Mezcal Market 2025-2033: Latest Updates, Industry Size, Share, Growth Opportunities and Business Statistics

Mezcal Market Size and Outlook 2025 to 2033

The Mezcal Market is witnessing remarkable growth globally, driven by the rising popularity of premium and craft alcoholic beverages. Mezcal, a distilled spirit made from the agave plant primarily in Mexico, has gained global recognition for its artisanal production methods, diverse flavor profiles, and cultural authenticity. The increasing demand for handcrafted and small-batch spirits among millennials and young adults, coupled with the growing influence of mixology and cocktail culture, is significantly boosting market expansion. Furthermore, international brands and distilleries are investing in mezcal production and export, strengthening its presence across North America, Europe, and Asia-Pacific. The surge in consumer preference for authentic, sustainably produced beverages is also shaping the industry’s evolution.

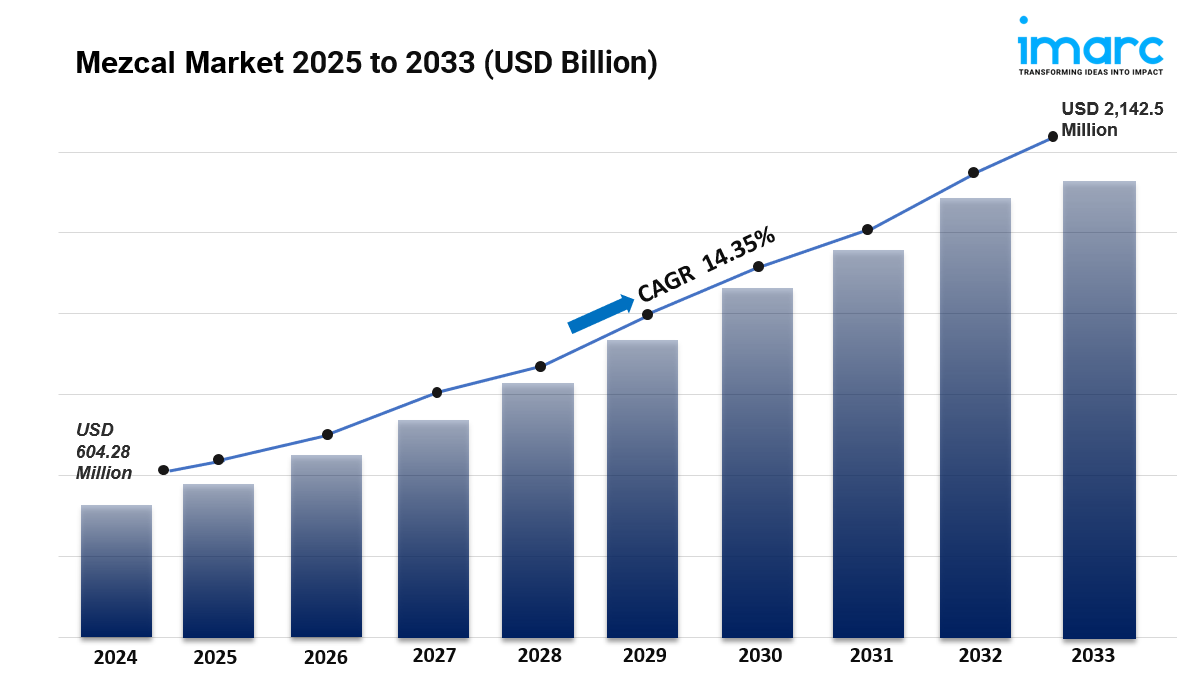

The global mezcal market Trends was valued at USD 604.28 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,142.5 Million by 2033, exhibiting a CAGR of 14.35% during 2025-2033. North America currently dominates the market, holding a significant market share of 54.7% in 2024. The escalating demand for craft spirits that are carefully crafted through professionals and increasing preferences for unique flavors that provide enhanced taste experience is propelling the market growth. Besides this, the mezcal market share is influenced by rising number of clubs, pubs, resorts, bars, hotels, and other food service establishments.

Key Trends

- Premiumization and Craft Spirits Movement:

Consumers are gravitating toward high-quality, artisanal mezcal varieties with unique regional flavors and traditional distillation techniques. - Global Expansion of Mexican Spirits:

Mezcal’s growing popularity outside Mexico, especially in the U.S. and Europe, is broadening the global agave-based beverage market. - Rising Cocktail and Mixology Culture:

Increasing use of mezcal in innovative cocktails is fueling demand in restaurants, bars, and home-bartending setups. - Focus on Sustainability and Ethical Production:

Producers are adopting eco-friendly farming and distillation practices to align with consumer demand for sustainable and transparent sourcing. - Product Innovation and Brand Collaborations:

New flavor infusions, limited editions, and partnerships with international beverage companies are driving market visibility and diversity.

Market Dynamics

- Drivers:

- Rising global appreciation for craft and heritage spirits.

- Expansion of distribution channels, including e-commerce and duty-free retail.

- Increasing tourism and cultural influence of Mexican beverages.

- Restraints:

- High production costs and limited agave availability.

- Regulatory challenges and export restrictions in certain regions.

- Opportunities:

- Growth of premium and organic mezcal segments.

- Expanding presence in emerging markets across Asia-Pacific and Europe.

- Collaborations with mixologists and global hospitality brands for brand positioning.

Request for a sample copy of this report: https://www.imarcgroup.com/mezcal-market/requestsample

AI Impact on the Mezcal Market:

Artificial intelligence is transforming the mezcal industry through sophisticated data analytics, consumer behavior prediction, and supply chain optimization. Researchers at the Universidad Panamericana Mexico City campus are using machine learning tools to decipher behavioral patterns and preferences of consumers of Mexican distillates such as mezcal and tequila. This analytical approach helps producers understand market dynamics and consumer preferences with unprecedented precision.

AI-powered systems are revolutionizing production quality control, enabling distilleries to monitor fermentation processes, optimize aging conditions, and maintain consistency across batches. Smart inventory management systems predict demand fluctuations, helping producers avoid stockouts while minimizing waste. Digital marketing platforms leverage AI algorithms to identify target demographics, personalize marketing campaigns, and optimize pricing strategies based on real-time market conditions.

The global AI in food and beverages market size is expected to reach $56.47 billion by 2029, with the market growing by USD 32.2 billion with a CAGR of 34.5% from 2024 to 2029. For mezcal producers, AI enables predictive analytics for agave cultivation, weather pattern analysis for optimal harvesting, and blockchain integration for authenticity verification. E-commerce platforms use AI to recommend mezcal varieties based on consumer preferences, while virtual reality experiences allow customers to virtually tour distilleries, enhancing brand engagement and educational value.

Segmental Analysis:

Analysis by Product Type:

- Mezcal Joven

- Mezcal Reposado

- Mezcal Anejo

Mezcal reposado stands as the largest component in 2024, holding 58.7% of the market. It undergoes oak barrel aging, developing complex flavors that appeal to premium spirit consumers. The aging process mellows the smoky intensity, making it more approachable for mainstream and new drinkers. This segment bridges the gap between unaged and extensively aged variants, attracting both casual consumers and connoisseurs seeking balanced complexity.

Analysis by Distribution Channel:

- On-Trade

- Off-Trade

On-trade distribution channel leads the market with 68.9% of the overall share in 2024. Bars and restaurants play a crucial role in mezcal's market expansion through curated tasting experiences, with professional bartenders educating consumers on mezcal's nuances, increasing awareness and appreciation for the spirit. The experiential nature of on-premises consumption introduces new consumers to mezcal, driving brand loyalty and repeat purchases through expertly crafted cocktails and food pairings.

Analysis of Mezcal Market by Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America led the market with a 54.7% share, driven by the United States serving as the largest export market for mezcal. Consumer demand for craft and artisanal spirits supports sustained growth across key metropolitan areas, with the tequila boom fueling crossover interest and introducing new consumers to mezcal's unique profile.

The United States holds 83.50% of the market share in North America, with a survey showing that 62% of US adults consume alcohol, fueling interest in premium beverages. Celebrity endorsements significantly impact market visibility, with Perro Verde Mezcal, backed by actor Benicio del Toro, debuting in the US market in November 2024, offering three artisanal expressions emphasizing sustainability and over 120 years of Oaxacan tradition.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=19186&flag=C

Leading Players of Mezcal Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Mezcal landscape include:

- Bacardi Limited

- Desolas

- Destileria Tlacolula Inc.

- Diageo plc

- Drink Monday

- El Silencio Holdings Inc.

- IZO Spirits

- Lágrimas de Dolores

- Pernod Ricard SA

- Rey Campero

- Wahoo Fitness

Leading mezcal producers are expanding global distribution networks, increasing brand visibility across key international markets. Established brands are investing in premiumization, focusing on artisanal production methods and high-quality agave sourcing, while marketing strategies emphasize authenticity, cultural heritage, and sustainability.

Key Developments in Mezcal Market:

- November 2024: Perro Verde Mezcal, backed by actor Benicio del Toro, debuted in the US market, offering three artisanal expressions, including Espadín, Ensamble, and Tobasiche. Crafted by Oaxacan mezcaleros with over 120 years of tradition, the brand emphasizes sustainability.

- September 2023: Bacardi Limited acquired ILEGAL Mezcal, a top super-premium artisanal mezcal brand, after collaborating successfully since 2015. This strategic acquisition strengthens Bacardi's premium spirits portfolio while maintaining ILEGAL's artisanal production methods and cultural authenticity.

- June 2024: Viamundi, a Mexican spirits brand, entered the US market with three artisanal offerings, including Raicilla, Sotol, and Mezcal. Co-founded by industry veterans Adam Castelsky and David Weissman, the brand partners with independent Mexican distillers to highlight traditional distillates.

- May 2024: The Whisky Exchange announced its Tequila and Mezcal Show in London for May 16-17, 2025, reflecting the retailer's growing commitment to agave spirits, which are witnessing 34% growth. This dedicated event highlights mezcal's increasing prominence in international markets.

- February 2025: Universidad Panamericana Mexico City campus researchers began using machine learning tools to analyze consumer behavior patterns and preferences for Mexican distillates including mezcal and tequila, demonstrating the integration of advanced analytics in understanding market dynamics.

Buy Now: https://www.imarcgroup.com/checkout?id=19186&method=1670

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness