South Africa Telecom Market Report 2025 | Growth, Size, and Forecast by 2033

Market Overview

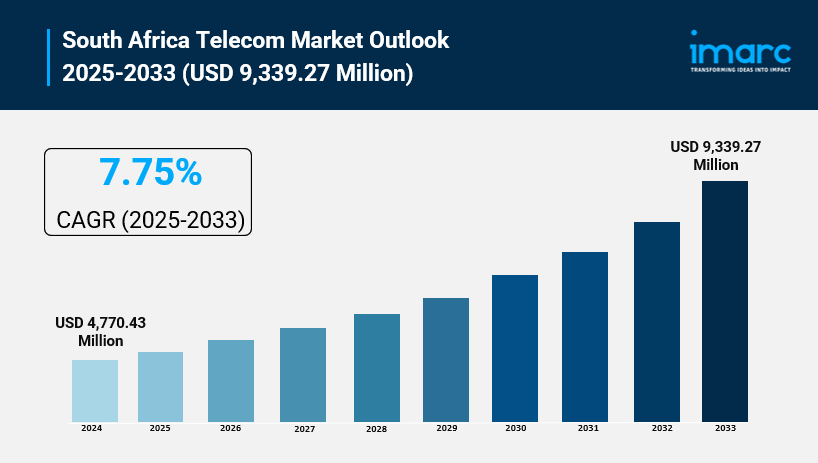

The South Africa telecom market size reached USD 4,770.43 Million in 2024 and is expected to grow significantly, reaching USD 9,339.27 Million by 2033, as per IMARC Group. The market is expanding due to fast mobile coverage growth and increased smartphone penetration. Operators are diversifying towards digital content, cloud computing, mobile financial services, and enterprise solutions. Public-private infrastructure investments and supportive government policies also contribute to market expansion. The forecast period covers 2025-2033 with a CAGR of 7.75%. For more details, visit the South Africa Telecom Market.

How AI is Reshaping the Future of South Africa Telecom Market

- AI-powered network optimization is enabling telecom operators to improve service quality and manage increasing traffic volumes effectively, as evidenced by the expansion in 4G and 5G networks.

- AI-driven data analytics are helping providers customize digital content and value-added services, catering to diverse customer requirements from individuals to SMEs and large corporations.

- Government-backed initiatives like Operation Vulindlela Phase II include digital transformation reforms, where AI plays a critical role in streamlining and enhancing service delivery.

- AI applications in mobile financial services and cloud computing allow telecom operators to create new revenue streams through value-added digital offerings.

- Telecom operators are leveraging AI to facilitate bundled solutions with fintech and content players, improving customer loyalty and driving digital ecosystem integration.

- Investments such as Vodacom's infrastructure spending aim to boost network coverage and 5G services, with AI technologies instrumental in managing and optimizing these network expansions.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-telecom-market/requestsample

Market Growth Factors

The rapid expansion of mobile coverage and the growing adoption of smartphones are key drivers fueling South Africa telecom market growth. Mobile operators' substantial investments in 4G and 5G network infrastructure are bridging the digital divide between urban and rural regions. These efforts not only enhance coverage but also support the rising demand for high-speed mobile internet, which is crucial for voice communication, mobile banking, and entertainment. Operators capitalize on this trend through competitive pricing on data packages and device financing schemes to increase their customer base, including the burgeoning use of mobile platforms for e-commerce and online education.

The momentum in South Africa's telecom market is further accelerated by the rising adoption of digital services and value-added products. Telecom operators are broadening their offerings beyond conventional voice and data services to include digital content, cloud computing, mobile financial services, and enterprise solutions. Customized service bundles address the specific needs of various customer segments, ranging from individuals to small and medium enterprises and large corporations. Collaborations between telecommunication companies, fintech firms, and content providers facilitate bundled solutions that enhance customer loyalty. The growing reliance on digital ecosystems is promoting platform-based models, positioning telecom operators as pivotal players in the nation's digital transformation.

Government policies and infrastructure development initiatives play a crucial role in supporting market expansion. Regulatory bodies such as the Independent Communications Authority of South Africa (ICASA) promote competition, optimize spectrum allocation, and encourage broadband access in underserved areas. Initiatives like the SA Connect program aim to improve internet access in schools, hospitals, and rural communities, creating a conducive environment for telecom companies to scale their networks and operations. Government incentives and investment-friendly policies attract both domestic and foreign capital towards telecom infrastructure projects, including fiber-optic networks and data centers. This regulatory environment is central to accelerating high-speed network deployment and achieving national digital inclusion goals.

The market report offers a comprehensive analysis of the segments, highlighting those with the largest South Africa telecom market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Market Segmentation

Services Insights:

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and Pay-tv Services

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Developement & News

- May 2025: President Cyril Ramaphosa launched Operation Vulindlela Phase II, focusing on accelerating structural reforms including digital transformation reforms. This integrates digital strategies to enhance economic growth and job creation, stimulating telecom sector innovation.

- May 2025: Vodacom announced a R20 billion ($1.1 billion) infrastructure investment for 2025–2026, targeting expanded 5G services and improved network coverage in underserved South African regions, reflecting commitment to national connectivity enhancement.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Musik

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness