How will the share of the Europe E-Commerce Market evolve in 2033?

Europe E-Commerce Market Forecast by 2033

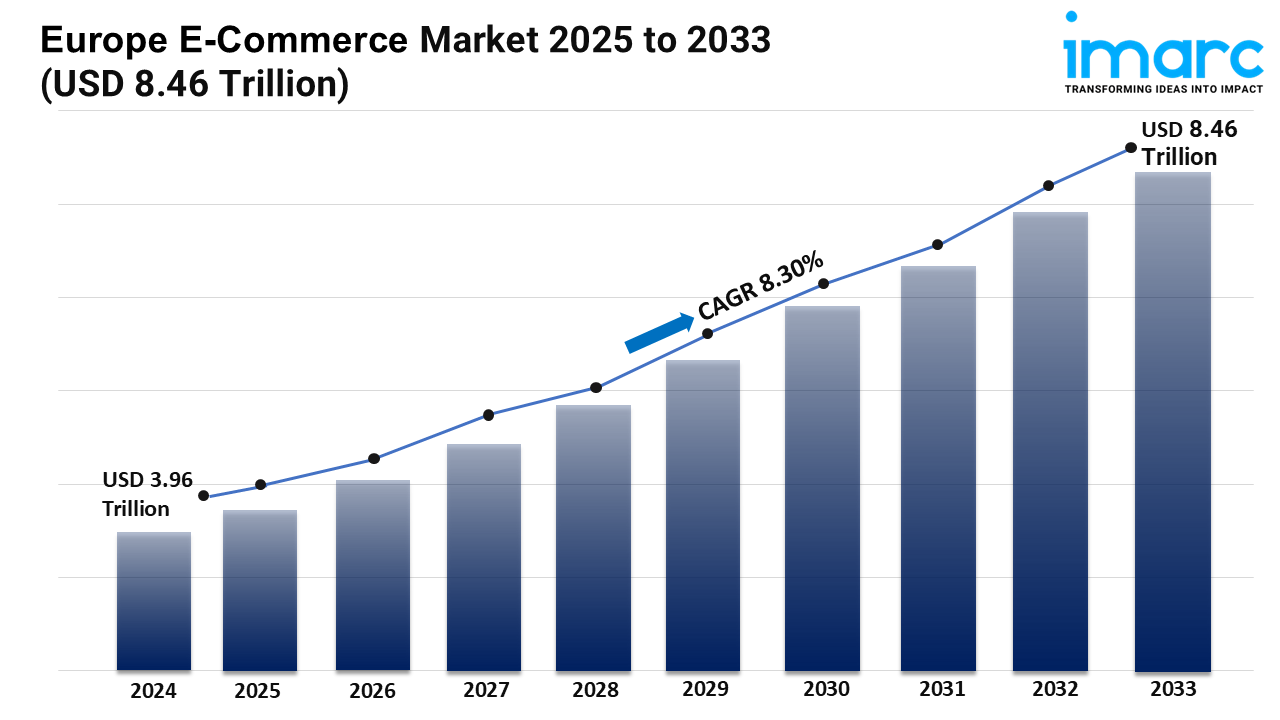

Market Size in 2024: USD 3.96 Trillion

Market Forecast in 2033: USD 8.46 Trillion

Market Growth Rate 2025-2033: 8.30%

The Europe e-commerce market reached USD 3.96 trillion in 2024 and is anticipated to surge to USD 8.46 trillion by 2033, expanding at a compound annual growth rate of 8.3 percent. This robust trajectory reflects rising internet penetration, widespread smartphone adoption, and evolving consumer preferences that favor seamless, secure, and sustainable online shopping experiences.

Growth Drivers Behind the European E-Commerce Market

EU Digital Services Act Implementation and Consumer Trust

The EU Digital Services Act is now in place. It is here to help make online spaces safer for me, you, and all people who use the internet. This rule wants tech companies to do more in keeping users safe and making sure their data is handled right. It also asks online platforms to be clear about what they do and how they work. When there are new rules like the Digital Services Act, people want to know if they can trust these companies. If companies follow the Act well, then this trust can grow. People want to feel safe when they use apps or websites. In the end, the Act tries to make sure our time online is safer and we get fair treatment from the services we use. The EU Digital Services Act (DSA) started fully in February 2024. All online marketplaces in the single market must now be open and answer for how they run their sites. The DSA says that these platforms have to share their risk reports every year. They also need third parties to check how their recommendation algorithms work. In May 2024, the European Commission said that 92 percent of the 19 Very Large Online Platforms covered by the Act have turned in their reports to follow the rules. This has made users trust these sites more. According to Eurobarometer in July 2024, 71 percent of people in Europe who shop online now feel safer buying from other countries. This number is up from 58 percent in 2022. With new rules, more people across the region are willing to try cross-border shopping, including many first-time buyers in Eastern and Southern Europe. Because of this, more people are buying online from other countries, and the whole market grows faster.

Expansion of Buy-Now-Pay-Later (BNPL) Across Six Additional Markets

In December 2024, eBay worked with Klarna to give people Pay in 3, Pay in 30 Days, and longer payment plans in Austria, France, Italy, the Netherlands, Spain, and the UK. This started after a test in Germany did well, with order sizes going up by 18 percent when new ways to pay were added. Klarna says that shops with buy now, pay later options had 25 percent more people finish buying sometime in early 2025. By making it easier to handle costs on things like electronics and home items, buy now, pay later helps more people pick these products. It also lets them come back to buy again and again across Europe.

EU-Japan Cross-Border Data Flow Agreement and Logistics Modernization

The EU and Japan have made a deal about the way data moves between their countries. This agreement helps to keep the data safe and make trade easier. It is good for businesses that work in more than one country. This deal should also help to modernize the way things are moved and tracked. Because of it, companies can now share information much more easily. They do not need to worry as much about rules stopping the flow of data. This will help save both time and money. People in the EU and Japan could now get better and faster service. In the end, this new partnership will help make sure that both trade and services are stronger for both sides. The agreement supports new ways of working in the world of logistics. More companies may now want to invest and work across borders. Both the EU and Japan can now look forward to new chances in data and shipping. The EU-Japan agreement for cross-border data started in July 2024. It got rid of rules that made companies store data in certain places, which used to be a problem. Now, e-commerce parcels can get cleared by customs in real-time. The European Commission said that big shipping routes from Japan to places like Rotterdam and Antwerp became about 1.3 days faster on average in the first six months. Shops like Zalando and Otto Group are using this easier setup to offer same-day shipping for some Asian products. With quicker and more steady transport, customers feel better about their purchases. It also means fewer items are sent back, so retailers keep more profit. This helps online shopping in Europe keep growing strong all the way to 2033.

Download the free sample report to explore detailed forecasts and segment-wise data: https://www.imarcgroup.com/europe-e-commerce-market/requestsample

Europe E-Commerce Market Segmentation

Analysis by Type:

- Home Appliances

- Apparel, Footwear, and Accessories

- Books

- Cosmetics

- Groceries

- Others

Analysis by Transaction:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

European E-Commerce Companies:

- Amazon Inc.

- eBay Inc.

- Allegro

- AliExpress

- Zalando SE

- ASOS PLC

- Cdiscount

- Emag LLC

- Otto GmbH & Co. KG

- Flubit Ltd.

Europe E-Commerce Market News

- July 2024: The EU-Japan cross-border data flows agreement entered into force, cutting logistics transit times and simplifying customs clearance for e-commerce parcels.

- June 2024: The European Commission published its first DSA compliance scorecard, showing 92 percent of Very Large Online Platforms had submitted risk-assessment reports.

- May 2024: Eurobarometer survey revealed that 71 percent of European online shoppers feel safer making cross-border purchases following DSA implementation.

- December 2024: eBay expanded Klarna’s Buy-Now-Pay-Later options to Austria, France, Italy, the Netherlands, Spain, and the UK.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness