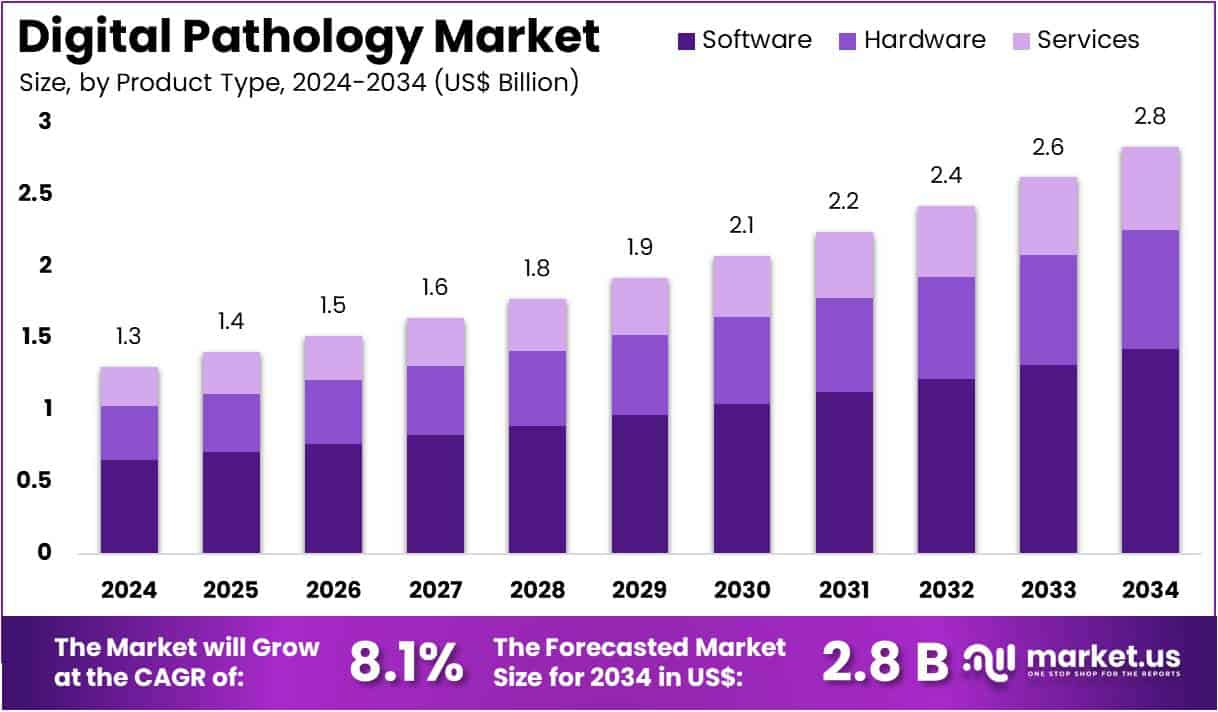

The Digital Pathology Market is set to reach around US$ 2.8 billion by 2034, rising from US$ 1.3 billion in 2024. It will grow at a CAGR of 8.1% from 2025 to 2034. This growth is driven by increasing demand for faster and more accurate diagnostics. Digital workflows are replacing traditional pathology methods, offering efficiency and remote access. Technological advancements, rising chronic disease cases, and healthcare digitization are major contributors fueling market expansion across various regions.

North America leads the global market, holding a 40.8% revenue share in 2024. The region’s dominance stems from widespread adoption of whole slide imaging (WSI) and AI-integrated diagnostics. Telepathology is also gaining momentum, enabling faster and remote consultations. Cancer prevalence in the U.S. drives the need for digital pathology. Regulatory support, such as FDA clearance of Philips’ IntelliSite Pathology Solution, has encouraged adoption. Major diagnostic players are showing growth, reflecting this market momentum and growing demand for advanced diagnostic tools.

Roche’s Diagnostics Division achieved 4% sales growth in 2024, reaching CHF 14.3 billion. Excluding COVID-19 products, the base business grew by 8%. Demand increased for immunodiagnostics, pathology, and molecular solutions. Danaher, which owns Leica Biosystems, also reported growth. Its Diagnostics segment’s core revenue rose by 1% in 2024. These developments reflect continued investment in cutting-edge diagnostic tools. With nearly 2 million new cancer cases projected in the U.S. for 2023, there is a clear need for digital pathology systems that can deliver accurate and timely results.

Asia Pacific is expected to grow at the highest CAGR through 2034. The growth is fueled by a large, aging population and rising chronic disease rates, especially cancer. Countries such as India, China, Japan, and Australia are upgrading healthcare systems. Government support for digital health is also increasing. In 2024, digital health funding in Asia Pacific reached US$2 billion across 244 deals. These investments focused on diagnostics and AI-based tools, creating strong foundations for digital pathology adoption in the region.

India alone reported an estimated 1.4 million cancer cases in 2023, according to ICMR. This underscores the urgent need for better diagnostic infrastructure. Healthcare providers in the region are adopting AI-powered pathology solutions. Roche’s Diagnostics Division saw a 17% sales increase in the International region in 2024, led by growth in China. This highlights rising demand for digital diagnostics. As Asia Pacific embraces digital transformation, the region will likely drive the future of digital pathology with improved outcomes and streamlined workflows.