Iowa Paycheck Calculator to Estimate Your Net Income Fast

When you look at your salary offer or invoice total, it’s important to remember that this is not the actual amount you’ll get in your bank account. Taxes and deductions reduce your earnings, leaving you with a lower take-home pay. That’s why an Iowa Paycheck Calculator is a helpful tool. It helps you estimate your net income by calculating the deductions for federal taxes, Iowa state taxes, Social Security, Medicare, and more.

For employees, freelancers, and small business owners, understanding how to calculate take-home pay Iowa is essential for financial planning. In this article, we will explain how an Iowa Paycheck Calculator works, why it is necessary, and how Otto AI can help you handle paycheck calculations easily.

What is an Iowa Paycheck Calculator?

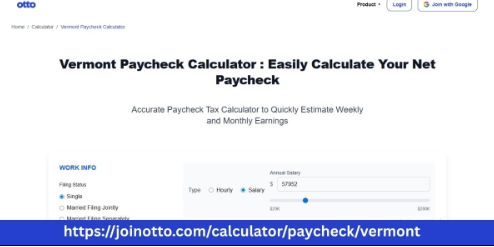

An Iowa Paycheck Calculator is an online tool that estimates how much of your gross salary will remain after all deductions. By entering a few key details like gross income, pay frequency, tax status, and deductions, the calculator gives you a clear view of your net pay.

This tool is useful for:

-

Employees who want to know how much they will take home.

-

Freelancers and entrepreneurs who plan for tax payments.

-

Small business owners managing employee payroll.

Using a paycheck calculator Iowa simplifies the process of understanding where your money goes and how much you can expect to receive.

Why Calculating Take-Home Pay in Iowa is Important

Many people are only familiar with their gross salary, but it’s the net pay that matters for budgeting and daily expenses. After deductions for taxes, Social Security, Medicare, and other contributions, your actual paycheck can be much lower than your salary figure.

A paycheck calculator Iowa is useful because it helps you:

-

Understand your exact take-home pay.

-

Create a realistic personal or business budget.

-

Avoid paycheck surprises.

-

Plan for quarterly tax payments if self-employed.

-

Ensure correct payroll processing for business owners.

Whether you’re employed by a company or working independently, knowing your net pay is critical for financial stability.

What Deductions Affect Your Paycheck in Iowa?

Several deductions are applied to your gross salary before you receive your final paycheck. These deductions include:

-

Federal Income Tax: Calculated based on IRS tax brackets and your filing status.

-

Iowa State Income Tax: Iowa applies progressive tax rates depending on your total earnings.

-

Social Security Tax: 6.2% of your gross income is deducted for Social Security.

-

Medicare Tax: An additional 1.45% is deducted for Medicare.

-

Pre-Tax Deductions: These include contributions to retirement accounts (401(k), IRA), health insurance premiums, and flexible spending accounts.

-

Post-Tax Deductions: Deductions such as union dues, wage garnishments, or loan repayments that are applied after taxes.

An Iowa Paycheck Calculator includes all these deductions to provide you with an accurate net pay estimate.

Small Business Owners: Simplify Payroll with an Iowa Paycheck Calculator

Small business owners have many responsibilities, and payroll management is one of the most time-consuming tasks. Mistakes in paycheck calculations can result in unhappy employees and potential tax compliance issues. An Iowa Paycheck Calculator can help businesses avoid these problems.

Key benefits for small businesses include:

-

Accuracy: Ensures correct tax and deduction calculations for employee paychecks.

-

Time-Saving: Automates complex payroll calculations.

-

Compliance: Helps business owners stay compliant with federal and state tax regulations.

-

Budget Planning: Makes it easier to forecast payroll expenses.

Otto AI offers user-friendly payroll tools, including an Iowa Paycheck Calculator, designed specifically for small business owners. With Otto AI, businesses can process payroll efficiently and without stress.

Freelancers and Entrepreneurs: Why You Should Use a Paycheck Calculator

Freelancers and self-employed individuals do not have taxes withheld from their payments. This means it’s up to them to plan for taxes and estimate their net income. Using an Iowa Paycheck Calculator makes this task simple and ensures you’re prepared when tax payments are due.

Here’s how freelancers benefit:

-

Estimate how much money to set aside for federal and state taxes.

-

Calculate net income for personal and business budgeting.

-

Plan quarterly tax payments accurately.

-

Avoid year-end surprises by tracking deductions throughout the year.

Otto AI’s Iowa Paycheck Calculator is perfect for freelancers and entrepreneurs looking for a simple way to manage their income and tax obligations.

Step-by-Step Guide: How to Use an Iowa Paycheck Calculator

Using a paycheck calculator Iowa is simple and doesn’t require any special knowledge. Follow these steps to calculate your take-home pay:

-

Enter Gross Income: Input your salary or hourly wage multiplied by the total hours worked.

-

Select Pay Frequency: Choose whether you’re paid weekly, bi-weekly, semi-monthly, or monthly.

-

Choose Filing Status: Indicate your federal tax filing status (Single, Married, Head of Household).

-

Input Allowances and Withholdings: Add the number of allowances from your W-4 form and any additional withholdings.

-

Add Pre-Tax Deductions: Include contributions like 401(k), health insurance premiums, or FSA/HSA accounts.

-

Calculate: The tool will process these details and show you an estimate of your net pay.

Otto AI’s Iowa Paycheck Calculator is designed to walk you through each step, making the process smooth and error-free.

Mistakes to Avoid When Using a Paycheck Calculator Iowa

Even though the calculator simplifies paycheck estimations, there are some common mistakes to avoid:

-

Forgetting Pre-Tax Deductions: Not including deductions like health insurance or retirement contributions will result in an inaccurate net pay estimate.

-

Wrong Pay Frequency Selection: Be sure to select the correct frequency, as weekly and bi-weekly pay schedules yield different results.

-

Using Old Tax Rates: Make sure the calculator is updated with current tax information.

-

Ignoring Additional Withholdings: Always add any extra withholdings specified on your W-4 form.

Otto AI’s paycheck calculator helps minimize these errors by providing clear instructions and updated tax data.

Otto AI: Simplifying Payroll and Paycheck Calculations

Otto AI is a platform that provides practical payroll solutions for small businesses, freelancers, and entrepreneurs. Their Iowa Paycheck Calculator is designed to make net income calculations fast, easy, and accurate.

Otto AI helps you:

-

Avoid errors in payroll processing.

-

Save time on manual calculations.

-

Stay compliant with federal and state tax regulations.

-

Focus more on growing your business instead of getting caught up in payroll complexities.

With Otto AI, paycheck calculations are simplified so you can manage your finances confidently.

Conclusion: Calculate Your Take-Home Pay Iowa with Ease

An Iowa Paycheck Calculator is a must-have tool for anyone who wants to understand their net earnings clearly. Whether you’re an employee wanting to plan your budget, a freelancer managing your own taxes, or a business owner processing payroll, this tool is essential.

Otto AI provides an Iowa Paycheck Calculator that is simple, accurate, and efficient. It makes paycheck calculations stress-free, giving you a clear view of your real income after deductions. If you want to calculate your take-home pay Iowa quickly and accurately, start using an Iowa Paycheck Calculator today and take full control of your finances.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness