy products. Valued at USD 3.4 billion in 2025, the market is projected to reach USD 5.6 billion by 2035, growing at a CAGR of 6.4% during the forecast period. This surge is fueled by expanding consumer awareness of gut health, clean-label ingredients, and the nutritional advantages of A2 protein.

Unlike traditional yogurt, A2 yogurt is made exclusively from A2 milk, which contains only the A2 beta-casein protein. The absence of A1 protein makes it gentler on digestion and an attractive choice for those seeking healthier dairy alternatives. As a result, A2 yogurt has evolved from a niche health product to a mainstream wellness staple in several markets, including the U.S., Australia, Germany, and China.

Get this Report at $3500 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-19920

Established Dairy Leaders and Emerging Innovators Shape Market Dynamics

Global dairy giants such as Danone, Nestlé, and The A2 Milk Company are strengthening their foothold in the A2 segment through strategic investments, acquisitions, and new product launches. For instance, The A2 Milk Company’s acquisition of a majority stake in Mataura Valley Milk underscores its commitment to innovation in premium A2 nutrition. Similarly, Danone and Nestlé have diversified their portfolios by introducing A2 yogurt lines catering to health-focused consumers across Europe and North America.

Meanwhile, emerging players such as Arla Foods, Lactalis, and Amul are leveraging regional supply chains and local partnerships to expand production capacity and reach new consumers. Smaller producers like Highland Farms and Alexandre Family Farm are also entering the market with sustainability-driven offerings, focusing on organic sourcing and transparent labeling. This blend of established manufacturers and innovative newcomers is accelerating global A2 yogurt adoption while fostering technological advancement in dairy processing.

Plain A2 Yogurt Gains Popularity as Consumers Prioritize Natural Nutrition

Among product variants, plain A2 yogurt holds the highest market share at 37.6% in 2025. Consumers are increasingly drawn to its natural composition, free from added sugars and artificial additives. The segment’s rise aligns with the global movement toward clean-label and minimally processed foods, with fitness and wellness enthusiasts seeking high-protein, low-sugar options. Manufacturers are responding with innovations such as fortified, high-protein variants that enhance the yogurt’s nutritional profile and expand its culinary applications.

Supermarkets and Hypermarkets Drive Market Accessibility

Retail availability continues to play a pivotal role in shaping the A2 yogurt market outlook. Supermarkets and hypermarkets are expected to account for 36.4% of total sales in 2025, providing consumers with convenient access to premium A2 dairy products. These modern retail formats ensure optimal storage conditions, promote trial purchases, and drive repeat buying behavior. Additionally, the growth of online platforms is complementing traditional sales channels, offering consumers greater product variety and doorstep convenience.

Technological Advancements and Global Expansion Boost Growth

Advances in dairy processing technology are helping manufacturers overcome the challenges associated with A2 milk production, such as heat stability and acid gelation issues. Processors are investing in precision fermentation and genetic breeding techniques to improve yield and product quality. This technological evolution, coupled with growing A2 dairy herds across India, China, and the U.S., is creating a strong foundation for market expansion.

Emerging markets like India are particularly promising, where A2 yogurt demand is fueled by cultural familiarity with dairy and increasing health consciousness. As consumers in these regions seek premium, digestible dairy options, both established and new manufacturers are positioning themselves to meet this evolving demand through localized production and new product development.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness