Qatar Digital Payment Market Size, Growth, and Trends Forecast 2025-2033

Qatar Digital Payment Market Overview

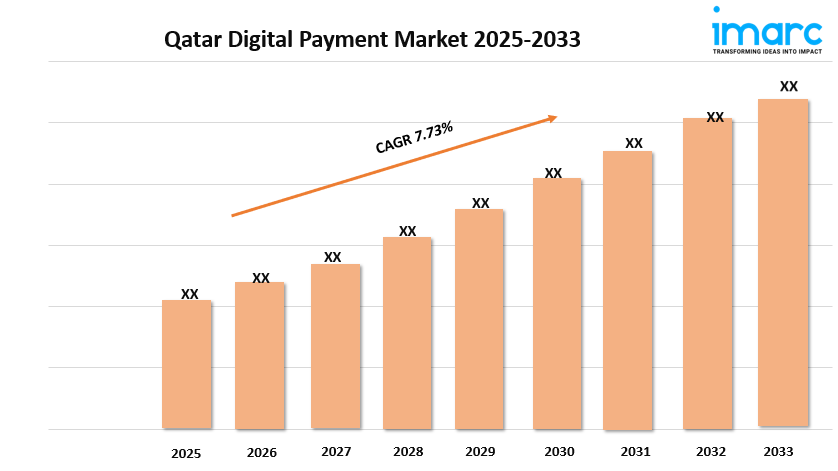

Market Size in 2024: USD 252.7 Million

Market Size in 2033: USD 493.9 Million

Market Growth Rate 2025-2033: 7.73%

According to IMARC Group's latest research publication, "Qatar Digital Payment Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the Qatar digital payment market size reached USD 252.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 493.9 Million by 2033, exhibiting a growth rate (CAGR) of 7.73% during 2025-2033.

How AI is Reshaping the Future of Qatar Digital Payment Market

-

Enhancing Fraud Detection: AI-powered systems analyze transaction patterns in real-time, with Qatar Central Bank's digital infrastructure processing over 51.7 million transactions monthly, requiring advanced fraud detection capabilities.

-

Powering Smart Payment Solutions: Machine learning algorithms optimize payment processing for Qatar's growing fintech sector, with digital transactions reaching $4.4 billion in July 2025 alone.

-

Enabling Predictive Analytics: AI enhances risk assessment and customer behavior analysis, supporting Qatar's rapid fintech growth driven by government digital transformation initiatives.

-

Streamlining Regulatory Compliance: Large language models assist financial institutions in meeting Qatar Central Bank regulations, reducing compliance costs and improving operational efficiency.

-

Personalizing Customer Experience: AI-driven chatbots and recommendation engines enhance user engagement, supporting the country's 99% smartphone penetration rate and digital-first payment adoption.

Grab a sample PDF of this report: https://www.imarcgroup.com/qatar-digital-payment-market/requestsample

Qatar Digital Payment Market Trends & Drivers:

Qatar digital payment market is experiencing robust growth, fueled by strong government initiatives under Qatar National Vision 2030. The Qatar Digital Government 2020 Strategy emphasizes digital service enhancement and electronic payment system development, creating a supportive environment for cashless transactions. The Qatar Central Bank has implemented favorable policies promoting financial digitalization, while maintaining high security standards. With nearly universal smartphone penetration and excellent internet connectivity infrastructure, Qatar provides an ideal foundation for mobile payment adoption. Government-backed initiatives are reducing barriers to digital financial services, encouraging both local and international fintech companies to establish operations in the country.

The surge in e-commerce platforms and digital retail is accelerating payment digitization across Qatar. According to the Qatar Chamber, e-commerce adoption significantly contributes to economic development under Qatar National Vision 2030, creating better business-to-consumer access and improved operational efficiency. This shift toward online shopping has highlighted the need for efficient and secure payment methods, driving businesses to integrate advanced digital payment solutions. The COVID-19 pandemic further accelerated contactless payment preferences, with consumers embracing the convenience and safety of digital transactions. Retail and e-commerce sectors are investing heavily in robust digital payment infrastructures to meet evolving consumer expectations and capitalize on the expanding digital economy.

The Banking, Financial Services, and Insurance (BFSI) sector dominates Qatar's digital payment landscape, supported by advanced technological infrastructure and regulatory frameworks. Healthcare, IT and telecom, media and entertainment, and transportation sectors are rapidly adopting digital payment solutions to enhance customer experience and operational efficiency. Cloud-based deployment models are gaining preference over on-premises solutions due to scalability and cost-effectiveness. The integration of digital wallets, net banking, and innovative payment modes is transforming traditional banking services. Regional adoption varies across Ad Dawhah, Al Rayyan, Al Wakrah, and other areas, with urban centers leading digital payment implementation.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging Qatar digital payment market trends.

Qatar Digital Payment Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Deployment Type Insights:

- Cloud-based

- On-premises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

Breakup by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Qatar Digital Payment Market

-

July 2025: Qatar Central Bank reported $4.4 billion in digital transactions processed across 51.7 million transactions, showcasing the rapid adoption of Fawran and other digital payment platforms throughout the country.

-

March 2025: Switzerland Global Enterprise released a comprehensive report highlighting Qatar's fintech sector growth, driven by increased digital payment adoption and strong government initiatives supporting financial technology development.

-

April 2025: Leading fintech companies in Qatar achieved significant milestones, with enhanced value propositions focusing on simplified transactions, secure payment information storage, and one-click payment solutions for improved customer experience.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness