Calculate Tax Easily with Maryland Sales Tax Calculator

Managing sales tax can be one of the most confusing parts of running a business, especially when dealing with state-specific tax rates like those in Maryland. Whether you are a small business owner, self-employed professional, or entrepreneur, knowing exactly how much sales tax to charge your customers is crucial. This is where a Maryland Sales Tax Calculator becomes an essential tool. It helps you avoid miscalculations, ensures compliance with Maryland tax laws, and saves valuable time that can be better spent growing your business.

Maryland has a statewide sales tax rate of 6%. This rate applies to most retail sales of goods and certain services. However, depending on your business type and location, there might be specific exemptions or unique scenarios you need to consider. For instance, some goods like groceries or prescription medicines are exempt from sales tax. Navigating through these rules manually can be both tiring and risky. This is why using a reliable Maryland sales tax calculator is a practical solution.

Sales tax is not just about adding an extra percentage to the bill. For businesses, it involves understanding which transactions are taxable, applying the correct tax rate, and reporting the collected tax accurately to the Maryland Comptroller. A sales tax calculator Maryland tool automates these steps. It allows you to enter the sale amount and instantly get the correct tax amount, reducing the chances of errors and ensuring your invoices are correct every time.

If you are an entrepreneur managing multiple invoices daily, manually calculating sales tax can become a time-consuming task. Moreover, manual calculations increase the risk of mistakes, which could lead to penalties or audits from tax authorities. By using a sales tax Maryland calculator, you can automate these calculations and focus more on your business operations rather than worrying about tax compliance.

For online sellers, the importance of using a sales tax in Maryland calculator becomes even more significant. E-commerce platforms often sell to customers in different states, making tax calculations complex. When selling to Maryland residents, it is important that the correct 6% sales tax is applied. A calculator designed for Maryland sales tax ensures that every online sale reflects the right tax amount, maintaining compliance and transparency with your customers.

Using a sales tax calculator for Maryland is not just beneficial for established businesses. Startups and self-employed professionals can greatly benefit from this tool as well. When starting a business, there are already countless tasks to manage, from marketing to product development. Handling sales tax manually adds unnecessary stress. An automated calculator simplifies this process, making tax calculations quick and hassle-free.

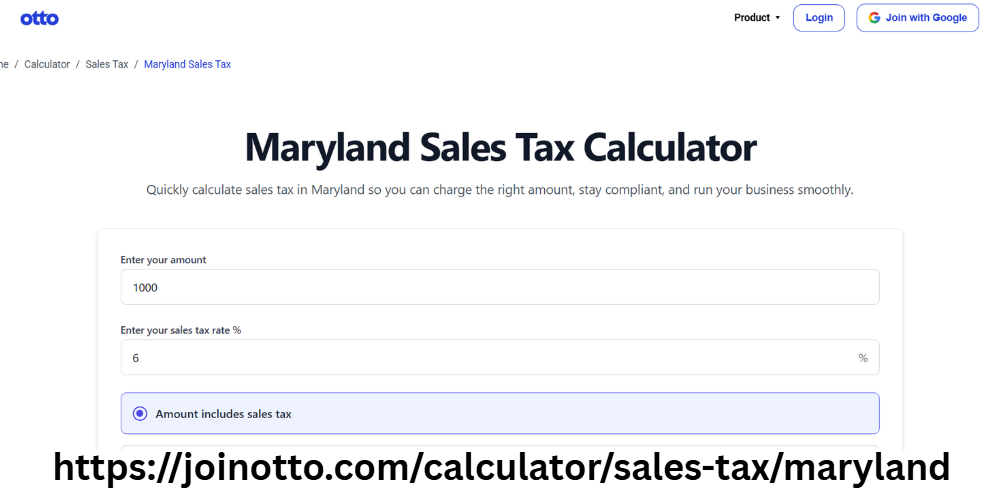

Otto AI provides a user-friendly Maryland sales tax calculator that fits perfectly into the workflow of small businesses and self-employed individuals. With Otto AI, you can input the sale price and get the exact tax amount in seconds. This not only speeds up the invoicing process but also ensures accuracy, so you can have peace of mind knowing your tax figures are correct.

Another advantage of using a Maryland sales tax calculator is during financial planning and forecasting. Knowing the exact tax amounts helps businesses set the right pricing strategies. It enables you to understand how much of your revenue goes to taxes and helps in better financial decision-making. Accurate tax calculations also ensure that your financial reports reflect the correct figures, which is important for audits and financial reviews.

Many entrepreneurs still rely on spreadsheets or manual methods to compute sales tax, which is outdated and inefficient. The digital age offers smarter solutions. By adopting a sales tax calculator Maryland businesses can stay updated with any tax rate changes automatically, ensuring ongoing compliance without manual checks.

One of the biggest concerns for businesses is facing penalties due to incorrect tax filing. Mistakes in sales tax calculation, whether overcharging or undercharging, can lead to customer dissatisfaction and possible legal issues. A sales tax Maryland calculator minimizes these risks by providing accurate figures every time, reducing the chances of human error.

Even for service-based businesses, where tax applicability might vary, having a tool that helps determine if a service is taxable and at what rate is extremely helpful. A Maryland sales tax calculator can be configured to handle such scenarios, making it versatile for various business types.

Otto AI's Maryland sales tax calculator is designed with simplicity in mind. It does not require advanced accounting knowledge to use. Whether you are preparing invoices, estimating costs, or managing tax filings, this tool is made to assist you at every step. It is an essential resource for anyone looking to streamline their tax processes while staying compliant with Maryland state tax regulations.

In conclusion, for businesses operating in Maryland, having an efficient Maryland Sales Tax Calculator is more than just a convenience—it is a necessity. It saves time, ensures accuracy, reduces the risk of penalties, and helps maintain transparency with customers. Otto AI offers an effective solution that helps small businesses, self-employed professionals, and entrepreneurs handle their sales tax with ease and confidence. Instead of spending hours on manual calculations, let Otto AI handle the numbers while you focus on growing your business.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness