Dental Insurance Market Analysis by Size, Growth, & Research Report (2025–2033) | UnivDatos

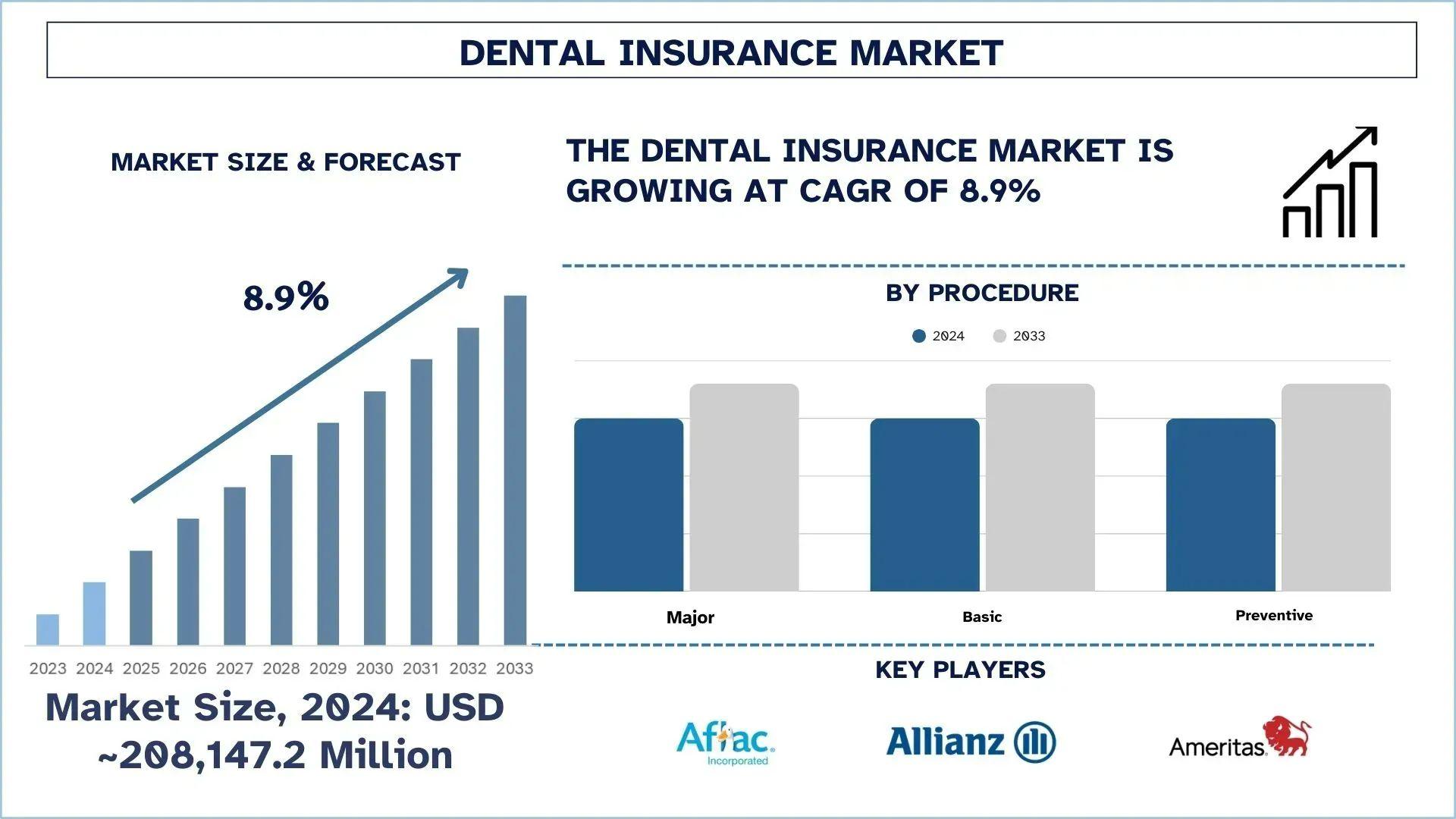

According to the UnivDatos, rising awareness of oral health and the increasing costs of dental treatments in emerging markets drive the Dental Insurance market. As per their “Dental Insurance Market” report, the global market was valued at USD 208,147.2 Million in 2024, growing at a CAGR of about 8.9% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The dental insurance market has been growing gradually over the years due to enhanced consciousness on the matter by clients, rising dental care costs, and increased focus has been placed on insurance costs and preventive procedures. In recent years, people have become more concerned with finding cheaper and more convenient methods of financing dental procedures and insurance plans that can range from limited to preventive care only to all-inclusive comprehensive plans. Mostly, defined benefit is employed by employers in the developed countries, while the developing countries’ people and companies are embracing new trends like public-private partnerships, accompanied by the increasing middle class. Market can also be attributed to an increase by digital transformation, where insurance is also using telehealth, mobile apps, and big data analytics to improve user experience and service delivery. Playing roles of health awareness, financial requirement, and technology advancement, the dental insurance market is evolving toward consumers’ focus on a global level.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/dental-insurance-market/?popup=report-enquiry

The Growing Demand for Dental Insurance

Dental insurance is on the rise due to the awareness pertaining to oral health and the rise in the costs of dental care. With people offering more time and resources to prevent disease and invest more in dental health, insurance provides an appropriate method to regulate costs, referring to checkups, Annual General Dental Care, fillings, and other operations. Furthermore, the awareness of oral–general health correlation exposes people to seek insurance to avert medical complications as a result of untreated dental diseases. Employers are also including dental care within group insurance health care policies; simultaneously, governments of several countries are implementing or improving state-funded dental insurance programs. This indeed depicts a rising trend because more and more people are embracing the need to cover their oral health needs through preventive, cost-effective, and easily accessible methods as opposed to curative methods.

Latest Trends in the Dental Insurance Market

The Dental Insurance market is experiencing dynamic shifts, influenced by evolving consumer preferences and innovative product developments. Key trends include:

Integration of Artificial Intelligence (AI)

AI continues to grow in its place in the dental insurance market at a very rapid rate. The innovations in AI technology are specifically enabling more streamlined handling of claims and diagnostics, as well as better identification of any occurring fraud. Soft cognitive services are being used by insurers to enable them to make claims regarding speeding up the process of arriving at a decision and increasing the accuracy of such a decision. Another of its applications is employed for medical insurance by analyzing data to determine a client’s dental health and suggest preventative measures. The members explain that in daily dentistry, AI helps in diagnosis, for instance, in the analysis of X-rays to check for possible cavities or signs of gum diseases that need referral for intervention. These increased efficiencies through the integration of AI into both the insurance industry and the clinical realm are enabling insurance plans to be less expensive while also creating ease in dental access for all parties.

Rise of Teledentistry

The practice of teledentistry is currently slowly picking up in the dental insurance market and is a common feature in today’s world due to the advancement in information technology and the high costs of going physically to a dental practitioner. With the help of the Internet, patients can contact a dentist online and get a consultation on further treatment, diagnostics, and prescriptions. This serves a significant role, especially in areas not served by a dentist or in the countryside. The follow-up appointment is also done through teledentistry to ensure the patient does not travel a long distance before they are attended to. The growing number of dental insurances covering teledentistry means that it is now viable for people to embrace this type of service. It has also been predicted that the use of teledentistry will increase in the near future since it serves as a supplement or augmentation to the traditional approaches to care delivery in oral health.

Focus on Preventive Care

Today, another important area in dental insurance is undergoing evolution, which implies that it is now more focused on preventive services, including examination, prophylactic treatment, and screening for diseases later on. This trend is attributed to the shift in perceptions that it is possible to save cash in the long run and avoid intricate operations, for example, root canal treatments or extractions. Many insurers currently allow full or low deductibles for preventive services with a view to ensuring that individuals visit the dentist regularly. This not only makes a long-term economic sense for insurance companies as well as for patients, but it has also proven to be beneficial in most overall health-related matters, such as linking dental health with such diseases as heart disease, diabetes, and stroke. Hence, the dental insurance business is about controlling the incidence and prevalence of diseases with the thought that higher levels of proactive care put the cost of health care under check while improving the lives of its members.

Consolidation through Mergers and Acquisitions

The overall development and growth in the dental insurance industry show increased action by large insurance firms, where they acquire small dental insurers and DSOs to consolidate a stronger market base and offer services. An instance of this is the acquisition of DentaQuest by Sun Life Financial, which is one of the largest dental benefit providers in the United States, to increase the firm’s scope of specialization in dental insurance. Such acquisitions and mergers make it possible for companies to maximize on the concept of economies of scale and at the same time, make it possible for the companies to offer more services to their customers. Moreover, through consolidations, such resources and technologies get improved by bringing them together and increasing innovation in areas of claims processing, customer services, and care delivery. This is because competition is anticipated to rise and, therefore, the appraisal of organizations to reposition themselves in the current markets.

Technological Advancements

There is increasing adoption of technology in dentistry, whereby the insurance companies have been adopting high technology when dealing with their clients, including digital systems, mobile applications, and telemedicine. Insurers are adopting new technologies that allow customer to access information about their plans, file claims, and make appointments with their preferred providers. Specifically, mobile applications that are utilized by clients enable them to monitor their dental health status, access entitlement, and be reminded of the check-up or treatment sessions, hence enhancing customer experience. Also, new technologies in the healthcare sector are being employed to allow for consultations via video conferencing and other techniques that would have otherwise taken many months before approval for such consultations to be made. Thus, utilizing technology is a significant step towards ensuring satisfaction and attainment of the optimum oral health status of the insurer’s members.

Click here to view the Report Description & TOC https://univdatos.com/reports/dental-insurance-market/

Shaping the Future of Dental Insurance: A Focus on Innovation and Accessibility

Today, changes and innovation, as well as population needs, drive the development of the market for dental insurance. Due to innovations such as AI, as well as the advent of teledentistry, combined with increased emphasis on preventive care and patient-centered care plans, the available dental coverage is now more consumer-oriented and time-effective. Some changes that the industry has mirrored involve issues such as an aging population and increased focus on preventive services in order to improve health as a whole. With context to Merger & Acquisition practices that push the market to consolidate and new technologies that create increased patient engagement and satisfaction, the future of dental insurance prospers through increased accessibility, affordability, and patient-tailored solutions to everybody who wants to retain their dental health of teeth with simplicity and confidence.

Related Report:-

Cyber Insurance Market: Current Analysis and Forecast (2024-2032) -

Mobile Health (mHealth) Application Market: Current Analysis and Forecast (2020-2027)

Dental Practice Management Software Market: Current Analysis and Forecast (2022-2028)

Healthcare Discount Plan Market: Current Analysis and Forecast (2023-2030)

Healthcare Fraud Detection Market: Current Analysis and Forecast (2021-2027)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness