UK Disaster Recovery as a Service Market Trends, Growth, and Forecast 2025-2033

UK Disaster Recovery as a Service Market Overview

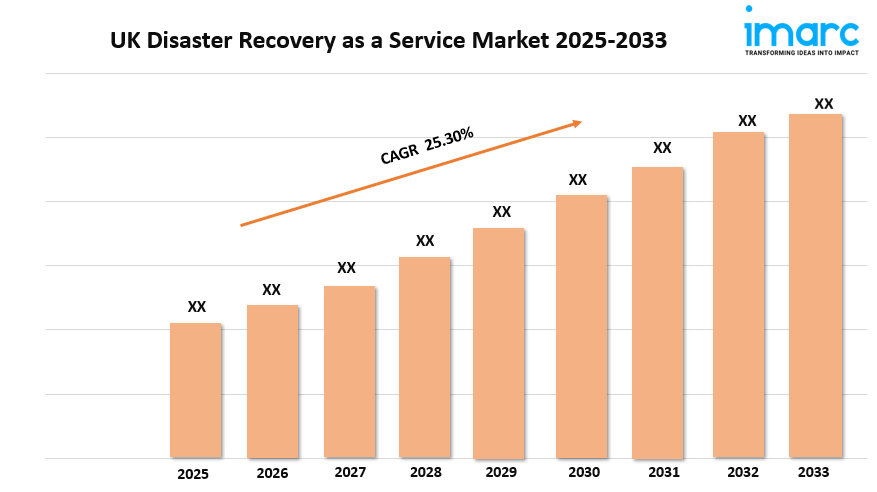

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 25.30% (2025-2033)

More businesses now depend on digital systems. This raises the need for strong data protection. It also highlights the importance of maintaining seamless operations. This market is witnessing steady growth as organizations focus on resilience against disruptions. According to the latest report by IMARC Group, the UK disaster recovery as a service market size reached USD 356.18 million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,711.63 million by 2033, exhibiting a growth rate (CAGR) of 25.30% during 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/uk-disaster-recovery-as-a-service-market/requestsample

UK Disaster Recovery as a Service Trends and Drivers:

The UK Disaster Recovery as a Service (DRaaS) market is growing fast. Businesses need to protect important data and keep operations running. This growth is due to rising cyber threats and natural disruptions. Companies in finance, healthcare, and retail are focusing on strong disaster recovery solutions. These solutions help reduce risks from ransomware, system failures, and unexpected outages. DRaaS is a cost-effective choice compared to traditional in-house systems. It lets businesses use cloud-based infrastructure for quick data restoration and less downtime. The flexibility of DRaaS is appealing. Companies can customize recovery plans to fit their needs without high upfront costs. Also, advanced technologies like artificial intelligence and machine learning are boosting DRaaS capabilities. They help automate threat detection and improve recovery processes. As businesses use hybrid and multi-cloud strategies, DRaaS providers offer more flexible solutions. This ensures smooth integration with existing IT setups. This trend shows a shift toward proactive risk management. Companies see a strong IT infrastructure as key. It helps them stay competitive and build customer trust.

Regulatory compliance and data sovereignty are also shaping the UK DRaaS market. Businesses must meet strict requirements like GDPR and other industry standards. DRaaS providers meet this need. They offer local data storage and recovery solutions. This keeps sensitive information in the UK and meets legal obligations. SMEs are adopting DRaaS. Affordable subscription models make disaster recovery planning easier and cheaper. Remote work and digital transformation are growing. This increases the need for DRaaS solutions that help with distributed IT setups. These solutions ensure secure access to data and applications from anywhere. Partnerships between DRaaS providers and managed service providers are growing. They offer complete solutions that combine disaster recovery with cybersecurity and IT support. This blending of services is building more trust in DRaaS. Businesses want comprehensive strategies to tackle evolving risks. As the market develops, competition among providers is spurring innovation. The focus is on quicker recovery times, improved security features, and easy-to-use interfaces. This approach aims to meet the diverse needs of UK businesses.

UK Disaster Recovery as a Service Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest UK disaster recovery as a service market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Service Type Insights:

- Backup and Recovery Services

- Real-time Replication Services

- Data Protection Services

- Professional Services

Service Provider Insights:

- Cloud Service Providers

- Managed Service Providers

- Telecom and Communication Service Providers

- Others

Deployment Mode Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

End-User Insights:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Vertical Insights:

- BFSI

- IT

- Government

- Healthcare

- Manufacturing

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

Street: Morgan Park QLD 4370

City/Town: Warwick

State/Province/Region: Queensland

Country: Australia

Zip/Postal Code: 4370

Email: sales@imarcgroup.com

Phone Number: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness