Insurance Rating Platform Market Analysis by Size, Share and Growth Report (2024–2032) | UnivDatos

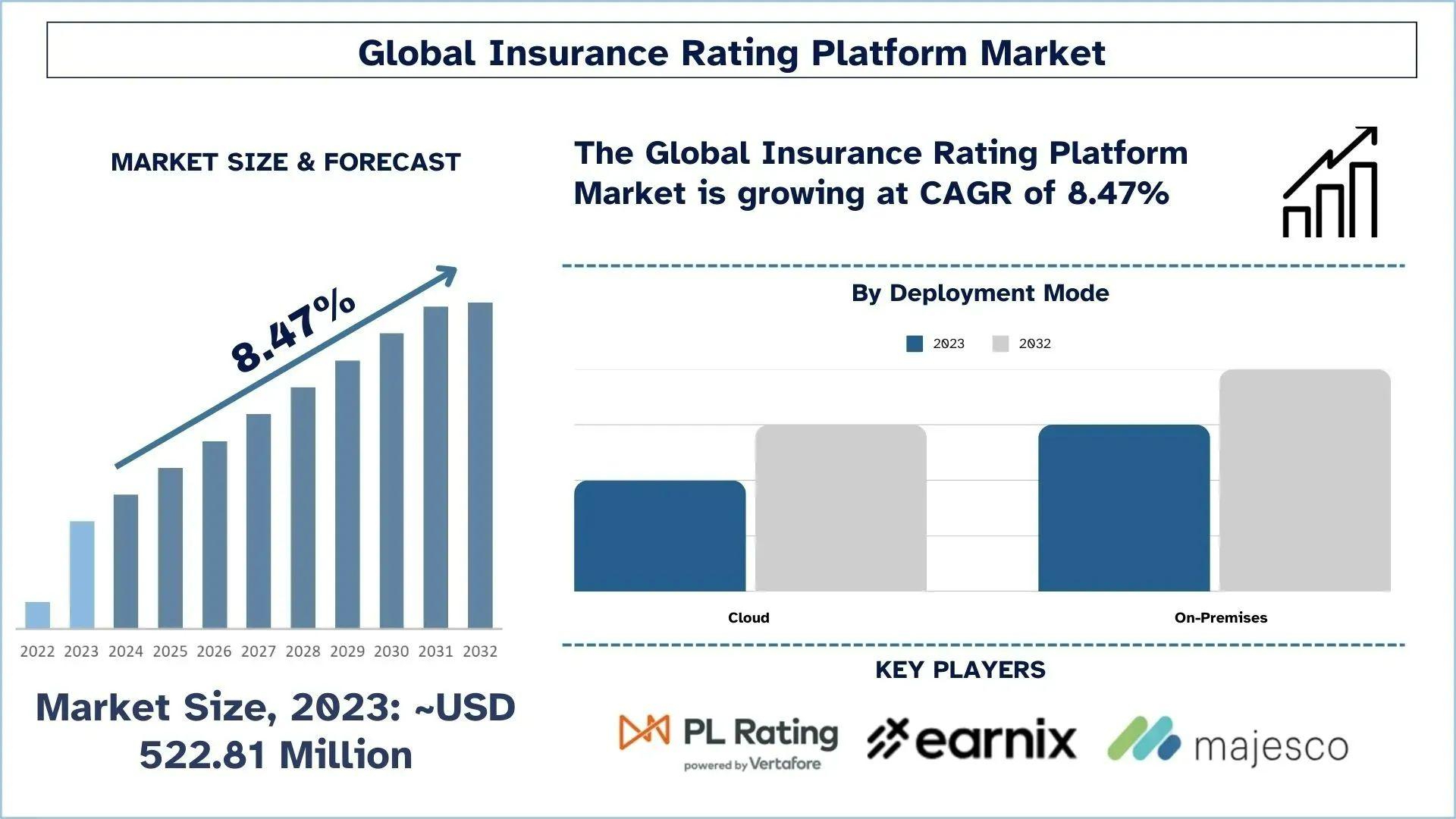

According to the UnivDatos, The Global Insurance Rating Platform Market was valued at USD 522.81 Million in 2023 and is expected to grow at a strong CAGR of around 8.47% during the forecast period (2024-2032).

Agiliux made its strategic market entry into UK territory through a May 2024 announcement from its Singapore headquarters. Agiliux achieves a key development with this market entrance because it provides its technological advancements to the established broker-driven market. Agiliux has developed a comprehensive digital platform dedicated to full operational digitalization of broker processes that boosts operational productivity as well as regulatory compliance requirements.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/insurance-rating-platform-market?popup=report-enquiry

Agiliux's UK Launch: Strategic Significance

Agiliux has chosen to enter the UK because it finds both high potential for growth and a need for a digital shift in the local market. Independent brokers who dominate the UK insurance market seek advanced technology solutions to enhance operational efficiency and boost customer service because of their growing demand for process streamlining. The company directs its business model at this market sector because it sees the potential to leverage the rising demand for compliant digital solutions.

Mohandeep Singh from Agiliux explained how the UK market attracts his company because its commercial lines and independent brokerage segment are more advanced compared to Asian countries. Agiliux stands to enhance its market presence because the active broker-driven industry, together with UK industry maturity, combined makes this market appealing for growth.

Benefits of Agiliux's Software for Insurance Brokers: Agiliux software brings multiple essential advantages to UK insurance brokers through its system.

· The platform centralizes all brokerage operations through one integrated system that covers all processes from broking slip development to placement as well as technical accounting services. The all-encompassing system design enables simpler workflow operations that eliminate the challenges brought by using separate systems.

· The solutions from Agiliux operate to maintain complete compliance standards established by the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). The platform introduces regulatory compliance controls into its working processes to assist brokers in achieving their local regulatory requirements.

· Through cloud-based deployment, brokers can access their data anywhere since it stays exclusively in the UK while reducing exposure to cyber-attacks. The system architecture enables brokers to work remotely and operate more efficiently.

· The platform integrates with other systems through API-based interfaces and open system architecture which allows brokers to make connections that bring together policy administration systems with CRM tools and analytical platforms.

Impact on the Insurance Rating Platform Market: The entry of Agiliux into the UK market generates multiple effects within the insurance rating platform market.

Agiliux solutions provide end-to-end digitalization that improves broker operations thus indirectly helping insurance rating platforms enhance their efficiency. The fast and precise data exchange secreted by optimized operational flows is vital for reliable insurance rate assessments as well as underwriting activities.

Agiliux maintains a regulatory compliance focus to keep insurance brokers in step with new evolving standards during operations. Insurance rating platforms need this compliance standard to perform accurate and compliant risk assessments because they must follow the same requirements.

Agiliux uses its innovative digital framework for brokerage operations to lead the way toward innovative practices across the entire insurance technology industry. The focus on digital transformation at Agiliux stimulates innovation within insurance rating platforms so they can implement better technology solutions while improving their services.

Click here to view the Report Description & TOC https://univdatos.com/reports/insurance-rating-platform-market

Conclusion

Agiliux enters the UK marketplace to spearhead digital transformation initiatives within the insurance brokerage business sector. The combination of full digital solutions and regulatory standards makes Agiliux powerful enough to assist insurance brokers in increasing their performance and development. The UK market entry demonstrates both the necessity of digital innovation and compliance for achieving better operational efficiency and customer service in the insurance rating platform domain. The UK operations of Agiliux will help advance insurance industry innovation while promoting the adoption of modern technological solutions.

Related Report

Private Health Insurance Market: Current Analysis and Forecast (2024-2032)

Cyber Insurance Market: Current Analysis and Forecast (2024-2032)

India Travel Insurance Market: Current Analysis and Forecast (2024-2032)

India Motor Insurance Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness