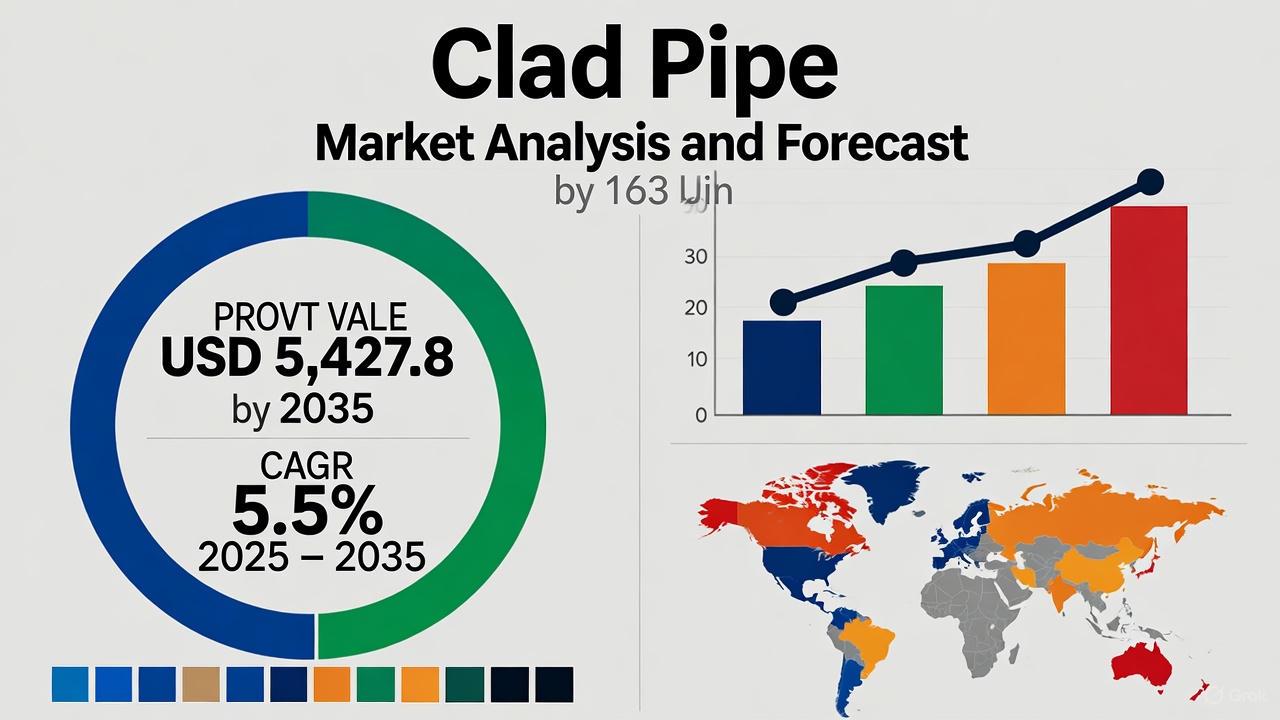

Clad Pipe Market to Surpass USD 5,427.8 million by 2035

The global clad pipe market is witnessing significant expansion, fueled by a rising demand for corrosion-resistant materials across oil and gas, chemical processing, and marine industries. Forecasts suggest the market will grow at a Compound Annual Growth Rate (CAGR) of 5.5%, reaching an estimated USD 5,427.8 million by 2035. Established manufacturers, alongside newer players, are capitalizing on this trend by advancing technology, optimizing operations, and expanding their global footprint.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-20434

Leading Players and Technological Advancements

Top market players such as Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group continue to set benchmarks in the clad pipe industry. Tenaris SA is widely recognized for its high-quality, corrosion-resistant pipes tailored for oil and gas applications. The Japan Steel Works specializes in robust clad pipes for subsea pipelines, while BUTTING Group delivers customized solutions for chemical and petrochemical industries. Together, these companies capture approximately 30% of the global market, leveraging innovation and strong industry presence.

EEW Group and Inox Tech S.p.A, contributing to another 25% of the market, focus on high-strength seamless clad pipes for industrial applications. Other manufacturers, including Proclad and Gulf Specialized Works, hold the remaining 45%, offering sustainable and application-specific solutions. Across the board, both Tier-I and Tier-II manufacturers are adopting advanced manufacturing techniques, such as metallurgical bonding, roll bonding, and weld-overlay technologies, to enhance durability, corrosion resistance, and operational efficiency.

Market Insights by Type and Grade

Metallurgical bonded pipes dominate the market, representing 46.1% of total demand. These pipes provide a permanent connection between the base metal and cladding layer, enhancing mechanical strength and durability, even under extreme offshore oil and gas conditions. Steel-bonded clad pipes ensure superior corrosion resistance, enabling reliability in high-pressure, high-temperature environments.

Alloy 625 is a standout grade in the market, accounting for 25% of sales. This nickel-based alloy offers excellent corrosion, oxidation, and high-temperature resistance, making it suitable for subsea pipelines, reactors, and marine applications. Its superior weldability and mechanical properties make it a preferred choice for manufacturers aiming to deliver high-quality, cost-effective solutions in demanding industrial conditions.

Emerging Opportunities Across Industries

The oil and gas sector remains the largest driver, contributing roughly 35% of global demand. Offshore exploration, complex refinery operations, and sour gas projects are stimulating the need for high-performance clad pipes. Additionally, growing investments in water infrastructure, such as desalination plants and water treatment facilities, are creating new opportunities for manufacturers to expand their offerings.

North America and Europe continue to be dominant markets, while the Asia-Pacific region is experiencing rapid growth due to large-scale energy and infrastructure projects. Tier-I companies are focusing on high-performance, long-lasting solutions, while Tier-II and Tier-III players compete through niche applications, cost-effective production, and regional customization.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness