California Sales Tax Calculator Guide for Business Owners and Entrepreneurs

Managing taxes is a crucial part of running any business, and understanding how sales tax works in California can save you from potential penalties and confusion. The California sales tax calculator is a helpful tool for small business owners, self-employed professionals, and entrepreneurs who need to determine the correct amount of sales tax on their products and services. Since sales tax rates can vary depending on the city, county, and type of goods sold, it’s important to have an accurate method to calculate what you owe. This blog will explain everything you need to know about using a California sales tax calculator in a simple and clear manner.

California has a statewide base sales tax rate, but local jurisdictions like cities and counties can add their own taxes on top of that. This means the total sales tax rate can differ depending on where the sale happens. For instance, a business in Los Angeles might have a higher combined tax rate compared to a business in a smaller town. The California sales tax calculator helps business owners quickly figure out how much tax to charge or pay by inputting the sales amount and selecting the correct location.

For entrepreneurs and freelancers who sell goods or services both online and offline, dealing with varying tax rates can be challenging. A sales tax calculator California simplifies this task by providing instant calculations based on current tax rates. Instead of manually looking up rates for each city or county, you can use a reliable calculator to do the math for you. This is especially useful when handling multiple transactions in different locations.

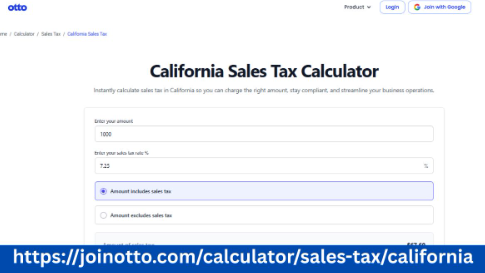

Sales tax in California calculator tools are designed to be user-friendly. You simply enter the sale price, and the calculator automatically adds the correct sales tax based on the location. This ensures accuracy and saves time for small businesses that may not have a dedicated accounting team. By using such a calculator, you reduce the risk of under-collecting or over-collecting sales tax, which can lead to compliance issues with tax authorities.

Otto AI offers a California sales tax calculator that is tailored for small businesses, freelancers, and entrepreneurs. It provides a straightforward interface where you can input your sale amount and receive accurate tax amounts instantly. This allows you to stay focused on your business operations without getting bogged down by complex tax calculations.

Another advantage of using a sales tax calculator California is that it helps with transparency. When you clearly display the tax amount to your customers at checkout, it builds trust and avoids confusion. Customers appreciate knowing exactly how much tax they are paying upfront, which can enhance their buying experience. For businesses, this clarity helps ensure you collect the right amount of tax and remit it properly to the tax authorities.

California’s tax laws also evolve over time, with rates being updated periodically. Relying on manual methods or outdated spreadsheets can lead to errors. A good sales tax California calculator tool stays updated with the latest tax rates across all cities and counties, giving you peace of mind that your calculations are always accurate.

For self-employed individuals who handle their own finances, having access to a reliable calculator is even more important. It simplifies invoice creation, helps in setting product prices correctly, and assists in filing accurate tax returns. Whether you’re selling handcrafted goods, digital services, or consulting, the sales tax in California calculator ensures that you are charging the correct tax rate for every transaction.

One common concern among small businesses is the complexity of tax compliance. Tax rules often come with detailed regulations, but tools like Otto AI’s California sales tax calculator make the process easier to manage. Instead of worrying about whether you are applying the correct tax rates for each location, you can rely on a tool that does it accurately and instantly.

In addition to calculating taxes on sales, these calculators are also useful when auditing past transactions. If you need to review past sales for accuracy or prepare for tax season, having a reliable calculator allows you to double-check figures without redoing complicated math. This is a valuable resource for business owners who want to ensure they are meeting their tax obligations properly.

For growing businesses that plan to expand into multiple locations within California, keeping track of varying sales tax rates becomes even more critical. A California sales tax calculator supports this growth by providing a scalable solution that can handle calculations across different regions. This means you can confidently expand your business reach without the stress of managing tax rates manually.

Otto AI understands the needs of small businesses and entrepreneurs, which is why its California sales tax calculator is designed to be both efficient and accurate. By incorporating this tool into your daily operations, you minimize the risk of tax errors, save valuable time, and focus more on growing your business rather than worrying about tax compliance.

In conclusion, using a California sales tax calculator is essential for businesses of all sizes to maintain accuracy and stay compliant with California’s complex tax structure. Whether you are a self-employed freelancer or a growing business, having a reliable tool like Otto AI’s sales tax calculator helps you calculate the correct sales tax easily and accurately. This ensures smooth operations, builds customer trust, and helps you avoid any tax-related surprises in the future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness