Global Managed IT Infrastructure Services Market Anticipated to Expand Rapidly From 2025 to 2029

Use Code ONLINE20 to Save 20% On Global Market Reports – Gain Access to Trusted Market Data, Growth Indicators, and Industry Analytics

What Is the Current Size and Annual Growth Rate of the Managed IT Infrastructure Services Market?

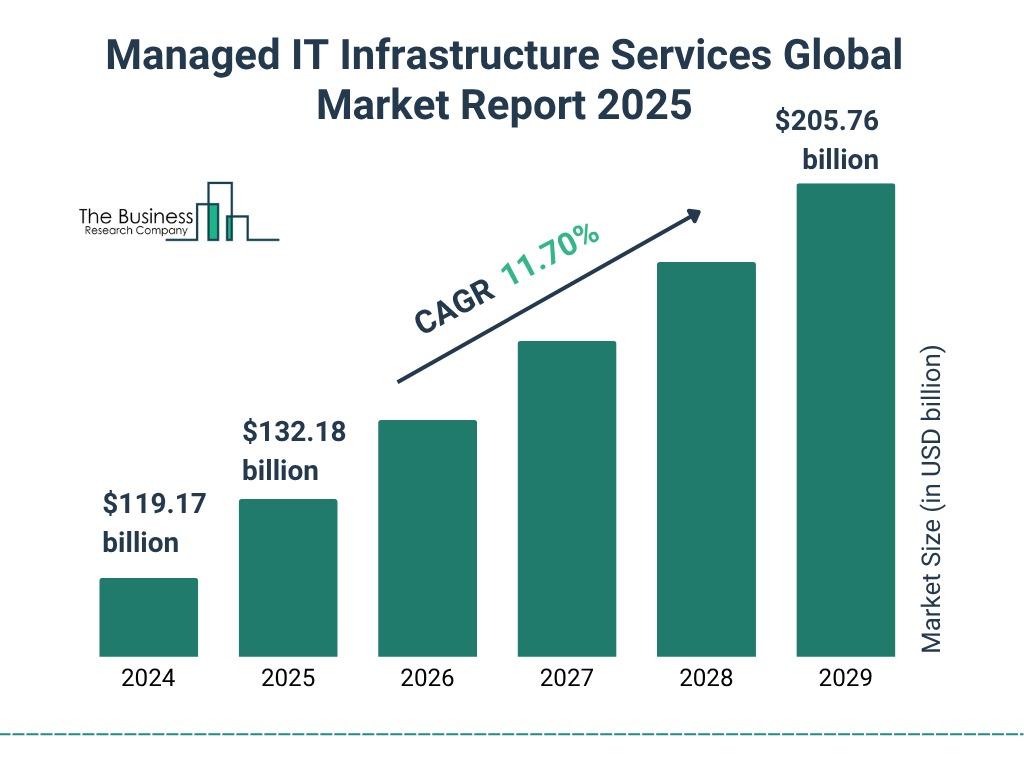

The managed it infrastructure services market size has grown rapidly in recent years. It will grow from $119.17 billion in 2024 to $132.18 billion in 2025 at a compound annual growth rate (CAGR) of 10.9%. The growth in the historic period can be attributed to rising complexity of it environments, cost optimization strategies, focus on core competencies, increasing cybersecurity concerns, scalability and flexibility needs.

The managed it infrastructure services market size is expected to see rapid growth in the next few years. It will grow to $205.76 billion in 2029 at a compound annual growth rate (CAGR) of 11.7%. The growth in the forecast period can be attributed to edge computing growth, cloud adoption, regulatory compliance requirements, data governance and management, pandemic-driven changes. Major trends in the forecast period include expanded genetic testing accessibility, rise in prophylactic measures, personalized treatment approaches, advancements in non-invasive screening, emergence of supportive therapies.

Get your free report sample today:

Managed IT Infrastructure Services Market Overview Report 2025 Sample (

https://www.thebusinessresearchcompany.com/sample.aspx?id=13210&type=smp)

What Are the Primary Factors Driving the Managed IT Infrastructure Services Market?

The increasing adoption of the Internet of Things (IoT) is expected to propel the growth of the managed IT infrastructure services market going forward. The Internet of Things (IoT) is a networked system of interconnected computing devices, mechanical and electronic machinery with unique identities (UIDs), and the capacity to transfer data without needing human-to-human or human-to-computer contact. Managed IT infrastructure services can help manage the scalability and complexity of IoT infrastructure by offering scalable software infrastructure, device management, enhanced security, and data management for IoT ecosystems. For instance, in September 2022, according to a report published by Ericsson, a Sweden-based telecommunications company, the global IoT connections reached 13.2 billion connections in 2022 and are expected to increase by 18% to 34.7 billion connections by 2028. Therefore, the increasing adoption of the Internet of Things (IoT) is driving the growth of the managed IT infrastructure services market.

How Is the Managed IT Infrastructure Services Market Categorized Based on Key Segments?

The managed it infrastructure servicesmarket covered in this report is segmented –

1) By Service Category: Virtualization, Networking, Storage, Servers

2) By Deployment Mode: On-Premises, Cloud

3) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

4) By End User: IT And Telecommunication, Retail, Transportation And Logistics, BFSI (Banking, Financial Services, And Insurance), Manufacturing, Other End Users

Subsegments:

1) By Virtualization: Server Virtualization, Desktop Virtualization, Application Virtualization

2) By Networking: Managed Network Services, Network Security Services, WAN Optimization Services

3) By Storage: Managed Storage Solutions, Backup And Disaster Recovery Services, Cloud Storage Solutions

4) By Servers: Managed Server Hosting, Server Maintenance And Support, Dedicated Server Services

Which Disruptive Trends Are Reshaping the Competitive Landscape of the Managed IT Infrastructure Services Market?

Major companies operating in the managed IT infrastructure services market are focusing on developing innovative solutions, such as cloud-delivered managed security solutions, to maximize their revenues in the market. Cloud-delivered managed security solutions refer to security technologies and services delivered and managed through the cloud and used to protect critical infrastructure and data from cyber threats. For instance, in February 2022, Juniper Networks Inc., a US-based developer and marketer of networking products, introduced Juniper Secure Edge, a cloud-delivered security solution. With the help of this new solution, enterprises could secure their workforces wherever they are by delivering firewall-as-a-service (FWaaS) as a single-stack software architecture. Its key features include unified policy management from a single UI (user interface) for all security use cases with dynamic zero-trust segmentation, investment protection, integration with any identity provider, and validated security effectiveness. Secure Edge provides a consistent security policy framework with policies that dynamically update based on new risk and attack vectors and follow users wherever they go. Automated access restrictions are provided to workers and outside contractors through granular policy management.

Who Are the Major Companies Operating in the Managed IT Infrastructure Services Market?

Major companies operating in the managed it infrastructure services market report are Microsoft Corporation, Verizon Communications Inc., AT&T Inc., Dell Inc., Lenovo Group Ltd., Accenture PLC, International Business Machines Corporation, Cisco Systems Inc., Fujitsu Limited, Canon Inc., Hewlett Packard Development Company L.P., Toshiba Corp., Tata Consultancy Services Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, NEC Corporation, Capgemini America Inc., NTT Ltd., Cognizant Technology Solutions Corp., Infosys Limited, DXC Technology Corporation, Atos SE, Wipro Ltd., HCL Technologies Limited, CGI Group Inc., Xerox Holdings Corp., Rackspace Inc., LTIMindtree Limited, Unisys Corporation, Cybernet Software Systems Inc., Happiest Minds Technologies Limited

Get the detailed managed it infrastructure services market report today

Managed IT Infrastructure Services Market Overview Report 2025 (

https://www.thebusinessresearchcompany.com/report/managed-it-infrastructure-services-global-market-report)

Which Region Holds the Largest Share of the Managed IT Infrastructure Services Market?

North America was the largest region in the managed IT infrastructure services market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the managed it infrastructure services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

#Contact Us:#

The Business Research Company: Market Research Reports (

https://thebusinessresearchcompany.com/)

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email: info@tbrc.info (mailto:info@tbrc.info)

#Follow Us On:#

LinkedIn: The Business Research Company | LinkedIn (

https://in.linkedin.com/company/the-business-research-company)

Global Managed IT Infrastructure Services Market Anticipated to Expand Rapidly From 2025 to 2029

Use Code ONLINE20 to Save 20% On Global Market Reports – Gain Access to Trusted Market Data, Growth Indicators, and Industry Analytics

What Is the Current Size and Annual Growth Rate of the Managed IT Infrastructure Services Market?

The managed it infrastructure services market size has grown rapidly in recent years. It will grow from $119.17 billion in 2024 to $132.18 billion in 2025 at a compound annual growth rate (CAGR) of 10.9%. The growth in the historic period can be attributed to rising complexity of it environments, cost optimization strategies, focus on core competencies, increasing cybersecurity concerns, scalability and flexibility needs.

The managed it infrastructure services market size is expected to see rapid growth in the next few years. It will grow to $205.76 billion in 2029 at a compound annual growth rate (CAGR) of 11.7%. The growth in the forecast period can be attributed to edge computing growth, cloud adoption, regulatory compliance requirements, data governance and management, pandemic-driven changes. Major trends in the forecast period include expanded genetic testing accessibility, rise in prophylactic measures, personalized treatment approaches, advancements in non-invasive screening, emergence of supportive therapies.

Get your free report sample today:

Managed IT Infrastructure Services Market Overview Report 2025 Sample (https://www.thebusinessresearchcompany.com/sample.aspx?id=13210&type=smp)

What Are the Primary Factors Driving the Managed IT Infrastructure Services Market?

The increasing adoption of the Internet of Things (IoT) is expected to propel the growth of the managed IT infrastructure services market going forward. The Internet of Things (IoT) is a networked system of interconnected computing devices, mechanical and electronic machinery with unique identities (UIDs), and the capacity to transfer data without needing human-to-human or human-to-computer contact. Managed IT infrastructure services can help manage the scalability and complexity of IoT infrastructure by offering scalable software infrastructure, device management, enhanced security, and data management for IoT ecosystems. For instance, in September 2022, according to a report published by Ericsson, a Sweden-based telecommunications company, the global IoT connections reached 13.2 billion connections in 2022 and are expected to increase by 18% to 34.7 billion connections by 2028. Therefore, the increasing adoption of the Internet of Things (IoT) is driving the growth of the managed IT infrastructure services market.

How Is the Managed IT Infrastructure Services Market Categorized Based on Key Segments?

The managed it infrastructure servicesmarket covered in this report is segmented –

1) By Service Category: Virtualization, Networking, Storage, Servers

2) By Deployment Mode: On-Premises, Cloud

3) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

4) By End User: IT And Telecommunication, Retail, Transportation And Logistics, BFSI (Banking, Financial Services, And Insurance), Manufacturing, Other End Users

Subsegments:

1) By Virtualization: Server Virtualization, Desktop Virtualization, Application Virtualization

2) By Networking: Managed Network Services, Network Security Services, WAN Optimization Services

3) By Storage: Managed Storage Solutions, Backup And Disaster Recovery Services, Cloud Storage Solutions

4) By Servers: Managed Server Hosting, Server Maintenance And Support, Dedicated Server Services

Which Disruptive Trends Are Reshaping the Competitive Landscape of the Managed IT Infrastructure Services Market?

Major companies operating in the managed IT infrastructure services market are focusing on developing innovative solutions, such as cloud-delivered managed security solutions, to maximize their revenues in the market. Cloud-delivered managed security solutions refer to security technologies and services delivered and managed through the cloud and used to protect critical infrastructure and data from cyber threats. For instance, in February 2022, Juniper Networks Inc., a US-based developer and marketer of networking products, introduced Juniper Secure Edge, a cloud-delivered security solution. With the help of this new solution, enterprises could secure their workforces wherever they are by delivering firewall-as-a-service (FWaaS) as a single-stack software architecture. Its key features include unified policy management from a single UI (user interface) for all security use cases with dynamic zero-trust segmentation, investment protection, integration with any identity provider, and validated security effectiveness. Secure Edge provides a consistent security policy framework with policies that dynamically update based on new risk and attack vectors and follow users wherever they go. Automated access restrictions are provided to workers and outside contractors through granular policy management.

Who Are the Major Companies Operating in the Managed IT Infrastructure Services Market?

Major companies operating in the managed it infrastructure services market report are Microsoft Corporation, Verizon Communications Inc., AT&T Inc., Dell Inc., Lenovo Group Ltd., Accenture PLC, International Business Machines Corporation, Cisco Systems Inc., Fujitsu Limited, Canon Inc., Hewlett Packard Development Company L.P., Toshiba Corp., Tata Consultancy Services Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, NEC Corporation, Capgemini America Inc., NTT Ltd., Cognizant Technology Solutions Corp., Infosys Limited, DXC Technology Corporation, Atos SE, Wipro Ltd., HCL Technologies Limited, CGI Group Inc., Xerox Holdings Corp., Rackspace Inc., LTIMindtree Limited, Unisys Corporation, Cybernet Software Systems Inc., Happiest Minds Technologies Limited

Get the detailed managed it infrastructure services market report today

Managed IT Infrastructure Services Market Overview Report 2025 (https://www.thebusinessresearchcompany.com/report/managed-it-infrastructure-services-global-market-report)

Which Region Holds the Largest Share of the Managed IT Infrastructure Services Market?

North America was the largest region in the managed IT infrastructure services market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the managed it infrastructure services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

#Contact Us:#

The Business Research Company: Market Research Reports (https://thebusinessresearchcompany.com/)

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email: info@tbrc.info (mailto:info@tbrc.info)

#Follow Us On:#

LinkedIn: The Business Research Company | LinkedIn (https://in.linkedin.com/company/the-business-research-company)