Passive Optical Network (PON) Equipment Market Outlook 2035: Powering the Next Wave of High-Speed Connectivity

The global Passive Optical Network (PON) Equipment Market is entering a phase of rapid expansion, driven by surging demand for high-speed broadband, government-led digitalization initiatives, and accelerating urbanization. Valued at US$ 15.8 billion in 2024, the market is projected to grow at a compound annual growth rate (CAGR) of 9.9% from 2025 to 2035, reaching an impressive US$ 49 billion by the end of the forecast period. As data consumption soars and smart infrastructure becomes the new norm, PON technology is increasingly viewed as a cornerstone of modern communication networks.

Understanding Passive Optical Network (PON) Technology

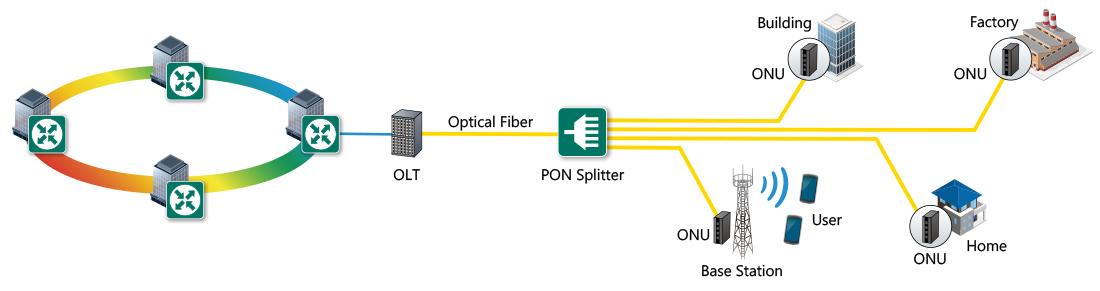

A Passive Optical Network (PON) uses a point-to-multipoint fiber optic architecture to deliver data from a central transmission point to multiple users via passive splitters. Unlike traditional copper or active fiber networks, PON systems eliminate the need for powered components between the service provider and end-user, enabling lower maintenance, higher efficiency, and reduced operational costs.

Key components of a PON system include the Optical Line Terminal (OLT), Optical Network Units (ONUs), and the Optical Distribution Network (ODN). Together, these elements enable high-capacity data transmission for applications like Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), and Fiber-to-the-Office (FTTO) networks.

Market Drivers: High-Speed Broadband and Digital Inclusion

The primary force propelling PON equipment adoption is the rising demand for high-speed broadband connectivity. The proliferation of video streaming, online gaming, IoT devices, cloud computing, and remote working has led to a surge in global data traffic. Telecommunication operators are increasingly investing in PON infrastructure to meet this growing need for bandwidth, reliability, and scalability.

Moreover, governments worldwide are recognizing broadband access as a public utility—a foundation for economic development and social equality. Numerous initiatives are being launched to bridge the digital divide by extending fiber connectivity to rural and underserved regions.

For example, the U.S. Senate Bill 156, signed in July 2021, allocated US$ 3.25 billion to construct an open-access broadband network across California. Similar initiatives in Europe, India, and Southeast Asia are creating robust demand for PON-based fiber deployments.

Gigabit PON (GPON) Leads the Market

Among the various PON technologies, the Gigabit Passive Optical Network (GPON) segment dominates due to its high-speed capability, superior security, and energy efficiency. GPON enables service providers to deliver multiple gigabit data streams over a single optical fiber, optimizing network performance and minimizing costs.

In 2025, Vecima Networks and Sercomm strengthened their partnership by successfully testing interoperability between Vecima’s Entra EXS1610 All-PON™ Shelf and Sercomm’s XGS2200C10 ONU. This collaboration enables broadband service providers to deploy multi-vendor, interoperable PON solutions, offering greater flexibility and scalability.

Additionally, next-generation technologies such as 10G-EPON, XG(S)-PON, and NG-PON2 are being developed to meet the ever-increasing bandwidth requirements of future digital ecosystems, including smart cities, 5G backhaul, and edge data centers.

Government Initiatives Accelerating PON Expansion

Governments around the world are actively promoting digital infrastructure development through financial incentives, regulatory frameworks, and public-private partnerships. These efforts are aimed at universal broadband access, smart city initiatives, and 5G network readiness.

By subsidizing Fiber-to-the-Home (FTTH) projects and encouraging open-access fiber networks, policymakers are directly driving demand for PON equipment such as OLTs, ONUs, optical splitters, and transceivers. The synergy between government support and private investment is creating a fertile ground for market growth, particularly in developing economies.

Regional Outlook: Asia Pacific Takes the Lead

The Asia Pacific region is expected to remain the fastest-growing market for PON equipment through 2035. Countries like China, Japan, South Korea, and India are making significant investments in fiber-optic infrastructure to support high-speed internet adoption. China’s extensive 5G rollout and India’s Digital Bharat mission are fueling large-scale deployment of PON networks for both residential and commercial applications.

Rapid urbanization, increasing smartphone penetration, and the expansion of smart city projects across the region are expected to further boost demand for advanced broadband infrastructure. Meanwhile, North America and Europe continue to maintain strong growth momentum, backed by early adoption of fiber networks and stringent quality and data protection standards.

Competitive Landscape

The PON equipment market is moderately fragmented, with several global players focusing on innovation, strategic partnerships, and technology upgrades. Key players include:

Adtran Inc., Calix Inc., Cisco Systems Inc., Huawei Technologies Co. Ltd., InCoax Networks AB, Mitsubishi Electric Corporation, Molex, Motorola Solutions Inc., Nokia Corporation, Verizon Communications Inc., and ZTE Corporation.

In August 2025, Calix expanded network design options in its ASM5001 Intelligent Access System, simplifying network aggregation and enabling faster scalability. Similarly, Vecima’s Entra vPON Manager, launched in May 2025, introduced a cloud-native management platform for streamlined PON subscriber management and telemetry-based network optimization.

Conclusion: Toward a Fiber-Connected Future

The global Passive Optical Network (PON) Equipment Market is poised for robust growth, fueled by the rising need for high-speed broadband, government-backed fiber initiatives, and technological innovation. As demand for digital connectivity continues to surge, PON systems are set to play a central role in shaping the future of communication infrastructure.

By 2035, with a projected valuation of US$ 49 billion, the PON equipment industry will stand as a critical enabler of next-generation connectivity—supporting smart cities, cloud ecosystems, and a truly networked global society.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness