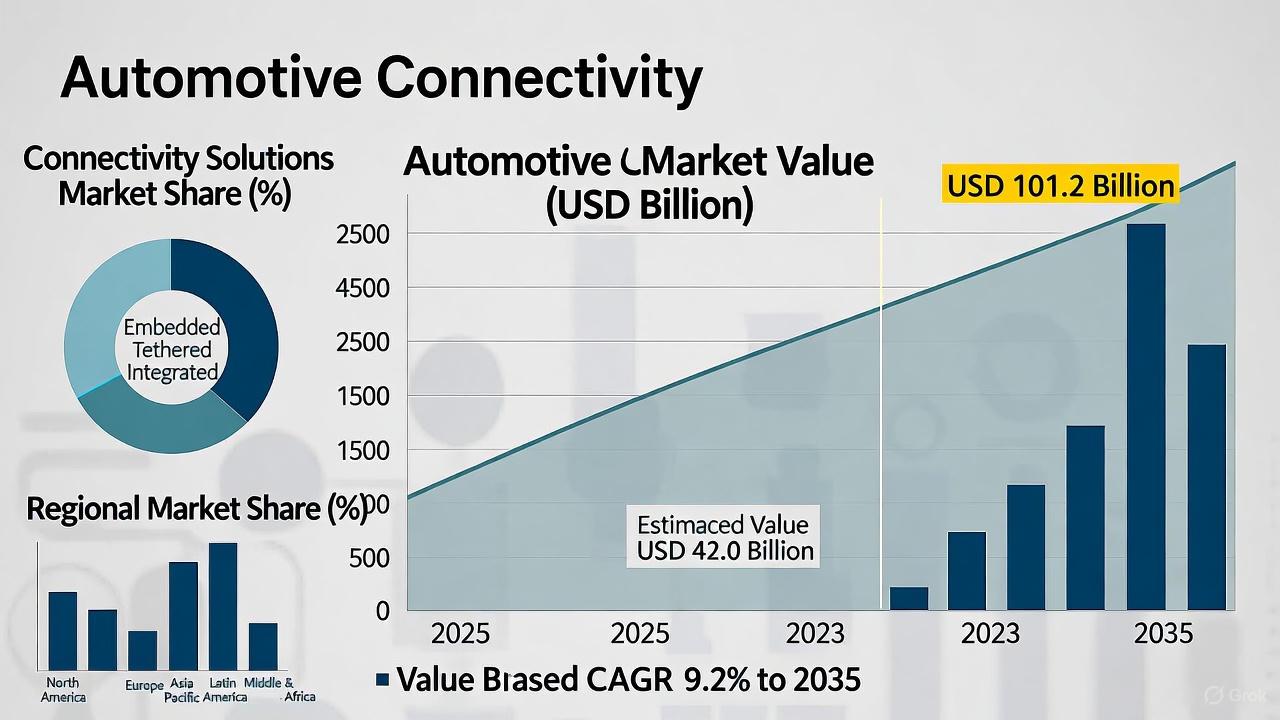

Automotive Connectivity Market to Surpass USD 101.2 Billion by 2035

The global automotive connectivity market is entering a transformative decade. Valued at USD 42.0 billion in 2025, it is projected to reach USD 101.2 billion by 2035, expanding at a CAGR of 9.2%. The revenue generated in 2024 stood at USD 38.4 billion, marking a year-on-year growth of 9.1%—a sign of the strong momentum fueling innovation in this sector. As vehicles become increasingly connected and software-driven, manufacturers—both established and emerging—are racing to develop next-generation solutions that redefine the driving experience.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-15903

Driving the Future: The Rise of Software-Defined and Connected Vehicles

Automotive connectivity is no longer just a feature; it’s the foundation of modern mobility. Software-defined vehicles (SDVs) are revolutionizing how automakers design and deliver cars. Over-the-air updates, predictive maintenance, and personalized in-car experiences are becoming mainstream as companies like Qualcomm, Harman International, and Bosch invest heavily in smart software ecosystems.

For newer entrants and expanding manufacturers, the shift toward SDVs offers an opportunity to collaborate on modular platforms and open-source ecosystems. These collaborations enable rapid innovation and allow smaller brands to compete in a space once dominated by a few industry giants.

Enhancing Safety and User Experience through ADAS and Infotainment

Connected technologies such as Advanced Driver Assistance Systems (ADAS) are reshaping how vehicles interact with their environment. Through vehicle-to-everything (V2X) communication, cars can exchange real-time data with road infrastructure and other vehicles, significantly enhancing road safety and reducing congestion.

At the same time, demand for integrated infotainment systems continues to rise. Consumers now expect their vehicles to mirror their digital lives—offering streaming services, real-time navigation, and voice-activated controls. This growing need for seamless digital integration is driving automakers like Toyota, Ford Motor Company, and Continental to invest in robust connectivity frameworks that combine convenience, entertainment, and safety.

5G and Embedded Connectivity at the Core of Industry Growth

Technological innovation is accelerating with the deployment of 5G-powered connectivity, which is expected to hold a 30.2% market share in 2025. The ultra-low latency and high-speed data transmission of 5G enable real-time updates, autonomous driving capabilities, and immersive infotainment experiences.

Meanwhile, embedded connectivity, projected to account for 42.4% of the market in 2025, is driving integration at the hardware level. This technology ensures that vehicles remain connected at all times, supporting features such as live diagnostics, over-the-air upgrades, and enhanced navigation accuracy. As vehicles move toward autonomy, embedded connectivity will become indispensable for ensuring reliability and performance.

Regional Momentum: Expanding Opportunities Across Global Markets

Global growth in automotive connectivity is being fueled by regional innovation. China leads the Asia-Pacific region, supported by government investments worth USD 15 billion in smart vehicle technologies and ADAS integration. Germany continues to pioneer connected vehicle design through collaborations among automotive giants like BMW and Mercedes-Benz, reinforcing Europe’s role as a hub for connected mobility.

In the United States, the emphasis on road safety and government-backed connectivity programs has accelerated the adoption of automated safety features. With 40% of new vehicles already equipped with advanced connected systems, the U.S. market remains pivotal for the industry’s evolution.

Overcoming Challenges: High Costs and Infrastructure Gaps

Despite its growth trajectory, the market faces significant barriers. High implementation costs and the need for robust infrastructure, such as 5G and cloud-based networks, pose challenges for smaller manufacturers. Addressing cybersecurity risks and ensuring interoperability among diverse systems will also be critical for sustained adoption. However, collaboration between telecom providers, governments, and automakers is helping bridge these gaps and foster a more connected global ecosystem.

Competitive Outlook: Innovation and Collaboration Drive Market Expansion

The competitive landscape is dominated by Tier-1 players like Qualcomm, Harman International, Bosch, and Denso, which collectively account for around 60–65% of the market. However, Tier-2 companies including Panasonic, NXP Semiconductors, and Ford Motor Company are rapidly scaling up through strategic collaborations and partnerships.

Recent developments underscore this momentum. In February 2024, Harman unveiled AI-powered in-vehicle systems that enhance personalization and safety. Around the same time, Qualcomm introduced Wi-Fi 7 for automobiles, enabling faster, more reliable in-car connectivity. These innovations highlight the industry’s shift toward intelligent mobility and seamless digital integration.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness