Payday Loans UK: A Complete Guide to Short-Term Borrowing in 2025

Navigating Financial Challenges in 2025

The cost of living in the UK continues to climb, putting pressure on even the most carefully planned budgets. Sudden expenses like medical bills, car repairs, or household emergencies can disrupt anyone’s financial stability. These issues touch people from all walks of life, creating urgent cash flow needs. Short-term borrowing options have become a popular solution for quick relief. They offer a way to handle unexpected costs without the delays of traditional banking. Understanding these options is key to making informed financial decisions.

The Appeal of Short-Term Payday Loans

For those needing immediate funds, short-term loans provide a fast and accessible solution. Leading providers of payday loans uk streamline the process with online applications and rapid approvals. These eliminate the need for lengthy paperwork or waiting weeks for a decision. Funds can often hit your account the same day, easing urgent situations. This speed is ideal for emergencies or bridging gaps until your next paycheck. Comparing lenders helps you find the best fit for your specific needs.

Breaking Down Credit Barriers

Traditional banks often reject applicants with imperfect credit, leaving many without options. Specialist lenders, however, focus on accessibility, welcoming those with lower scores. They prioritize basic income checks over strict credit histories. This opens doors for people facing financial hurdles. It’s a practical way to tackle unexpected expenses without judgment. Researching reputable providers ensures you avoid unreliable operators.

Top UK Lenders for 2025

This guide explores trusted short-term finance providers in the UK for 2025. Each offers unique features to suit different financial situations. From one-off loans to flexible credit lines, there’s something for everyone. Knowing their strengths helps you choose wisely. Whether it’s a small boost or a larger sum, options are available. Reviewing these ensures you select a lender that aligns with your goals.

Understanding Short-Term Loan Types

Short-term loans vary to match different needs, from single-payment options for emergencies to revolving credit for ongoing support. Eligibility often depends on income rather than perfect credit. This flexibility caters to both immediate and extended financial needs. Choosing the right type depends on your situation. One-time loans suit quick fixes, while credit lines offer repeated access. Evaluate your needs to pick the most suitable product.

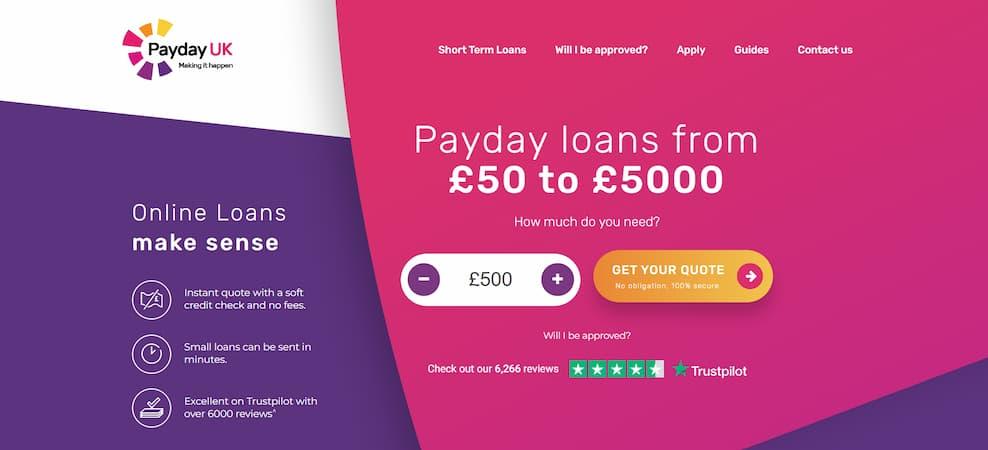

Payday UK: Streamlined and Fee-Free

Payday UK offers loans from fifty to five thousand pounds, covering minor and major needs. Their website is easy to navigate, with applications taking just minutes. An eligibility tool checks approval odds in under a minute without affecting your credit. Instant quotes and no extra fees make it user-friendly. Same-day funding is possible for smaller amounts, perfect for urgent situations. It’s a convenient choice for quick financial relief.

Payday UK’s Hassle-Free Process

Applications are mobile-friendly, completed in moments from anywhere. Light checks skip the need for IDs or bank statements, keeping things simple. You’re not obligated to accept their offer, allowing room to compare. Multiple applications may impact future eligibility, so proceed carefully. A guarantor might occasionally be required. Their email support team responds promptly to any concerns.

Flexible Repayments at Payday UK

Repayment terms range from three to thirty-six months, fitting various budgets. This flexibility helps manage financial planning effectively. If issues arise, their customer service is quick to assist via email. High approval rates broaden access for many. The ninety-one percent representative rate is higher than some competitors. Plan repayments carefully to avoid strain.

Pounds to Pocket: Quick and Guarantor-Free

Pounds to Pocket supports those with poor credit, requiring only steady income. Loans range from one hundred to five thousand pounds. Applications are open twenty-four-seven, taking just five minutes. Same-day approvals and transfers address urgent needs. Some benefits, like housing or jobseeker aid, don’t qualify as income. They partner with responsible lenders for ethical service.

High Approval Odds with Pounds to Pocket

With a ninety-eight percent approval rate, they tailor solutions for diverse profiles. No guarantors or extra fees simplify the process. Repayments span one to thirty-six months for flexibility. Their site offers free debt management resources for added support. Not all benefits work for repayments, so verify eligibility. This ensures a smooth borrowing experience.

Cashfloat: Direct Lending with Perks

Cashfloat ensures same-day funding for approved loans, ranging from two hundred fifty to fifteen hundred pounds. Repayments can be one sum or spread over nine installments. As a direct lender, they skip intermediaries for clarity. Rates range from two hundred ninety-five point five eight to twelve hundred ninety-four percent. Early repayment avoids penalties, reducing interest costs. It’s ideal for smaller, urgent transactions.

Cashfloat’s Inclusive Policies

All credit scores are considered, though full-time employment boosts approval chances. Part-timers or benefit recipients may face challenges. No guarantor is needed post-approval, streamlining the process. A five percent cashback rewards timely payments and survey completion. UK-based support is available around the clock. This ensures reliable help whenever needed.

Lolly: Fast Funds and Proven Reliability

Lolly delivers funds in as little as an hour for supported banks. Loans range from one hundred to five thousand pounds with instant online decisions. Operating since 2005, they have a trusted track record. No hidden application fees keep costs clear. Repayments run three to twenty-four months at seventy-nine point five percent. High approval rates suit various credit backgrounds.

Lolly’s Transparent Approach

Their partner lenders achieve a ninety-eight percent approval rate, welcoming diverse applicants. Alternative offers may come if initial requests don’t match. No paperwork or obligation enhances ease. Clear terms help you make informed contract decisions. Support is online anytime, with phone lines open during business hours. They function as brokers, not direct lenders.

Drafty: Innovative Credit Solutions

Drafty provides loans from fifty to three thousand pounds without guarantors or forms. Highly rated on Trustpilot, they offer instant transfers to certain banks. As a direct lender, they manage everything in-house. Applications are open anytime for convenience. Their Flex option charges interest only on used amounts, like an overdraft. This suits those needing ongoing financial flexibility.

Drafty’s Versatile Loan Structures

Standard loans repay over twelve, eighteen, or twenty-four months. The Flex line allows repeated borrowing within limits if payments are timely. No early repayment fees add flexibility. A minimum income of twelve hundred fifty pounds monthly is required. Only employed applicants qualify, excluding the jobless. Support includes chat, email, and phone, available anytime.

SteadyPay: App-Driven for Modern Borrowers

SteadyPay caters to students and shift workers through a mobile app. Loans up to three hundred pounds come with three-month terms. A top-up feature supports uneven incomes up to one thousand pounds. It’s a subscription model, skipping extra interest beyond ninety-one point two five percent. A thirty-pound monthly fee applies. Full-time employment is required for eligibility.

SteadyPay’s Unique Subscription Model

Bad credit is accepted, and data is handled securely. Top-ups unlock after two months of subscription. The app-only setup may not suit older users. No bank details are stored, ensuring privacy. This modern approach appeals to tech-savvy borrowers. Non-workers are excluded from applying.

Moneyline: Support for Benefit Recipients

Moneyline offers two hundred to one thousand pounds for those on benefits or with poor credit. Decisions take two days, with next-day funding. As a direct lender, they keep processes straightforward. A ten-minute app and mobile management simplify oversight. Repayments span fourteen to thirty-two weeks. Strict rules may decline those with gambling or default history.

Moneyline’s Benefit-Friendly Approach

They accept disability or universal credit and check for extra entitlements. Recent bank statements determine eligibility. Support includes chat, email, and phone options. Approvals are slower than competitors, which may frustrate some. Their inclusivity for benefits is a key strength. Verify your income meets their criteria before applying.

The Speed Advantage of Short-Term Loans

Online applications are far quicker than bank processes, wrapping up in minutes. Instant approvals and same-day transfers tackle urgent needs. This efficiency is vital when time is tight. No lengthy forms or delays keep things moving. It’s perfect for sudden financial challenges. Confirm payout timelines with your bank for accuracy.

Accessibility for Diverse Borrowers

Light checks focus on income, not deep credit histories, preserving your score. This welcomes those with poor credit to apply. It broadens access to financial relief significantly. Responsible lenders prioritize affordability over past issues. Compare options to find the best match. This ensures fair and accessible borrowing.

Convenient and Private Applications

Apply via phone or laptop with minimal information required. No in-person meetings ensure discretion and ease. Secure systems protect your data fully. Rejections happen online, avoiding awkwardness. This privacy suits those seeking quiet solutions. Use a secure device to safeguard your application.

Freedom to Compare Loan Offers

Non-binding quotes let you shop around for the best terms. This flexibility ensures you find a deal that fits your budget. Multiple options empower smarter choices. Review rates and conditions carefully before signing. It prevents committing to unfavorable terms. Take time to explore all possibilities.

The High Cost of Quick Access

High interest rates can significantly increase repayment amounts. Accessibility comes at a premium, requiring careful budgeting. Low earners may find quick cash tempting. Plan repayments to avoid financial strain. Rates vary, so scrutinize offers closely. Calculate total costs upfront to avoid surprises.

Avoiding the Debt Cycle

Borrowing to cover prior loans risks a dangerous spiral. These aren’t long-term solutions and can trap even cautious borrowers. Plan repayments to avoid repeat borrowing. Seek free debt advice if you’re struggling. Staying mindful keeps your finances in check. Break the cycle early to stay secure.

Future Credit Considerations

While accessible to poor credit, these loans may impact future applications. Mortgages or car loans could view them negatively. Plan ahead if big borrowing is planned. Timely repayments help lessen impacts. Keep your long-term credit goals in mind. Consult advisors before major financial steps.

Handling Late Payments Proactively

Missed payments lead to steep fees and agency involvement. Contact lenders early to address struggles. Free debt services offer guidance to avoid escalation. Penalties can worsen debt quickly. Proactive steps keep issues manageable. Always communicate before missing a payment.

Decoding APR for Clarity

The annual percentage rate shows the yearly cost of borrowing. High rates are common, so check for additional fees. Compare APRs to find affordable options. Knowing the full cost prevents surprises. Request clear breakdowns from lenders. This ensures you’re fully informed before agreeing.

Ensuring Lender Legitimacy

Regulatory bodies like the FCA protect against unreliable operators. Unlicensed providers are risky—avoid them completely. Confirm licensing through official sources. This safeguards your financial security. Trustworthy lenders display credentials openly. Research thoroughly to stay protected.

Examining Loan Terms Closely

Contracts may seem similar, but details vary significantly. Seek lower rates and flexible repayment options. Read fine print to spot restrictive clauses. Favorable terms ease repayment burdens. Compare multiple offers for clarity. This diligence saves money over time.

Spotting Hidden Charges

Fees for late payments, early settlements, or calls can accumulate. Some lenders hide these in contracts. Review terms to identify potential costs. Transparent providers list fees upfront. Ask questions to avoid surprises. Clarity protects your financial health.

Flexible Repayment Options

Modern lenders offer adjustable due dates or extended plans. This moves beyond rigid next-payday demands. Choose terms that align with your income flow. Flexible schedules reduce default risks. Confirm options before committing. It’s essential for manageable borrowing.

Tools for Loan Management

Online portals or apps simplify tracking and paying loans. These tools keep finances organized over time. Choose lenders with user-friendly platforms. Familiar systems prevent oversight errors. Check access options before applying. This ensures smooth loan management.

Are Short-Term Loans Suitable for You?

These loans shine in emergencies with quick, light-check access. They’re not ideal for everyone, so evaluate carefully. Avoid rushing into the first offer you see. Weigh benefits against high costs. Responsible use prevents financial strain. Consider alternatives if repayment seems challenging.

Choosing Trustworthy Lenders

Select providers with clear terms and no hidden fees. Look for fair policies on late or early payments. Licensed lenders ensure safer dealings. Transparency builds trust in the process. Check reviews for real user experiences. This leads to better borrowing decisions.

Planning for Successful Repayment

High costs require solid repayment strategies. Ensure dues are affordable without strain. Calculate total costs before agreeing. Free debt advice can guide tough situations. Borrowing should solve, not create, problems. Plan wisely to maintain financial health.

Conclusion: Borrowing Wisely in 2025

Short-term finance remains crucial for handling unexpected expenses. Choose vetted providers and understand all terms fully. Plan repayments to avoid debt traps. Use these as temporary aids, not ongoing solutions. In this evolving market, payday loans uk via Banko Wallet empower financial stability. Borrow responsibly to secure your future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness