Maximize Accuracy with Oregon Paycheck Calculator

Understanding your paycheck is crucial for managing your finances, especially if you are a small business owner or self-employed. Many workers in Oregon often face confusion when trying to determine their net income after taxes and deductions. An Oregon Paycheck Calculator is a useful tool that simplifies this process, allowing you to calculate take home pay Oregon quickly and accurately. By using such a calculator, you can make informed financial decisions, plan your budget efficiently, and avoid surprises at the end of the month.

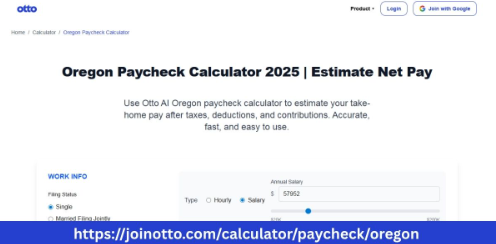

The Oregon Paycheck Calculator is designed to take into account all the necessary deductions, including federal taxes, state income tax, Social Security, and Medicare contributions. For self-employed individuals or small business owners, understanding these deductions is essential to maintain proper cash flow and financial stability. The tool works by allowing you to enter your gross income, pay frequency, and any pre-tax deductions. Once you input this information, the calculator provides an accurate estimate of your net pay.

One of the key advantages of using a paycheck calculator Oregon is that it saves time and reduces errors. Manually calculating take-home pay can be complicated due to different tax rates, local taxes, and other deductions that may apply. The calculator automates these calculations, ensuring that you receive precise results every time. It also provides a breakdown of each deduction, which helps you understand exactly where your money is going and how much is being withheld for taxes.

In Oregon, state income tax rates vary depending on your income level. This makes it important to use a tool that accounts for these variations. The Oregon Paycheck Calculator allows you to input your filing status, exemptions, and any other relevant information to produce an accurate estimate. For those who work multiple jobs or have irregular income, the calculator can accommodate these variations as well. This flexibility ensures that every paycheck is correctly calculated, helping you avoid unexpected tax liabilities.

Small business owners can also benefit from using a paycheck calculator Oregon to manage payroll. Keeping track of employee salaries, taxes, and deductions can be time-consuming and prone to mistakes. By utilizing a reliable tool, you can streamline payroll processing, ensure compliance with federal and state regulations, and provide employees with accurate paychecks. This not only improves efficiency but also enhances trust between employers and employees.

Another important feature of the Oregon Paycheck Calculator is its ability to help with financial planning. By knowing your net pay in advance, you can better manage monthly expenses, savings, and investments. Entrepreneurs who need to balance business expenses with personal income can use this information to make informed decisions about budgeting and cash flow management. For instance, you can determine how much to set aside for taxes or savings each month, which reduces financial stress and allows for long-term planning.

In addition to calculating take-home pay Oregon, these calculators often include options for deductions such as health insurance, retirement contributions, and other benefits. This comprehensive approach ensures that your paycheck reflects all relevant deductions, giving you a clearer picture of your finances. Small business owners can also use this information to make strategic decisions about employee benefits and compensation, helping them attract and retain talent.

Accuracy is a major benefit of using the Oregon Paycheck Calculator. Even small errors in manual calculations can lead to underpayment or overpayment, creating financial complications for both employers and employees. By relying on a trustworthy tool, you reduce the risk of errors and maintain accurate records for tax filing purposes. This is particularly valuable for entrepreneurs who handle their own payroll and need to ensure compliance with tax laws.

Otto AI offers resources and guidance for small business owners who want to make the most of paycheck calculators. By using tools like the Oregon Paycheck Calculator, entrepreneurs can streamline their financial management, save time, and focus more on growing their business rather than getting bogged down in complicated calculations. Leveraging technology in this way makes financial planning more manageable and less stressful.

Many people underestimate the value of understanding their paycheck. Knowing your net pay helps you plan for everyday expenses, emergencies, and long-term financial goals. It also allows you to identify opportunities to increase your savings or reduce unnecessary deductions. A paycheck calculator Oregon makes it easy to access this information, empowering you to make informed financial decisions without needing extensive accounting knowledge.

The convenience of using an online paycheck calculator cannot be overstated. You can use it at any time, from anywhere, without needing specialized software or accounting expertise. This accessibility is particularly beneficial for self-employed individuals who may not have a dedicated accounting team. By entering your income details into the Oregon Paycheck Calculator, you receive instant results that can guide your budgeting and financial planning.

Using a paycheck calculator also provides transparency in financial transactions. By understanding the deductions applied to your earnings, you gain insight into your tax obligations and contributions to benefits programs. This transparency helps prevent surprises during tax season and ensures that you are not underpaying or overpaying on your taxes. Additionally, it allows small business owners to maintain clear records for their employees, promoting trust and reliability.

Financial literacy is essential for anyone managing their own income, and an Oregon Paycheck Calculator is an effective tool to enhance this knowledge. By seeing how different factors—such as additional income, overtime, or deductions—affect your net pay, you can make better decisions about work hours, business investments, and personal spending. For entrepreneurs, this understanding is critical for balancing personal and business finances.

In conclusion, using an Oregon Paycheck Calculator is a smart step for anyone looking to gain clarity and control over their finances. The calculator helps you accurately calculate take home pay Oregon, understand your deductions, and plan for future expenses. Small business owners and self-employed individuals benefit from the simplicity, efficiency, and accuracy these tools provide. By leveraging resources like Otto AI, managing paychecks becomes straightforward and stress-free, allowing you to focus on growing your business and securing your financial future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness