Japan Control Valves Market Size, Share Outlook 2033

Japan Industrial Valves Market Overview

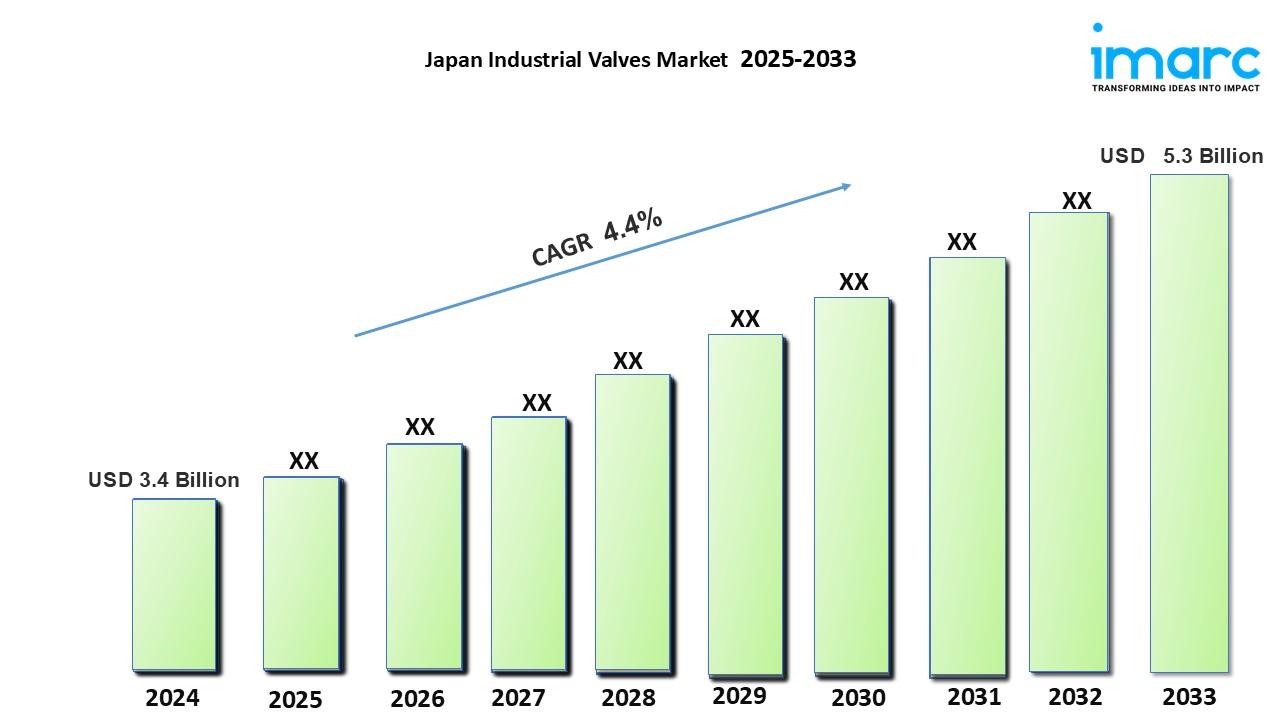

Market Size in 2024: USD 3.4 Billion

Market Forecast in 2033: USD 5.3 Billion

Market Growth Rate 2025-2033: 4.4%

According to IMARC Group's latest research publication, "Japan Industrial Valves Market Report by Product Type, Functionality, Material, Size, End Use Industry, and Region 2025-2033," the Japan industrial valves market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033.

Download a Free Sample PDF of this report: https://www.imarcgroup.com/japan-industrial-valves-market/requestsample

Growth Factors in the Japan Industrial Valves Market

Robust Industrial and Infrastructure Development

Japan’s ongoing industrial and infrastructure projects, particularly in oil and gas, power, and water treatment sectors, drive demand for industrial valves. The country’s focus on upgrading aging infrastructure, such as water treatment plants in the Kanto Region, has increased the adoption of high-performance valves like gate and butterfly valves. For instance, a 2024 project by Tokyo Metropolitan Government utilized steel ball valves for a wastewater treatment facility, improving operational efficiency. This trend, supported by government investments in infrastructure modernization, significantly contributes to market growth across various industries.

Advancements in Automation and Smart Valves

The integration of automation technologies in industrial processes is boosting the demand for smart control valves equipped with sensors and IoT capabilities. These valves enhance precision and efficiency in industries like chemical and pharmaceutical. For example, in 2024, Yokogawa Electric Corporation supplied smart control valves for a chemical plant in the Chubu Region, reducing downtime by 15%. Japan’s leadership in industrial automation, coupled with the push for Industry 4.0, drives the adoption of advanced valve technologies, fueling market expansion.

Stringent Environmental and Safety Regulations

Japan’s strict environmental and safety regulations, particularly in the oil and gas and power sectors, are propelling the demand for reliable and durable industrial valves. Regulations mandating leak-proof and corrosion-resistant valves have led to increased adoption of alloy-based and stainless steel valves. For instance, a 2024 initiative by JFE Steel in the Kyushu-Okinawa Region introduced corrosion-resistant check valves for a power plant, ensuring compliance with environmental standards. This regulatory push encourages industries to invest in high-quality valves, driving market growth.

Key Trends in the Japan Industrial Valves Market

Rise of Smart and IoT-Enabled Valves

The adoption of IoT-enabled smart valves is a growing trend, enabling real-time monitoring and predictive maintenance in industrial applications. These valves optimize operations in sectors like oil and gas and water treatment. For example, a 2024 project by Mitsubishi Heavy Industries in the Kinki Region integrated IoT-enabled globe valves in a power plant, improving efficiency by 12%. This trend, driven by Japan’s advanced technological infrastructure, is increasing the market share of control valves with smart functionalities.

Focus on Sustainable and Energy-Efficient Valves

Sustainability is a key trend, with industries prioritizing energy-efficient and eco-friendly valve designs to meet Japan’s carbon neutrality goals. Manufacturers are developing valves with low-emission seals and recyclable materials. For instance, in 2024, KITZ Corporation introduced eco-friendly butterfly valves for a water treatment facility in the Hokkaido Region, reducing energy consumption by 10%. This trend aligns with environmental regulations and drives demand for sustainable valve solutions across multiple industries.

Growing Demand for Compact and High-Pressure Valves

The demand for compact and high-pressure valves, particularly in the 1”–6” size range, is rising due to their versatility in space-constrained applications like pharmaceutical and food processing plants. For example, a 2024 project by Asahi Yukizai in the Central/Chubu Region supplied compact ball valves for a beverage processing facility, enhancing operational flexibility. This trend, driven by the need for efficient and reliable components in high-precision industries, is boosting the market for smaller-sized valves.

Japan Industrial Valves Market Industry Segmentation

The report has segmented the market into the following categories:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Japan Industrial Valves Market Share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Product Type Insights:

- Gate Valve

- Globe Valve

- Butterfly Valve

- Ball Valve

- Check Valve

- Plug Valve

- Others

Functionality Insights:

- On-Off/Isolation Valves

- Control Valves

Material Insights:

- Steel

- Cast Iron

- Alloy Based

- Others

Size Insights:

- Upto 1”

- 1”–6”

- 7”–25”

- 26”–50”

- 51” and Above

End Use Industry Insights:

- Oil and Gas

- Power

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Food and Beverage

- Others

Regional Insights

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=18521&flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

The Japan industrial valves market is set for steady growth through 2033, driven by infrastructure modernization, automation, and stringent environmental regulations. Regions like Kanto and Kinki will lead due to their concentration of industrial activities and infrastructure projects. Innovations in smart and eco-friendly valves, such as IoT-enabled control valves, will cater to the demand for efficiency and sustainability. For instance, collaborations like Yokogawa’s partnership with energy firms in 2024 are expected to accelerate smart valve adoption. Government initiatives promoting green industrial practices will further drive demand, ensuring robust growth across oil and gas, power, and water treatment sectors.

Research Methodology

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness