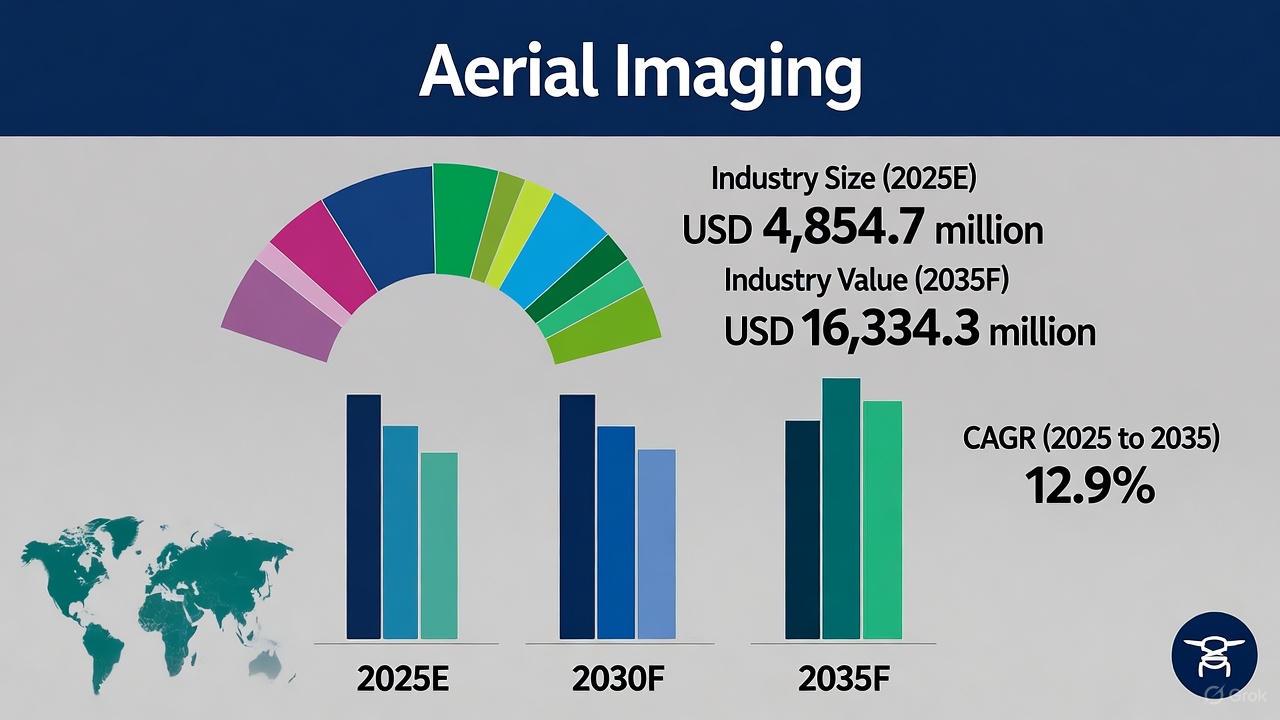

Aerial Imaging Market to Surpass USD 16.3 Billion by 2035

The global aerial imaging market is on an impressive trajectory, projected to surge from USD 4,854.7 million in 2025 to USD 16,334.3 million by 2035, reflecting a robust CAGR of 12.9%. The transformation is driven by the rapid adoption of advanced UAVs (unmanned aerial vehicles), thermal imaging systems, and high-resolution camera technologies across industries such as defense, agriculture, urban development, and environmental monitoring.

As urbanization accelerates, governments and private enterprises are investing heavily in drone mapping software and GIS tools to collect real-time, high-precision imagery. These advancements are proving vital for smart city projects, infrastructure planning, and environmental surveillance.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-14483

Emerging Technologies Redefining Industry Potential

The growing demand for high-resolution and thermal imaging has strengthened the role of aerial imaging in mission-critical operations. Advanced HD cameras now provide detailed clarity, which is crucial for urban mapping, defense surveillance, and disaster management. The U.S. Department of Homeland Security’s investment in surveillance technology underscores the importance of aerial imaging in public safety.

In 2024, DJI introduced its Mavic 3 Enterprise series, achieving rapid market adoption across government and commercial sectors, marking a new benchmark in drone-based imaging solutions. Likewise, the U.S. Department of Defense allocated USD 50 million for deploying thermal imaging-enabled UAVs to enhance tactical operations and border monitoring.

This technological momentum has encouraged both established manufacturers like FLIR Systems, Parrot, and DJI and emerging players such as Quantum Systems, Wingtra, and Skycatch to push boundaries in imaging precision and data analytics.

Regional Insights: Expanding Horizons Across Key Markets

North America currently leads the global aerial imaging market, supported by significant investments in drone technologies and AI-powered imaging analytics. Meanwhile, China and Japan are showcasing rapid advancements due to smart infrastructure expansion and industrial automation initiatives.

Europe is witnessing steady adoption of aerial imaging for real estate, infrastructure management, and environmental studies. Notably, Germany’s CAGR of 8.7% through 2035 indicates consistent growth driven by innovation and public-private collaborations.

In India, aerial imaging has become integral to national defense and border surveillance. The Ministry of Defense’s USD 600 million investment in UAV-based monitoring, coupled with partnerships like IdeaForge and Bharat Electronics, reflects the country’s growing reliance on advanced aerial intelligence. India’s aerial imaging market is expected to expand at a CAGR of 14.8% through 2035.

Similarly, the U.S. Federal Emergency Management Agency (FEMA) has allocated USD 15 million for integrating drones into disaster response operations, illustrating how UAVs are becoming indispensable in emergency management.

Market Segmentation and Key Growth Drivers

Among various sectors, government applications dominate the market, capturing over 22.9% share in 2024. Heavy investments in aerial imaging for security, infrastructure management, and urban planning are fueling steady demand.

In the component category, services are projected to grow at a CAGR of 14.6% between 2025 and 2035. Governments in Brazil and South Africa have launched large-scale geospatial mapping initiatives, allocating USD 1.5 billion and USD 500 million, respectively, to leverage aerial imaging for smarter city development and land-use planning.

Competitive Landscape: Innovation Through Collaboration

The aerial imaging landscape is highly competitive, with Tier 1 vendors such as DJI, Parrot, and FLIR Systems commanding nearly 45% of the market share. Meanwhile, Tier 2 and Tier 3 vendors, including senseFly, Delair, Quantum Systems, and Wingtra, are carving niches through innovation, regional focus, and specialized applications.

Recent strategic partnerships are accelerating innovation in data processing and imaging precision. In June 2024, CAPE Analytics partnered with Vexcel to enhance AI-driven property analytics. Similarly, Datumate joined forces with Birds Eye to streamline aerial surveying efficiency. In the renewable sector, Aurora Solar adopted Eagle View’s imaging technology to improve solar panel layout and installation accuracy.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness