Nanomedicine Market Size, Share, Industry Overview, Growth and Forecast 2025-2033

IMARC Group, a leading market research company, has recently released a report titled "Nanomedicine Market Size, Share, Trends and Forecast by Nanomolecule Type, Product, Application, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global nanomedicine market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Nanomedicine Market Highlights:

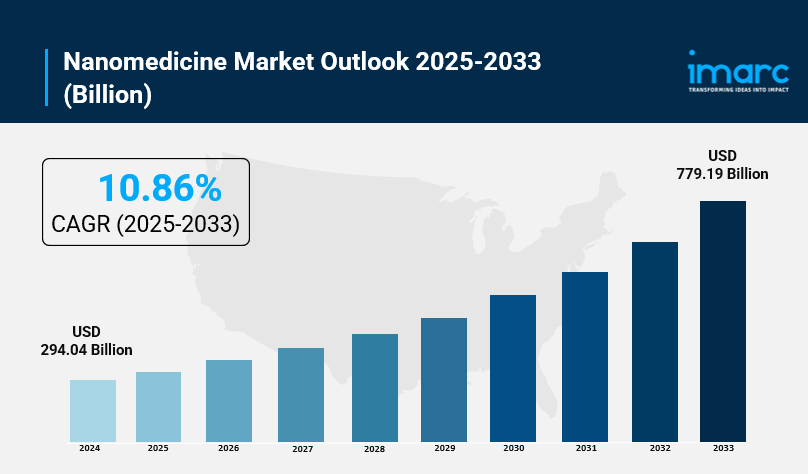

- Nanomedicine Market Size: Valued at USD 294.04 Billion in 2024.

- Nanomedicine Market Forecast: The market is expected to reach USD 779.19 billion by 2033, growing at an impressive rate of 10.86% annually.

- Market Growth: The nanomedicine market is experiencing robust growth driven by rising cancer incidence rates and the urgent need for targeted treatment options that minimize side effects.

- Technology Integration: Advanced technologies like RFID tracking, AI-powered analytics, and IoT-enabled drug delivery systems are revolutionizing precision medicine and personalized healthcare.

- Regional Leadership: North America commands the largest market share at 49.9%, fueled by strong research infrastructure, significant healthcare investment, and favorable regulatory frameworks.

- Innovation Surge: Breakthrough developments in nanoparticle design, particularly in targeted drug delivery and STING pathway activation, are transforming cancer therapy outcomes.

- Key Players: Industry leaders include Abbott Laboratories, Pfizer Inc., Merck & Co. Inc., Novartis AG, and Nanobiotix, which dominate the market with cutting-edge solutions.

- Market Challenges: High production costs, complex regulatory pathways, and the need for seamless integration with existing healthcare infrastructure present ongoing challenges.

Claim Your Free “Nanomedicine Market” Insights Sample PDF: https://www.imarcgroup.com/nanomedicine-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Chronic Disease Burden:

Chronic diseases like cancer are becoming more common across the globe. The National Cancer Institute estimates 2025 will bring 2041910 new cancer diagnoses in the United States and 618120 cancer deaths in that country. The annual incidence rate for cancer is 445.8 in 100,000. High cancer prevails and puts huge pressure on health care systems to find more effective cancer therapies. A solution to the challenges of cancer therapies has been developing in nanomedicine which provides targeted chemotherapy to the diseased cells, limiting damage to normal cells and the toxic side effects associated with customary chemotherapeutics. In September 2024, a pan-viral nanomedicine developed at the University of Chicago Medicine Thorough Cancer Center showed improved intratumoral penetration and retention following STING pathway activation, ultimately achieving highly effective and curable effects in preclinical studies.

- Revolutionary Breakthroughs in Targeted Drug Delivery:

Nanotechnology is transforming therapeutic delivery, by the introduction of nanoparticles, liposomes and nanoscale coordination polymers (NCPs) into every element of nanomedicine, offering unprecedented drug targeting advantages. These nanomedicine systems overcome a bottleneck of conventional chemotherapy: the enormous majority of drug is metabolized or excreted through enzymes or kidneys before ever reaching the target tumors. In May 2025, Netherlands-based nanomedicine contract research organization Nanoworx B.V. announced it would be scaling up service offerings to include design, development and scale-up of nanoparticle medicines for academic and commercial clients. This is in addition to Nanoworx's existing capabilities, which enable easier translation of lab discoveries into clinical applications via its equipment and know-how. In November 2024, EVŌQ Nano announced that it was expanding its platform of antimicrobial medical devices to include EVQ-218, a non-ionic silver nanoparticle with greater than 99.99% pathogen killing. This proves that nanomedicines are not limited to oncology and can have applications in infections and implantable devices.

- Massive Government Investment Driving Innovation:

Global investment in nanomedicine R&D is substantial. In 2021, the US National Institutes of Health (NIH) invested USD 625 million within nanomedicine. The National Nanotechnology Initiative coordinates nanoscale science, engineering and technology across 11 U.S. federal agencies. They have nanoscale R&D budgets, showing annual spending above USD 2 billion. The NIH budget for extramural research grants during United States fiscal year 2023 was US$34.9 billion to 58950 institutions covering topics such as the support of the initial effort to establish AI-enabled biomedical nanomedicine. For example, NIH recently announced the award of US$14.6 million to Georgia Tech and Emory University for cardiovascular nanomedicine research. The Nano Mission in India has been launched by the Government of India to establish centers of excellence, and to support start-ups in the country. As a part of Production-Linked Incentive (PLI) scheme, the Government of India has committed USD 1.06 billion towards manufacturing of semiconductors and electronic components based on nanotechnology. In Europe, the Horizon Europe programme provided EUR 4.7 million, in funding to NANORIGO, which was a collaborative project of 28 partners, led by Aarhus University.

- Clinical Translation and Regulatory Support Accelerating Market Growth:

Translation of nanomedicine is accelerating with favorable regulatory environments, such as fast-tracking of clinical trials. Since the introduction in 1995 of the first nanomedicine Doxil (pegylated liposomal doxorubicin), there are around 700 health products using nanomaterials across all disease classes in development or on the market. Also in 2022, the FDA published final guidance on drug development for products containing nanomaterials, including the mechanisms for filing an application. This regulatory certainty is contributing to increased investment within the nanomedicine field by pharmaceutical companies. The European Medicines Agency has also established scientific advice avenues, with its Simultaneous National Scientific Advice (SNSA) pilot, where developers of medicinal products can seek simultaneous scientific advice from several health authorities. Clinical success with the SNSA is beginning to emerge: in September 2024, Cytiva launched a high-throughput RNA delivery LNP kit for NanoAssemblr Ignite systems, enabling mRNA and saRNA vaccine development from discovery to clinical evaluation with ready-to-use components. A USD 2.5 million Department of Defense (DoD) grant was awarded to the research teams at Northeastern University and Mass General Hospital to develop nanomedicine treatments that release drugs over time to treat late stage breast cancer, reducing the typical weekly visits to hospital to once a month.

Nanomedicine Market Report Segmentation:

Breakup by Nanomolecule Type:

- Nanoparticles

- Quantum Dots

Nanoparticles dominate with 76.7% market share, remaining the preferred choice due to their exceptional versatility, precision in delivering therapeutic agents, and ability to penetrate biological barriers for targeted drug delivery.

Breakup by Product:

- Therapeutics

- Regenerative Medicine

- In-Vitro Diagnostics

- In-Vivo Diagnostics

- Vaccines

Therapeutics lead with 34.7% of the market, reflecting their transformative role in enhancing treatment efficacy through targeted drug delivery, reducing side effects, and enabling controlled sustained release for improved patient outcomes.

Breakup by Application:

- Clinical Oncology

- Infectious Diseases

- Clinical Cardiology

- Orthopedics

- Others

Clinical oncology commands 32.5% market share, driven by the high demand for more effective cancer treatments that can deliver chemotherapeutic agents directly to tumor cells while minimizing exposure to healthy tissues.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads with 49.9% of the global market, with the United States alone accounting for 92.60% of the North American market, driven by advanced healthcare infrastructure, strong R&D capabilities, and robust regulatory support from the FDA.

Who are the key players operating in the industry?

The report covers the major market players including:

- Abbott Laboratories

- Arrowhead Pharmaceuticals Inc.

- General Electric Company

- Luminex Corporation

- Merck & Co. Inc.

- Nanobiotix

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Starpharma Holdings Limited

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4052&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness