GCC Health Insurance Market 2025 | Size, Growth, and Forecast by 2033

GCC Health Insurance Market Overview

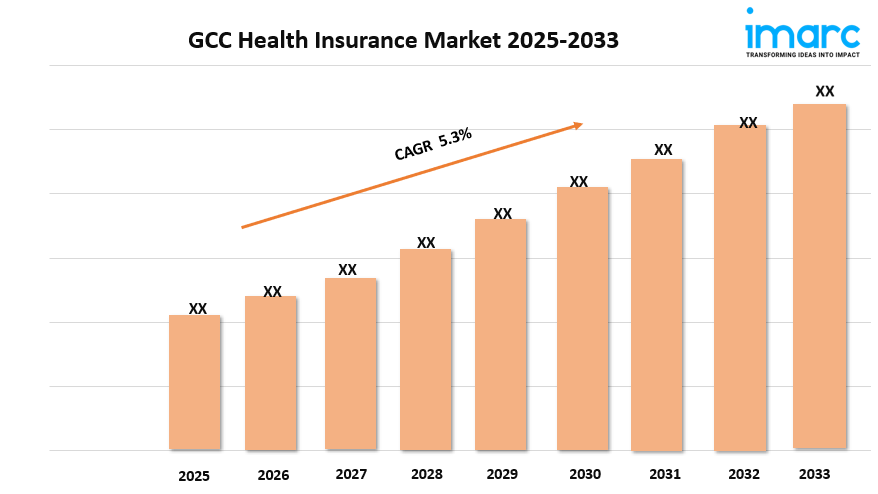

Market Size in 2024: USD 18.4 Billion

Market Size in 2033: USD 29.2 Billion

Market Growth Rate 2025-2033: 5.3%

According to IMARC Group's latest research publication, "GCC Health Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the GCC health insurance market size was valued at USD 18.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 29.2 Billion by 2033, exhibiting a CAGR of 5.3% during 2025-2033.

How AI is Reshaping the Future of GCC Health Insurance Market

- Automated Claims Processing: AI-powered systems streamline claims verification and processing, reducing settlement times from weeks to hours while cutting administrative costs by 30%.

- Personalized Risk Assessment: Machine learning algorithms analyze health data to create personalized insurance premiums, with UAE leading digital health platforms reducing underwriting time by 60%.

- Predictive Health Analytics: AI models predict health risks and enable proactive care management, with Saudi Arabia's Vision 2030 investing $20B in digital health transformation.

- Enhanced Customer Experience: Chatbots and digital assistants handle 70% of customer inquiries, while telemedicine integration provides seamless healthcare access across GCC nations.

- Fraud Detection Systems: Advanced AI algorithms detect insurance fraud patterns, with Kuwait and Qatar implementing blockchain-based verification systems to reduce fraudulent claims by 45%.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-health-insurance-market/requestsample

GCC Health Insurance Market Trends & Drivers:

The GCC health insurance market is experiencing robust growth driven by mandatory insurance regulations across the region. The UAE leads with comprehensive coverage requirements in Abu Dhabi and Dubai, while Saudi Arabia's National Health Insurance Program aims for universal coverage by 2030. Government investments of over $50 billion in healthcare infrastructure are creating demand for innovative insurance products. Digital transformation initiatives are revolutionizing service delivery, with 85% of insurers adopting AI-powered platforms for customer engagement. The region's growing expatriate population, comprising 60% of residents, continues to drive demand for comprehensive health coverage.

Rising healthcare costs and increasing awareness of health risks are pushing individuals and employers toward comprehensive insurance solutions. Private healthcare spending in the GCC has grown 8% annually, with premium healthcare services driving demand for high-value insurance products. The COVID-19 pandemic accelerated digital health adoption, with telemedicine usage increasing 400% and creating new insurance coverage categories. Corporate wellness programs are becoming standard, with 70% of large employers offering enhanced health benefits. Medical tourism growth, particularly in UAE and Saudi Arabia, is expanding international coverage requirements.

The demographic transition and lifestyle diseases are reshaping insurance product offerings across GCC markets. With diabetes affecting 18% of the adult population and cardiovascular diseases rising 25% in the past five years, insurers are developing specialized coverage plans. An aging population and increasing life expectancy are driving demand for long-term care insurance. The region's youth population (65% under 35) seeks digital-first insurance experiences with flexible coverage options. Mental health awareness campaigns have led to a 150% increase in behavioral health coverage requests, creating new market segments for specialized insurance products.

Our comprehensive GCC health insurance market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

GCC Health Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Individual

- Group

Breakup by Service Provider:

- Public

- Private

Breakup by Region:

- Saudi Arabia

- UAE

- Oman

- Kuwait

- Bahrain

- Qatar

Recent News and Developments in GCC Health Insurance Market

- February 2025: UAE's ADNIC launched AI-powered health screening programs integrated with wearable devices, offering personalized insurance premiums based on real-time health data, attracting 50,000 new policyholders within three months.

- March 2025: Saudi Arabia's Council of Health Insurance implemented new regulations requiring 80% digital claims processing by 2026, with major insurers investing $2 billion in technology upgrades to comply with the mandate.

- April 2025: Qatar's National Health Insurance Company introduced blockchain-based medical record verification, reducing claim processing time by 65% and eliminating duplicate coverage issues for 1.2 million residents.

- May 2025: Kuwait's insurance market saw consolidation with the merger of Gulf Insurance Group and Warba Insurance, creating a $3.2 billion health insurance entity covering 30% of the market share.

- June 2025: Bahrain launched the region's first parametric health insurance product using IoT sensors, automatically triggering payments for chronic disease management, serving 25,000 patients with diabetes and hypertension.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness