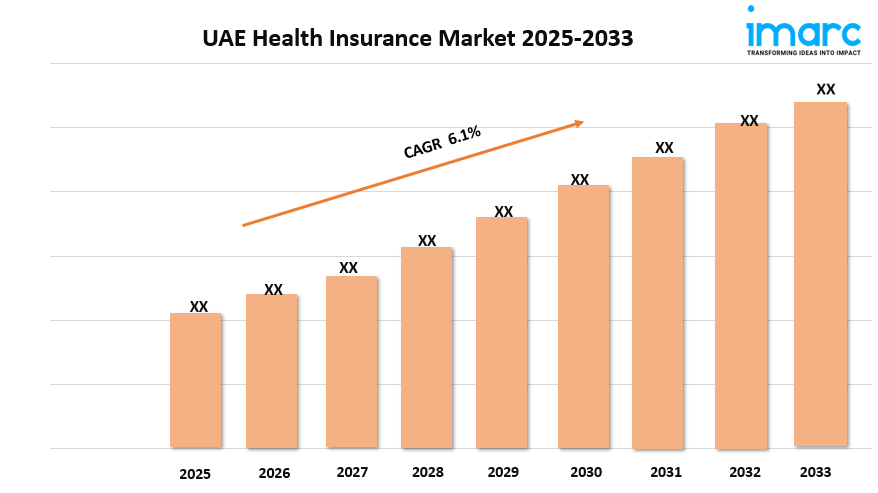

UAE Health Insurance Market Outlook, Growth, and Forecast 2025-2033

UAE Health Insurance Market Overview

Market Size in 2024: USD 8.72 Billion

Market Size in 2033: USD 14.9 Billion

Market Growth Rate 2025-2033: 6.1%

According to IMARC Group's latest research publication, "UAE Health Insurance Market Size, Share, Trends and Forecast by Type, and Service Provider, 2025-2033", the UAE health insurance market size was valued at USD 8.72 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.9 billion by 2033, exhibiting a CAGR of 6.1% during 2025-2033.

Growth Factors in the UAE Health Insurance Market

- Mandatory Health Insurance Regulations

The UAE government's implementation of mandatory health insurance across emirates like Abu Dhabi and Dubai has significantly driven the growth of the health insurance market in UAE. These regulations require employers to provide coverage for employees, ensuring a broad population base has access to insurance. For instance, Dubai's Health Insurance Law mandates comprehensive coverage for all residents, boosting demand for private insurance plans. This policy not only increases market penetration but also encourages insurers to offer diverse plans tailored to various workforce needs, fostering competition and innovation while ensuring financial protection against medical expenses for a growing number of residents.

- Rising Population and Expatriate Influx

The UAE’s rapidly growing population, fueled by a significant expatriate community, is a key growth factor for the health insurance market. Expatriates, who often require health insurance as a visa prerequisite, create a large customer base. For example, Abu Dhabi’s Thiqa program covers UAE nationals, while private insurers like Daman cater to expatriates, offering customized plans. This demographic diversity drives demand for flexible insurance products that address varied healthcare needs, from basic coverage to specialized treatments. The influx of medical tourists further amplifies the need for comprehensive health plans, supporting market expansion.

- Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases, such as diabetes and cardiovascular conditions, is propelling the demand for comprehensive health insurance in the UAE. With lifestyle-related illnesses becoming more common, individuals and employers seek robust coverage to manage high treatment costs. For instance, the International Diabetes Federation notes a high prevalence of diabetes in the UAE, prompting insurers to develop plans covering long-term care and preventive measures. Companies like Sukoon have introduced tailored products addressing chronic conditions, ensuring policyholders have access to ongoing treatments, which enhances market growth by meeting critical healthcare needs.

Key Trends in the UAE Health Insurance Market

- Digital Transformation in Insurance Services

The adoption of digital technologies is reshaping the UAE health insurance market, enhancing customer experience and operational efficiency. Insurers are investing in online platforms and mobile apps for seamless policy management, claims processing, and telemedicine services. For example, Abu Dhabi National Insurance Company (ADNIC) offers a “Get a Quote” feature on its website, allowing customers to purchase policies or submit claims in seconds. This trend not only streamlines processes but also appeals to tech-savvy consumers, fostering greater engagement and accessibility while reducing administrative costs for insurers.

- Focus on Mental Health Coverage

Growing awareness of mental health issues is driving insurers to integrate mental health coverage into their plans, reflecting a shift in consumer preferences. Partnerships like Dubai National Insurance’s collaboration with Takalam, a mental health platform, provide policyholders with access to counseling and professional support. This trend addresses rising mental health challenges, such as postpartum depression, which affects a significant portion of women in Abu Dhabi. By offering tailored mental health services, insurers enhance customer satisfaction and differentiate their offerings in a competitive market, aligning with evolving societal needs.

- Strategic Partnerships and Collaborations

Collaborations between insurers and healthcare providers are a prominent trend, improving service delivery and expanding market reach. A notable example is Sukoon’s partnership with Aster DM Healthcare, which introduced innovative health plans for individuals and corporates. These partnerships enable insurers to offer comprehensive coverage, streamline healthcare access, and enhance patient experiences. By aligning with reputable healthcare institutions, insurers can develop customized products that cater to diverse needs, fostering customer loyalty and driving market growth through innovative and accessible insurance solutions.

Download a sample PDF of this report: https://www.imarcgroup.com/uae-health-insurance-market/requestsample

UAE Health Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

- Individual

- Group

Analysis by Service Provider:

- Public

- Private

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The UAE health insurance market is poised for sustained growth, driven by ongoing government initiatives, technological advancements, and increasing healthcare awareness. The government’s commitment to improving healthcare infrastructure, such as through the Dubai Health Strategy 2021, will continue to support market expansion by promoting accessibility and quality care. The integration of AI, telemedicine, and digital platforms will enhance customer engagement, making insurance more convenient and personalized. Additionally, rising healthcare costs and a focus on preventive care will drive demand for comprehensive plans. As insurers innovate and form strategic partnerships, the market will evolve to meet diverse needs, ensuring robust growth and improved health outcomes for UAE residents.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness