How to Pay Salary to Employees in India is a tricky question faced by businesses looking to expand to India. There are unique salary payment rules in India for employment, inward remittance, and taxes. But every problem has a solution. If you want to hire a remote team in India or pay freelancers there, this blog will help. We'll show you legal, efficient, and effective ways to pay employees in India.

How to Pay Employees in India

Options to Hire and Pay Employees in India

1. Set Up a Local Entity

A common way to hire and pay Employees in India is by forming a local entity. This method helps you manage operations and keeps you legally in control of your organization. For businesses, this can be a major weakness. It involves many legal steps. You need to handle registration, set up taxes, and create payroll systems. Navigating the laws of a foreign country is not simple if the very question in your mind is how to pay foreign employees!

This method is also highly deterred by various businesses as it comes with a relatively high cost and compliance burden.

Recommended for: Automobile companies looking to sell in India, firms looking to avail subsidies and benefits passed on by the Indian government.

2. Use an Employer of Record (EOR)

The lesser-known cousin of forming a subsidiary, Employer of Record or EOR, is by far the fastest and safest way to hire and pay employees in India. EOR is an equilibrium that lets you avail all the features without the burden of legal compliance and managing a subsidiary in India.

In this model, the EOR is the legal employer of the employee. This means the parent organization no longer holds legal responsibility. The EOR also manages payroll, reimbursements, and taxes.

Recommended for: Startups, SMBs, and Enterprises testing the Indian market.

3. Hire as Independent Contractors

If you’re not ready for a big commitment and don’t worry about IP risk or data privacy, consider hiring an independent contractor. This option allows for quick onboarding. Plus, there’s little to no compliance since the tax burden is on the contractor. You can easily pay through PayPal or similar services.

It’s a great choice for businesses with a lean or operations-focused team. It requires little to no paperwork.

The PE risk, or misclassification risk, still affects the parent organization in some cases.

What are the mandatory deductions and contributions in the Indian payroll system?

Now that we understand how to hire and pay employees in India, let’s look at salary compliance for them.

Income Tax (TDS)

One of India’s direct taxes, the income tax, is deducted at the source, and as per Indian labour law, the employer is liable to withhold income tax. Non-compliance with TDS can lead to a heavy penalty.

Working with a payroll expert is crucial. Tax rates depend on salary and benefits. They can change often based on location and services provided.

Provident Fund (PF)

Provident Fund is the 401K equivalent of what India has to offer, which is to safeguard the employees during times of trouble or retirement. As it is designed to safeguard the employees, it is mandatory for employees earning below ₹15,000/month

One of the standout features in terms of compliance with PF is that both the employer and employee contribute ~12% each

Employee State Insurance (ESI)

Another welfare benefit applicable is the employee state insurance if the salary is below ₹21,000/month. These are benefits that cover health insurance and social benefits. Just like the income tax, these fees are to be deducted by the employer.

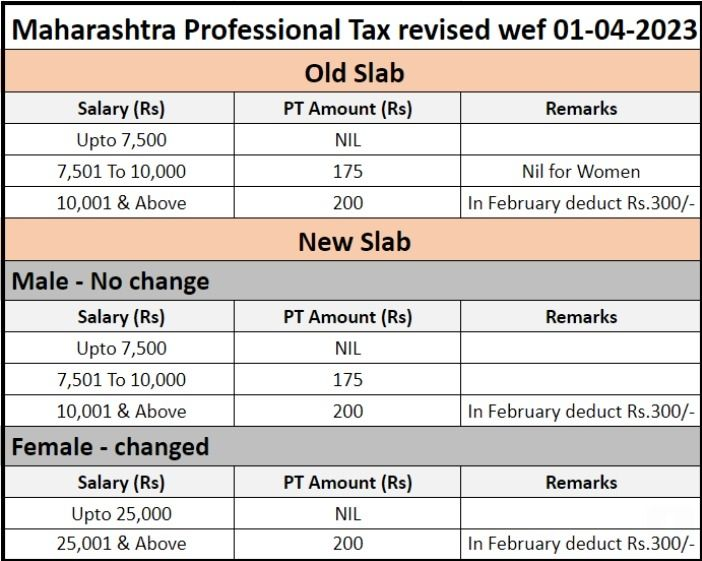

Professional Tax

A nominal tax, which varies by state (eg, Maharashtra, Karnataka), is deducted by the employer and is paid to the state government. This, too, is a direct tax; however, it is clearly stated in the constitution that the professional tax is capped at ₹2,500 per year, as per Article 276.

Gratuity

Gratuity in India is a one-time payment from an employer to an employee. This happens when an employee leaves the company after five or more years of service. It rewards long service and support after employment ends. This applies to resignations, retirements, or terminations that aren't due to misconduct. The Payment of Gratuity Act, 1972 covers this benefit. It ensures that eligible employees get fair pay based on their last salary and years of service.

How does Gratuity calculation work and the taxes associated with Gratuity?

Gratuity in India is calculated using the formula: (15 × last drawn basic salary × years of service) ÷ 26 . Under Section 10(10) of the Income Tax Act, gratuity received by an employee is tax-exempt up to ₹20 lakhs. This exemption includes government and private-sector workers under the Payment of Gratuity Act.

For private employees not covered under the Act, the exemption is the lowest of:

-

- ₹20 lakhs

- Gratuity actually received

- Half month's salary × years of service

What is the step-by-step payroll process in India?

Payroll in India is the complete process of calculating, paying, and reporting employee salaries. It also includes ensuring compliance with laws. It includes calculating gross pay, applying deductions like PF, ESI, and TDS, and then paying the net salary. This must also follow all labor laws and tax rules.

To How to Pay Salary to Employees in India

-

- Set Up Payroll Policy

To Pay employees in India, the very first step you need to take is to define the salary components, set the pay frequency (which for India is quite standard at monthly), and tax compliance rules and declarations. - Collect Employee Details

The second important step is to gather all the supporting documents from the employees PAN (Permanant Account Number), Aadhaar, Bank info (Bank name, Account number, IFSC code), canceled check, Form 12BB, and other statutory documents. - Track Attendance & Leave

To pay the correct salary it is important to know the exact payable hours, use HRMS, digital attendance or biometric tools to log work hours, paid/unpaid leave, and overtime (if applicable). - Calculate Gross Salary

When you finally reach the stage where you are crunching numbers, start off by reaching the gross salary, for which add up all the salary components such as basic pay, HRA, special allowances, performance linked incentives, and bonuses.

You can go through the comprehensive salary calculator in India here to get an in-depth insight of all the terminologies. - Apply Deductions

After you have the gross salary with you, comes the time to apply all the standard deductions such as Provident Fund (PF), Employee State Insurance (ESI), TDS, Professional Tax, and any voluntary benefits. - Determine Net Salary

Now that you have the gross salary and the deductions handy, you simply need to subtract all the deductions from the gross salary to get the net salary. - Salary Disbursement & Payslip Generation

The calculated net salary is then transferred to the bank account provided by the employee through the employers bank, this generates the proof of pay as well as the official payslips. - Statutory Filing & Tax Deposits

Submit PF, ESI, and TDS returns and deposit deducted amounts with relevant government bodies.

- Set Up Payroll Policy

Salary Payment Rules in India

As per Indian law, salaries must be paid:

-

- Within 7 days after the end of the pay cycle (monthly/bi-weekly).

- In Indian Rupees , unless otherwise approved.

Via bank transfer , cheque, or electronic payment cash payments are restricted .

Types of Payment System

Direct bank transfers – This method works well for independent contractors or freelancers. Payments are made against invoices or for services rendered, this one of the most common and easy to execute types of payment system globally

Salary accounts in local banks – is the most common types of payment system organizations in India use to pay their workers. It is the preferred method as it creates a trail and document, vital to support employees' loan claims.

Use EOR or payroll providers with local banking support – If your business isn't registered in India, this is the best option. It helps you avoid compliance issues. Plus, it makes sure your workforce has the documents needed for loans.

Pay cycles – In India, the workforce usually follows a monthly pay cycle. Salaries are processed either on the last working day of the month or on the 1st of the next month.

To pay employees in India correctly, you need more than a payroll system. You also need local knowledge and support for compliance. Make sure your team is paid accurately and legally, whether through a local entity or Employer of Record Services .

Why Choose Remunance for Your Payroll Operations in India?

Remunance lets you pay Indian employees without having to create a formal business. Whether you are employing contract or full-time employees, we guarantee seamless onboarding, pay structure, and adherence to Indian legislation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness