Florida Sales Tax Calculator with Smart Interface by Otto AI

Running a business in Florida comes with its unique challenges, and understanding the state’s tax obligations is one of them. Among these, calculating the correct sales tax for transactions is a task that needs attention. This is where a reliable Florida Sales Tax Calculator becomes essential. For small business owners, self-employed professionals, and entrepreneurs, accuracy in tax computation is not just a legal necessity but also a way to build customer trust and maintain smooth business operations. Otto AI brings a solution that helps you calculate sales tax in Florida with speed and precision, reducing the chances of errors and making the entire process stress-free.

Florida has a base state sales tax rate of 6%, but counties can impose their own local surtax, which makes the actual rate vary depending on where the sale takes place. This layered tax structure can often be confusing, especially when handling multiple transactions across different counties. A dependable sales tax calculator Florida tool ensures that you are charging the correct amount, avoiding both underpayment and overcharging your customers. Otto AI’s tool is designed to handle these variables with ease, allowing you to focus more on growing your business rather than worrying about tax rates.

For small businesses, every penny counts. Using a Florida tax calculator sales platform removes the guesswork from manual calculations and helps you stay compliant with state laws. Whether you are managing an online store, a retail outlet, or offering professional services, the calculator provides real-time results. Just by entering the sale amount and selecting the county, you can instantly see the exact sales tax applicable. This makes billing faster and ensures transparency with your clients.

One of the common issues entrepreneurs face is the lack of clarity in understanding the difference between state tax and county surtax. The sales tax in Florida calculator by Otto AI is built to handle these details. It breaks down the total tax into components, showing you how much goes to the state and how much to the local county. This breakdown helps in record-keeping and also simplifies tax filing at the end of the year.

Accuracy in sales tax calculation also reflects on customer satisfaction. When clients see clear and precise billing, it builds trust and enhances your business reputation. Mistakes in sales tax can lead to disputes, refunds, and even penalties. Therefore, having a reliable sales tax Florida calculator at your disposal not only saves time but also protects your business from potential financial risks.

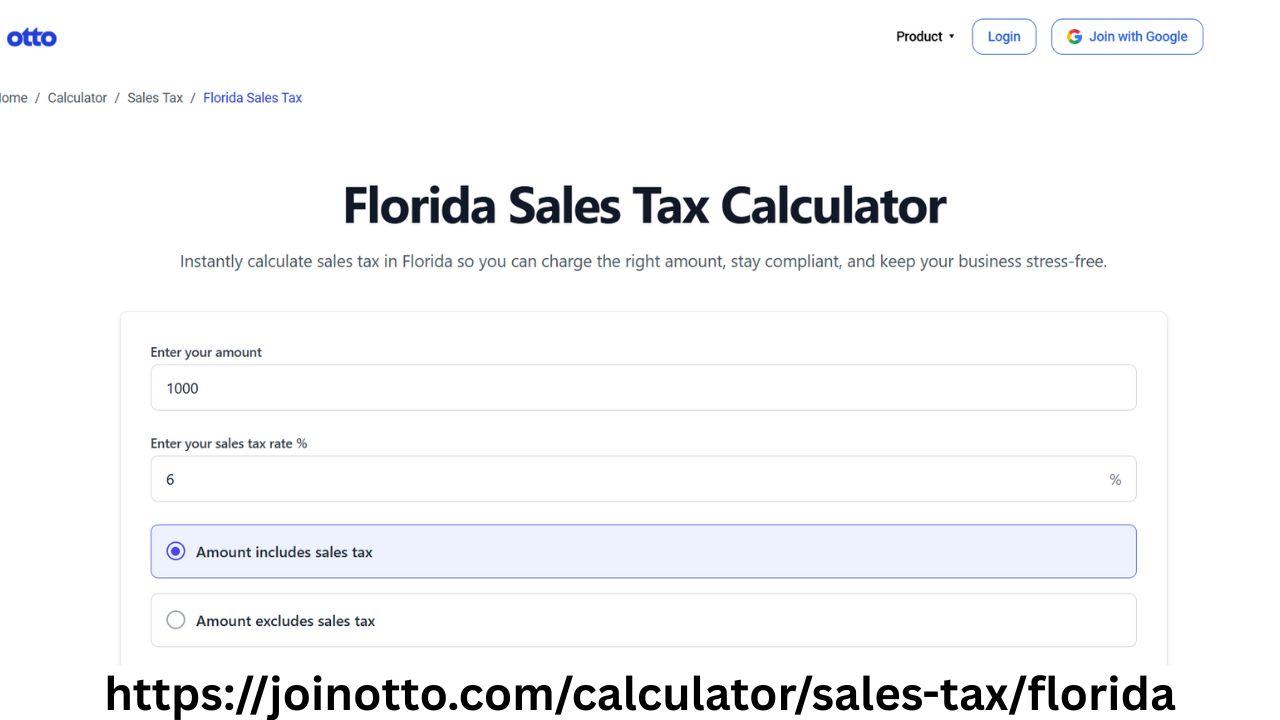

Otto AI understands that time is valuable for small business owners. This is why the Florida Sales Tax Calculator is designed with a user-friendly interface that does not require any technical expertise. Even if you are new to handling taxes, the tool guides you step-by-step to ensure that every transaction is accurate. No need to memorize complex tax codes or keep manual records. The calculator does the heavy lifting for you, allowing you to process sales quickly and confidently.

Beyond basic calculations, Otto AI’s Florida Sales Tax Calculator can be an essential tool for planning your pricing strategies. Knowing the exact tax amount for each product or service helps you set competitive prices while ensuring profitability. It also assists in forecasting your tax liabilities, so there are no surprises when it’s time to file returns. This kind of proactive approach is crucial for entrepreneurs who want to manage their finances effectively.

For self-employed professionals and freelancers offering services in Florida, understanding how sales tax applies to different types of transactions can be tricky. Not every service is taxable, and the rules can change depending on the nature of the service and the location of the client. The sales tax calculator Florida tool can help by providing quick answers, so you can invoice correctly and stay compliant without spending hours researching tax codes.

One of the significant advantages of using Otto AI’s Florida Sales Tax Calculator is its ability to stay updated with current tax rates. Florida’s counties may adjust their surtax rates periodically, and keeping track of these changes manually is not practical for busy business owners. The calculator is constantly updated to reflect any changes in the tax rates, ensuring that you are always using the correct figures in your transactions.

Moreover, the calculator is not limited to one-time calculations. You can use it for bulk transactions, making it an efficient tool for businesses that handle large volumes of sales. Whether you are preparing invoices for multiple clients or running a retail POS system, the calculator integrates seamlessly into your workflow, saving time and minimizing errors.

In addition to businesses, the Florida Sales Tax Calculator can also be helpful for customers who want to understand how much tax they are paying on their purchases. Transparent billing practices improve customer experience and build loyalty. By offering receipts that clearly show the tax breakdown, you are adding value to your customer service.

Compliance with Florida’s tax regulations is non-negotiable. Penalties for underpayment of sales tax can be hefty, and audits can be stressful. By using a reliable sales tax Florida calculator like Otto AI’s, you are safeguarding your business against such issues. The calculator keeps a record of your calculations, which can be useful during audits or for internal reviews.

The tool is designed keeping in mind the diverse needs of Florida’s business ecosystem. Whether you are running a small café, managing an online boutique, or offering consulting services, Otto AI’s Florida Sales Tax Calculator adapts to your business needs. It’s not just a calculator; it’s a business assistant that ensures every sale is compliant, accurate, and transparent.

In the ever-evolving business landscape of Florida, having dependable tools is key to staying ahead. Otto AI’s Florida Sales Tax Calculator offers a solution that blends simplicity with efficiency. It removes the complexities associated with tax calculations, allowing business owners to focus on what they do best – serving their customers and growing their business.

To sum up, a Florida Sales Tax Calculator is more than just a convenience; it’s a necessity for businesses that aim for accuracy and compliance. Otto AI provides a robust tool that caters to small businesses, entrepreneurs, and self-employed professionals, ensuring every transaction is calculated correctly. By integrating this tool into your daily operations, you not only streamline your billing process but also protect your business from potential tax issues. Otto AI’s Florida Sales Tax Calculator is your partner in maintaining financial accuracy and building a trustworthy business.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness