Large Drilling Rig Market Size, Share & Top 10 Players | CAGR 5.6% Forecast 2026–2034

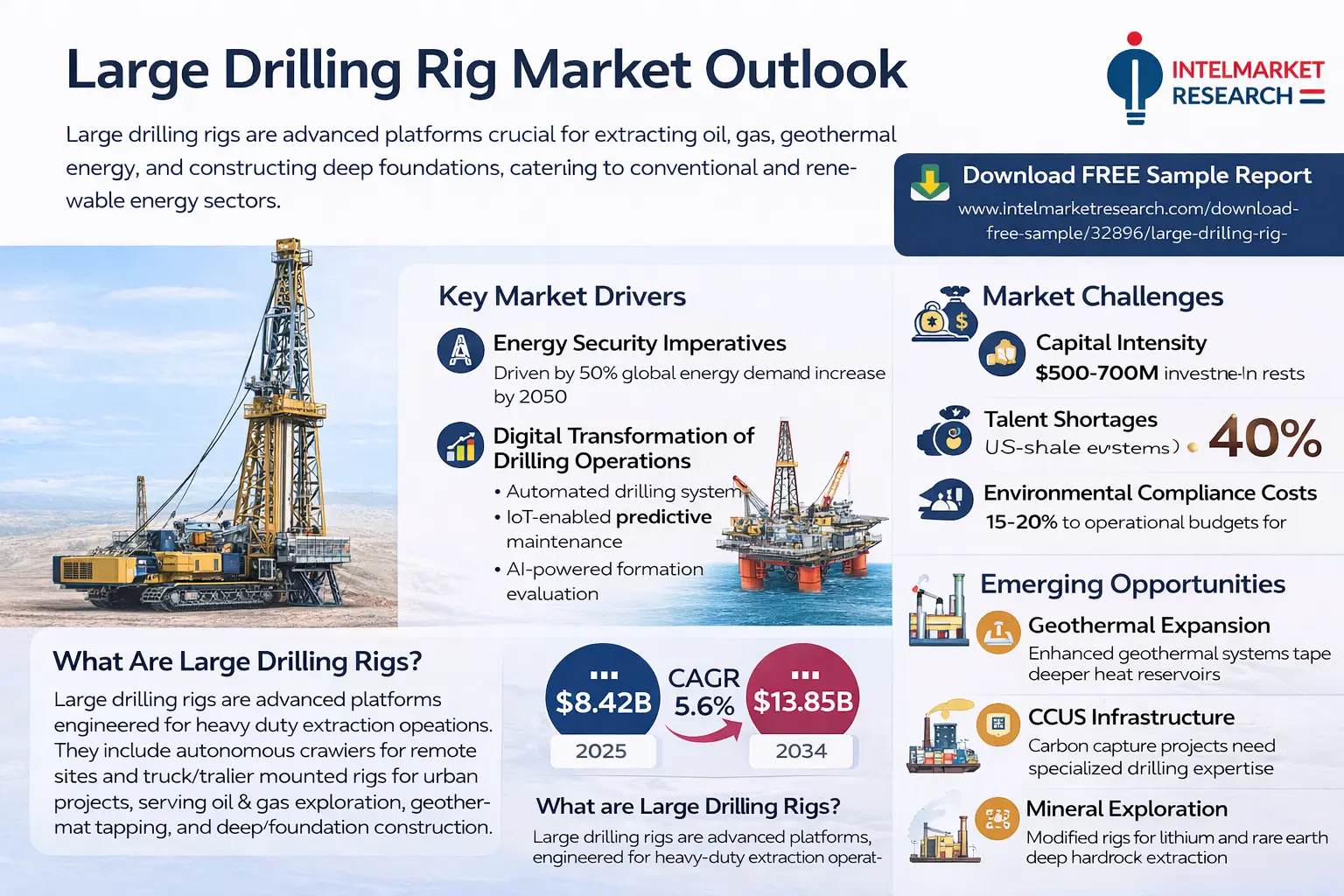

According to a new report from Intel Market Research, Global Large Drilling Rig market was valued at USD 8.42 billion in 2025 and is projected to reach USD 13.85 billion by 2034, growing at a CAGR of 5.6% during the forecast period (2026–2034). This expansion is fueled by increasing energy demands, technological advancements in drilling systems, and robust infrastructure development across emerging economies.

What Are Large Drilling Rigs?

Large drilling rigs represent the backbone of modern extraction industries, engineered for heavy-duty operations in challenging environments. These sophisticated platforms are categorized into autonomous crawlers for remote locations and versatile truck/trailer-mounted rigs for urban infrastructure projects. Their applications span oil & gas exploration, geothermal energy tapping, and deep foundation construction - making them indispensable for both conventional and renewable energy sectors.

This comprehensive analysis offers stakeholders a 360-degree view of market dynamics, from macroeconomic influences to micro-level competitive intelligence. The report decodes complex market behavior patterns through rigorous SWOT and value chain analysis, while benchmarking 15+ industry leaders across operational parameters.

For strategic planners and investors, these insights reveal where technology disruptions are occurring, which regional markets are primed for growth, and how regulatory shifts are reshaping profitability models. The findings are particularly valuable for equipment manufacturers, service providers, and policymakers navigating this capital-intensive sector.

Download FREE Sample Report:

https://www.intelmarketresearch.com/download-free-sample/32896/large-drilling-rig-marketLarge Drilling Rig Market Size, Share & Top 10 Players | CAGR 5.6% Forecast 2026–2034

According to a new report from Intel Market Research, Global Large Drilling Rig market was valued at USD 8.42 billion in 2025 and is projected to reach USD 13.85 billion by 2034, growing at a CAGR of 5.6% during the forecast period (2026–2034). This expansion is fueled by increasing energy demands, technological advancements in drilling systems, and robust infrastructure development across emerging economies.

What Are Large Drilling Rigs?

Large drilling rigs represent the backbone of modern extraction industries, engineered for heavy-duty operations in challenging environments. These sophisticated platforms are categorized into autonomous crawlers for remote locations and versatile truck/trailer-mounted rigs for urban infrastructure projects. Their applications span oil & gas exploration, geothermal energy tapping, and deep foundation construction - making them indispensable for both conventional and renewable energy sectors.

This comprehensive analysis offers stakeholders a 360-degree view of market dynamics, from macroeconomic influences to micro-level competitive intelligence. The report decodes complex market behavior patterns through rigorous SWOT and value chain analysis, while benchmarking 15+ industry leaders across operational parameters.

For strategic planners and investors, these insights reveal where technology disruptions are occurring, which regional markets are primed for growth, and how regulatory shifts are reshaping profitability models. The findings are particularly valuable for equipment manufacturers, service providers, and policymakers navigating this capital-intensive sector.

📥 Download FREE Sample Report: https://www.intelmarketresearch.com/download-free-sample/32896/large-drilling-rig-market