UAE Meat Market Size, Share, Growth, and Forecast 2025-2033

UAE Meat Market Overview

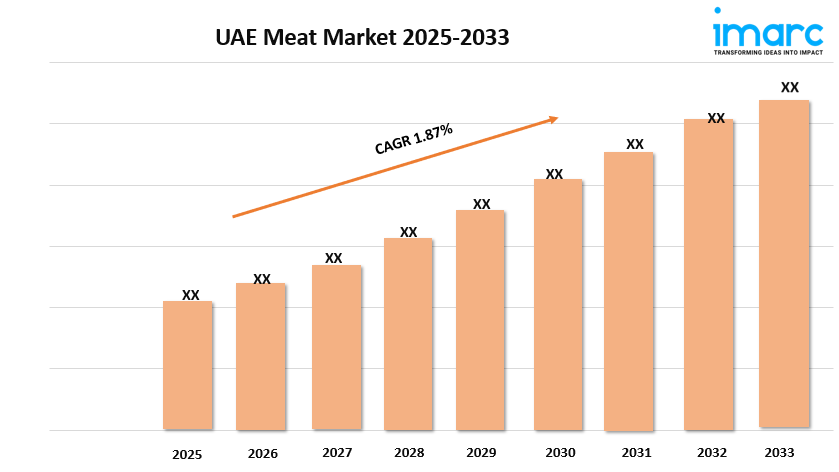

Market Size in 2024: USD 6.90 Billion

Market Size in 2033: USD 8.15 Billion

Market Growth Rate 2025-2033: 1.87%

According to IMARC Group’s latest research publication, “UAE Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033”, the UAE meat market size reached USD 6.90 Billion in 2024. The market is projected to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033.

How AI is Reshaping the Future of UAE Meat Market

- AI is transforming the UAE meat market by optimizing cultured meat production, improving cell growth conditions, and improving resource use efficiency, which cuts costs and boosts sustainability.

- The UAE government supports AI adoption in agriculture through initiatives like "Plant the Emirates" and partnerships with global foundations to enhance food security and sustainable farming.

- Leading UAE meat companies invest in AI for automated meat processing, quality control, and smart packaging, increasing efficiency and product consistency.

- The UAE's diverse population consumes about 85 kg of meat yearly on average, with growing demand for halal and premium quality meats, encouraging AI-driven local production.

- Recent trade deals and industry approvals, such as direct meat exports from Pakistan to UAE supermarkets, are facilitated by AI-enhanced quality and operational standards.

Download a sample copy of the Report: https://www.imarcgroup.com/uae-meat-market/requestsample

UAE Meat Market Trends & Drivers:

The UAE meat market is propelled by its diverse and growing population, with about 88% expatriates from Asia, Europe, and the Middle East. This multicultural mix drives demand for a wide range of meats such as beef, lamb, chicken, and veal. On average, a UAE resident consumes close to 85 kg of meat yearly—far above the global average—showcasing strong consumer appetite, especially for halal-certified imports. Urbanization and rising incomes further boost demand through foodservice chains and retail outlets focusing on varied, high-quality meat selections tailored to diverse tastes.

Health awareness is reshaping the UAE meat market as more consumers seek lean, organic, hormone-free, and antibiotic-free meats. Premium categories like wagyu beef and free-range chicken are gaining attention among health-conscious buyers. This has led retailers and restaurants to highlight clear labeling and source transparency to meet stricter consumer expectations. With concerns over lifestyle diseases pushing dietary changes, there's a growing preference for healthier protein options, encouraging innovations targeting wellness that transform both product offerings and foodservice menus.

Government regulations and food security initiatives play a critical role in market growth. The UAE enforces strict halal standards, hygiene protocols, and food safety inspections to ensure quality control for both local and imported meats. The UAE Food Security Strategy includes boosting local production and reducing import dependency through investments in livestock farming and modern abattoirs. Strategic trade relationships with major meat-exporting countries like Brazil and Australia also help diversify supply, ensuring stable meat availability and competitive pricing, which collectively strengthen the market.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging UAE meat market trends.

UAE Meat Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Raw

- Processed

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Meat Market

- 2025: The UAE meat industry is advancing with AI-powered robotics and automation in meat sorting, cutting, and packaging, significantly improving operational efficiency, consistency, and safety.

- 2025: Blockchain technology combined with IoT sensors enables comprehensive halal traceability from farm to fork, allowing instant verification of meat certification and origin, greatly enhancing consumer trust.

- 2025: Sustainable developments include Dubai’s Food Tech Valley and new plant-based meat production facilities like Switch Foods, supporting food security and expanding protein source options in the UAE market.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness