GCC Real Estate Market Trends, Growth, and Demand Forecast 2025-2033

GCC Real Estate Market Overview

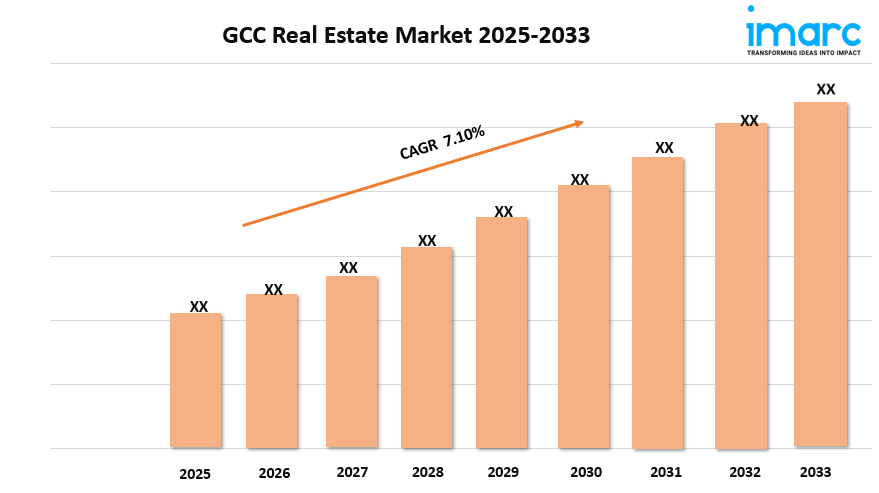

Market Size in 2024: 131.86 Billion

Market Size in 2033: USD 252.80 Billion

Market Growth Rate 2025-2033: 7.10%

According to IMARC Group's latest research publication, "GCC Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Country, 2025-2033", the GCC real estate market size was valued at USD 131.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 252.80 Billion by 2033, exhibiting a CAGR of 7.10% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/gcc-real-estate-market/requestsample

Growth Factors in the GCC Real Estate Market

- Urbanization and Population Growth

The GCC real estate market is growing fast. Rapid urbanization and a rising population are key factors. Cities such as Dubai, Riyadh, and Doha are growing. More people are moving there for jobs and a better lifestyle. For instance, Saudi Arabia’s Vision 2030 has led to big projects like NEOM. These projects attract new residents and investors. This increase in population boosts demand for residential, commercial, and retail properties. Also, more expatriates are moving to the UAE and Qatar. This increases the demand for different housing options. These include luxury villas and affordable apartments. This boosts construction and real estate activity.

- Government Initiatives and Economic Diversification

GCC governments are promoting real estate growth to diversify their economies. Saudi Arabia’s Vision 2030 and the UAE’s Vision 2021 focus on reducing oil dependency. They do this by investing in real estate and tourism. For example, Dubai’s Expo 2020 legacy project is now District 2020. This area has become a hub for innovation and business, drawing global investors. The initiatives offer incentives, such as tax breaks and relaxed foreign ownership laws. These measures encourage investment in both commercial and residential properties. These policies foster a strong setting for real estate development. They also encourage long-term market growth.

- Infrastructure Development

Large infrastructure investments in the GCC boost real estate growth. Projects such as Qatar's Lusail City for the 2022 FIFA World Cup and Abu Dhabi's Saadiyat Island cultural district show how infrastructure boosts property demand. Better transport systems, such as the Riyadh Metro and Dubai’s Route 2020, improve connectivity. This makes suburbs more attractive for homes and businesses. These developments increase property values and create chances for mixed-use projects. They meet the region's rising demand for integrated urban living spaces.

Key Trends in the GCC Real Estate Market

- Rise of Sustainable Developments

Sustainability is changing the GCC real estate market. Developers are focusing on eco-friendly projects. Green building certifications, like LEED, are becoming popular. Masdar City in Abu Dhabi highlights energy-efficient designs and renewable energy use. Buyers and tenants want properties with a lower environmental impact. Global awareness and government rules drive this shift. For example, Dubai’s Sustainable City features solar-powered homes and water recycling systems. These elements attract eco-conscious residents. This trend helps the GCC lower its carbon footprint. It affects both home and business designs.

- Technology Integration in Real Estate

The adoption of technology is revolutionizing the GCC real estate sector. Smart home systems, virtual property tours, and blockchain-based transactions are becoming standard. In Dubai, companies like Emaar use AI platforms to improve customer experiences. They offer virtual reality tours of properties. PropTech startups are also making property management easier. Apps let tenants pay rent and report issues online. This trend boosts efficiency, transparency, and accessibility. It attracts tech-savvy investors and residents. Digital transformation is speeding up. Technology is changing how marketers promote, sell, and manage properties in the region.

- Growth of Affordable Housing

The demand for affordable housing is rising in the GCC. This trend comes from the needs of middle-income residents and young professionals. Governments have started programs to meet this demand. One example is Saudi Arabia’s Sakani program. This program aims to provide affordable homes to citizens. Developers are also stepping up by creating cost-effective housing projects. For example, Dubai South’s residential communities serve various income groups. This shift moves away from luxury developments towards inclusive housing solutions. It ensures more people can access homes. It also supports social stability by addressing housing shortages for the growing population.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging GCC Real Estate market trends.

GCC Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

Analysis by Business:

- Sales

- Rental

Analysis by Mode:

- Online

- Offline

Regional Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The GCC real estate market is set for steady growth. This growth comes from economic diversification, technology, and sustainability efforts. Governments are pouring money into big projects. For example, Saudi Arabia has the Red Sea Project, and the UAE is developing Aljada. These projects will likely draw global investors looking for high returns. Affordable housing and smart city initiatives will help more people. This promotes inclusivity. However, challenges exist. Geopolitical uncertainties and changing oil prices may shake investor confidence. Still, the GCC real estate sector can adapt. It uses new financing and sustainable methods. This builds strong urban ecosystems for future generations.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness