Funded Trading Platforms Explored: Fundedfirm vs Brightfunded

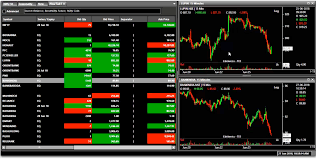

For traders looking to trade with real capital without risking personal funds, FundedFirm vs BrightFunded offers two compelling options. Both platforms provide professional trading accounts and pathways to develop skills, manage real funds, and grow as a trader through a funded account. Yet, they differ in assessment methods, account flexibility, profit distribution, and support services. Understanding these differences can help traders align with a platform that suits their strategy and long-term goals.

The Entry Process

The first step in funded trading is the evaluation phase. Brightfunded uses a structured process with defined profit targets and strict risk rules. This ensures discipline but may feel restrictive for traders who rely on adaptive strategies in volatile markets.

For traders looking to trade with real capital without risking personal funds, FundedFirm vs BrightFunded offers two compelling options. Both platforms provide professional trading accounts and pathways to develop skills, manage real funds, and grow as a trader through a funded account. Yet, they differ in assessment methods, account flexibility, profit distribution, and support services. Understanding these differences can help traders align with a platform that suits their strategy and long-term goals.

The Entry Process

The first step in funded trading is the evaluation phase. Brightfunded uses a structured process with defined profit targets and strict risk rules. This ensures discipline but may feel restrictive for traders who rely on adaptive strategies in volatile markets.

Funded Trading Platforms Explored: Fundedfirm vs Brightfunded

For traders looking to trade with real capital without risking personal funds, FundedFirm vs BrightFunded offers two compelling options. Both platforms provide professional trading accounts and pathways to develop skills, manage real funds, and grow as a trader through a funded account. Yet, they differ in assessment methods, account flexibility, profit distribution, and support services. Understanding these differences can help traders align with a platform that suits their strategy and long-term goals.

The Entry Process

The first step in funded trading is the evaluation phase. Brightfunded uses a structured process with defined profit targets and strict risk rules. This ensures discipline but may feel restrictive for traders who rely on adaptive strategies in volatile markets.