Japan Gas Turbine Market Size, Trends & Share Outlook 2025–2033

Japan Gas Turbine Market Overview

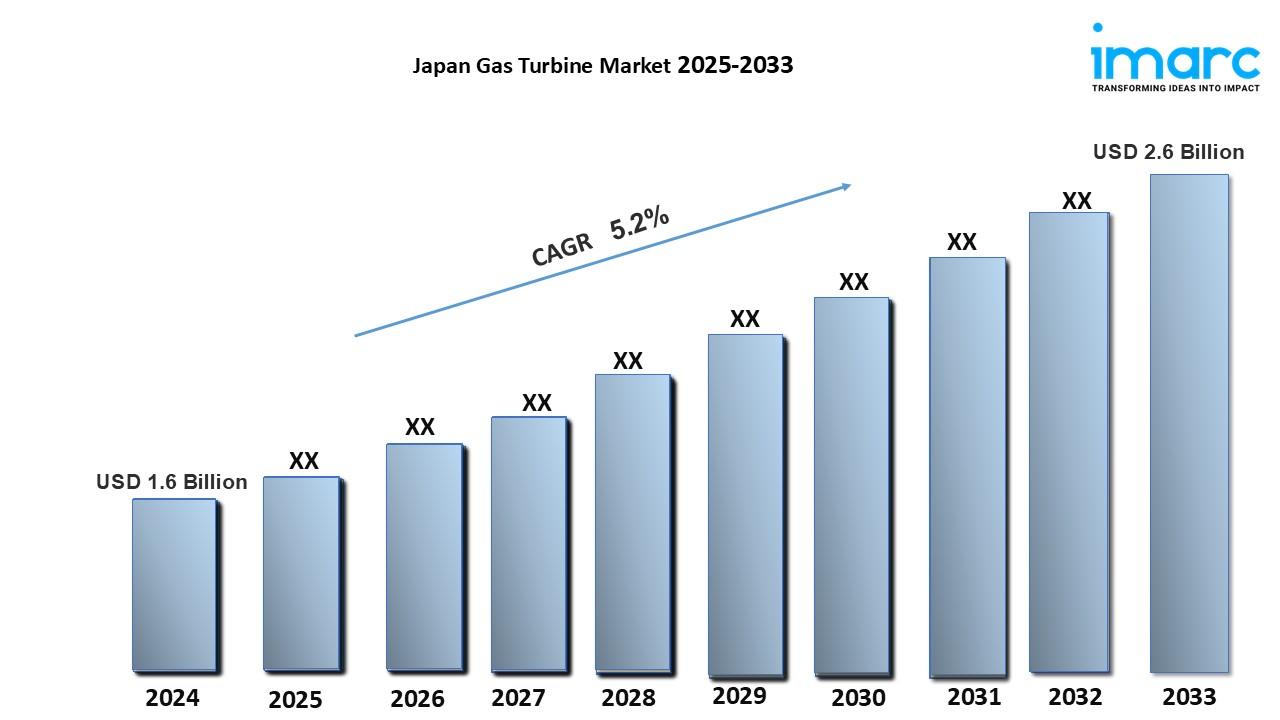

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 2.6 Billion

Market Growth Rate 2025-2033: 5.2% CAGR

According to IMARC Group's latest research publication, "Japan Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End User, and Region 2025-2033," the Japan gas turbine market size was valued at USD 1.6 Billion in 2024. IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is driven by Japan’s energy transition policies, increasing demand for cleaner energy sources, advancements in turbine technology, and growing industrial and power generation needs.

Download a Free Sample PDF of this report: https://www.imarcgroup.com/japan-gas-turbine-market/requestsample

Growth Factors in the Japan Gas Turbine Market

Energy Transition and Decarbonization Policies

Japan’s commitment to carbon neutrality by 2050 and policies like the Green Growth Strategy drive demand for gas turbines as a cleaner alternative to coal. Natural gas emits 50% less CO2 than coal, making gas turbines critical for reducing emissions. In the Kanto Region, gas turbine installations for power generation grew by 12% in 2024, with a projected CAGR of 5.4%, supported by government incentives.

Increasing Demand for Cleaner Energy Sources

Post-Fukushima, Japan has diversified its energy mix, with natural gas accounting for 34% of electricity generation in 2024. Gas turbines, particularly combined cycle systems, are favored for their efficiency and lower environmental impact. In the Chubu Region, gas-fired power capacity increased by 15% in 2024, with a projected CAGR of 5.3%.

Advancements in Turbine Technology

Innovations in materials, such as superalloys and thermal barrier coatings, have improved turbine efficiency by 15%, enabling operation at temperatures above 1500°C. Hydrogen-ready turbines, like GE Vernova’s 6F.03 model, support Japan’s National Hydrogen Strategy. In the Kansai Region, adoption of advanced turbines grew by 14% in 2024, with a projected CAGR of 5.5%.

Growing Industrial and Power Generation Needs

Japan’s industrial sector, including chemicals and manufacturing, demands reliable power. Gas turbines support cogeneration and distributed energy systems. In the Kyushu-Okinawa Region, industrial turbine applications grew by 13% in 2024, with a projected CAGR of 5.1%, driven by energy-intensive industries.

Key Trends in the Japan Gas Turbine Market

Combined Cycle Gas Turbine (CCGT) Dominates Technology Segment

CCGTs, which use waste heat to power steam turbines, held a 60% market share in 2024, valued at USD 960 Million, due to their high efficiency (up to 60%) and low emissions. In the Tohoku Region, CCGT installations grew by 16%, with a projected CAGR of 5.6%. Open Cycle Gas Turbines (OCGTs) are the fastest-growing segment, with a CAGR of 6.0%, driven by their rapid startup capabilities for peak power needs.

Heavy Duty (Frame) Type Leads Design Type Segment

Heavy Duty turbines accounted for 55% of the market share in 2024, valued at USD 880 Million, due to their reliability in large-scale power generation. In the Chugoku Region, heavy duty turbine sales grew by 14%, with a projected CAGR of 5.2%. Aeroderivative turbines, valued for their flexibility in distributed power, are the fastest-growing segment, with a CAGR of 5.8%.

Above 300 MW Dominates Rated Capacity Segment

Turbines above 300 MW held a 50% market share in 2024, valued at USD 800 Million, critical for base-load power generation. In the Kanto Region, demand for high-capacity turbines grew by 15%, with a projected CAGR of 5.3%. The 1–40 MW segment is the fastest-growing, with a CAGR of 6.2%, driven by decentralized power applications in remote areas.

Power Generation Leads End-User Segment

The power generation sector accounted for 65% of the market share in 2024, valued at USD 1.04 Billion, driven by rising electricity demand and grid modernization. In the Hokkaido Region, power generation turbine sales grew by 17%, with a projected CAGR of 5.4%. The oil and gas sector is the fastest-growing, with a CAGR of 5.9%, due to turbine use in extraction and processing.

Integration with Renewable Energy and Digital Solutions

Hybrid systems combining gas turbines with solar and wind are gaining traction to stabilize intermittent renewable energy. Digital solutions like predictive maintenance and AI analytics, adopted by companies like Siemens, improve efficiency by 10%. In the Shikoku Region, hybrid turbine projects grew by 12% in 2024, with a projected CAGR of 5.7%.

Japan Gas Turbine Market Industry Segmentation

The report has segmented the market into the following categories:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan Gas Turbine Market Share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

Design Type Insights:

- Heavy Duty (Frame) Type

- Aeroderivative Type

Rated Capacity Insights:

- Above 300 MW

- 120–300 MW

- 40–120 MW

- Less Than 40 MW

End-User Insights:

- Power Generation

- Mobility

- Oil and Gas

- Others

Regional Insights

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=18055&flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

The Japan gas turbine market is poised for steady growth through 2033, driven by decarbonization goals, technological advancements, and rising energy demand. The Kanto and Chubu regions will lead due to high industrial activity and energy consumption. Challenges include high capital costs (e.g., USD 1–2 million per MW for CCGTs) and competition from renewables, with solar and wind costs dropping 82% and 39% over the past decade. Innovations in hydrogen-fueled turbines, digital monitoring, and hybrid systems will support growth, aligning with Japan’s USD 20 billion clean energy market target by 2030.

Research Methodology

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

Street: 563-13 Ueyan

City: Iwata City

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness