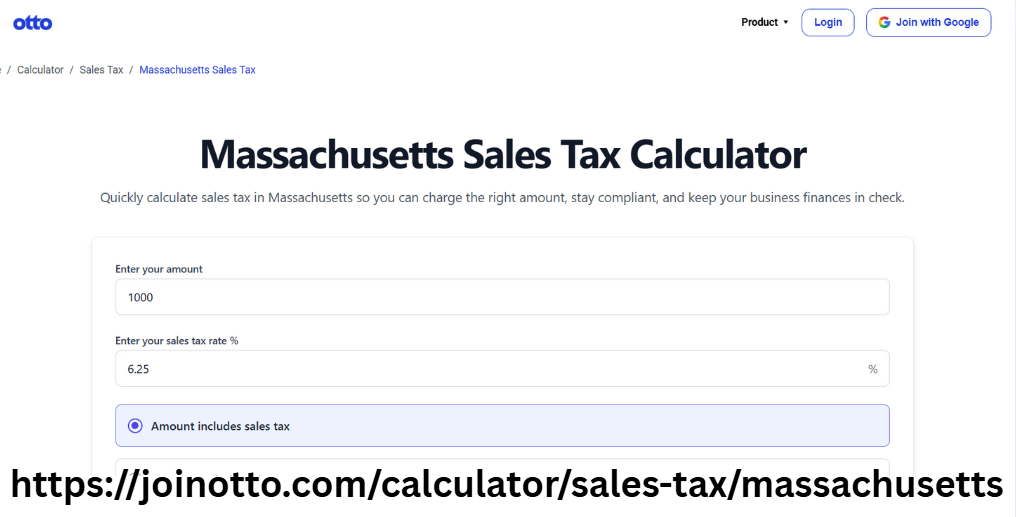

Otto AI Smart Massachusetts Sales Tax Calculator

Running a business in Massachusetts comes with its own unique set of challenges. Whether you are a freelancer, a self-employed designer, or someone running a local store, one thing you cannot ignore is sales tax. Getting the numbers wrong can mean extra penalties, lost revenue, or confused customers. That is where the Massachusetts Sales Tax Calculator becomes an essential part of your daily business tools. With Otto AI, you can use this calculator to quickly estimate sales tax without second-guessing or doing manual math. It’s designed with simplicity in mind, making it ideal for small business owners and entrepreneurs who want to save time and focus more on their business instead of tax paperwork.

Massachusetts currently has a state sales tax rate of 6.25%. However, this rate can vary depending on what you're selling and whether local municipalities add any special taxes. Some items like groceries and clothing under a certain value are exempt. Others, like meals or certain services, may have slightly different rules. This makes tax calculation a bit tricky, especially when you're in a rush or dealing with multiple products. That’s why a sales tax calculator Massachusetts tool like the one offered by Otto AI can be incredibly useful. It takes all these variables into account and delivers an accurate figure in seconds.

Instead of dealing with complex spreadsheets or flipping through tax charts, you can enter the price of your product or service into the calculator and get a real-time result. For example, if you're selling an item for $100, the calculator will instantly show you the sales tax (which is $6.25) and the final amount ($106.25). This is especially helpful when preparing invoices, making quotes, or working on online pricing. The sales tax Massachusetts calculator not only saves time but also reduces human error, which is critical when managing customer expectations and bookkeeping.

Otto AI has developed the Massachusetts Sales Tax Calculator specifically for everyday users. You don’t need any accounting background to use it. The interface is clean, the steps are few, and the output is clear. This makes it a great fit for solopreneurs, market sellers, eCommerce stores, or anyone who needs to deal with Massachusetts tax calculations regularly. Whether you’re billing a client or managing checkout at your retail counter, having a quick and accurate tax tool at your fingertips means you can spend more time selling and less time calculating.

For those offering services, the tool is just as beneficial. In Massachusetts, certain services are taxable while others are not. For example, personal training may be taxable, while legal consulting might not be. Having a reliable calculator allows you to quickly test scenarios. This becomes useful when you're quoting rates or discussing budgets with clients. Instead of making rough guesses, you can provide a detailed cost breakdown with tax included, showing your professionalism and attention to detail.

The sales tax calculator Massachusetts is also valuable for those managing inventory or setting prices. Let’s say you want to price your item at $50 after tax. You can reverse-calculate with the tool to find out what pre-tax price you need to set. This helps with pricing strategies and profit margins. Many small businesses don’t realize how much of a difference clear tax planning can make until they start using the right tools.

Otto AI ensures the calculator is always up-to-date with the latest state tax laws. Massachusetts occasionally updates its tax rates or makes changes to taxable items. Manually keeping track of these changes can be time-consuming and confusing. With this calculator, you don’t have to worry. The backend is regularly updated so you always get the correct numbers based on the latest rules.

One of the most important benefits of using a Massachusetts Sales Tax Calculator is trust. Your clients or customers will trust you more when your pricing is consistent and accurate. It eliminates awkward moments at the cash register or over email when someone questions a total. You can even show them the breakdown to prove transparency. Over time, these small actions build confidence in your brand.

Otto AI has designed this tool to support more than just calculations. It supports decision-making. Whether you're planning your next product launch or trying to estimate monthly earnings, knowing the exact tax portion allows for better financial planning. It’s not just about the final price; it’s about understanding how taxes impact your business overall.

If you work in a seasonal business, like summer events, holiday markets, or freelance services, the tool becomes even more important. When your workload spikes, the last thing you want to worry about is whether you charged the right amount of sales tax. Having a dependable calculator available 24/7 ensures your numbers are always correct, whether it’s 2 PM or 2 AM.

There’s also peace of mind. Nobody likes dealing with audits or correcting tax returns. Overcharging customers can lead to complaints, while undercharging may result in penalties or having to pay out of your pocket. With the sales tax massachusetts calculator, you avoid both risks. It creates a layer of confidence and protection around your transactions.

Even better, Otto AI makes sure this tool works smoothly on any device. You can use it on your phone while traveling, on your tablet at a market, or on your computer at your desk. There’s no need to install anything or sign up for complicated software. Just open it, input your number, and get your result.

For new entrepreneurs, using a tax calculator may seem like a small step, but it’s part of building a solid business foundation. Financial discipline, transparency, and accuracy are what set sustainable businesses apart. And having a tool like Otto AI’s Massachusetts Sales Tax Calculator means you're already moving in the right direction.

In conclusion, managing taxes may never be fun, but it doesn’t have to be difficult. A simple tool like the Massachusetts Sales Tax Calculator can make a big difference in how you handle pricing, customer communication, and compliance. Whether you are invoicing clients, creating an online store, or selling at local fairs, Otto AI provides a reliable, quick, and user-friendly solution that supports your growth every step of the way.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness