Brazil Aquaculture Market Size, Share, Forecast, Outlook 2033

Brazil Aquaculture Market Overview

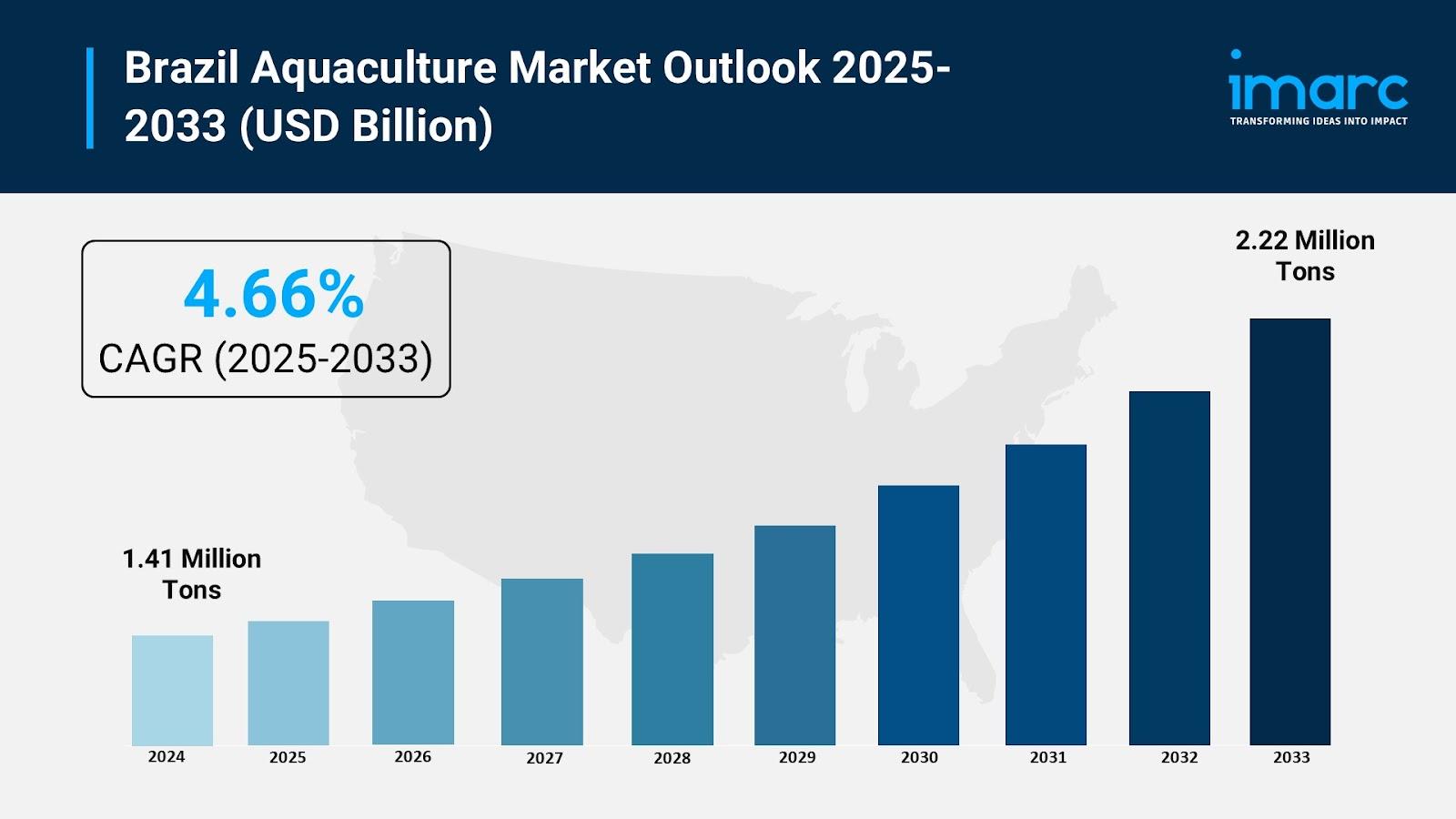

The Brazil aquaculture market size was 1.41 Million Tons in 2024 and is expected to reach 2.22 Million Tons by 2033. It is projected to grow at a CAGR of 4.66% during the forecast period from 2025 to 2033. The market growth is fueled by increasing seafood demand, supportive government policies, abundant freshwater resources, and advancements in aquaculture technologies.

Study Assumption Years

- Base Year: 2024

- Historical Period: 2019-2024

- Forecast Period: 2025-2033

Brazil Aquaculture Market Key Takeaways

- The Brazil aquaculture market size was 1.41 Million Tons in 2024.

- The market is forecast to grow at a CAGR of 4.66% from 2025 to 2033.

- The market is projected to reach 2.22 Million Tons by 2033.

- Brazil’s aquaculture industry produced a record 968,745 tons in 2024, growing 9.21% from 2023.

- Tilapia led production with 662,230 tons, a 14.36% increase and constituting 68.36% of total production.

- Exports doubled to 13,792 tons, valued at $59 Million, with the U.S. accounting for 89% of exports.

- Government initiatives promote certifications like ASC and GlobalG.A.P. to boost exports.

Sample Request Link: https://www.imarcgroup.com/brazil-aquaculture-market/requestsample

Brazil Aquaculture Market Growth Factors

The Brazil aquaculture market is being propelled by rising demand for seafood, especially tilapia, driven by both domestic consumption and export growth. In 2024, total aquaculture production reached 968,745 tons, marking a 9.21% increase from 2023, with tilapia leading at 662,230 tons (+14.36%), accounting for over two-thirds of production. This growth is supported by abundant freshwater resources and government support aimed at sustainable fish farming and infrastructure development such as ports and cold chains.

Technological adoption is another key driver, with advanced automated feeding systems, water quality monitoring sensors, and data analytics improving production efficiency and reducing feed waste. Notable innovations include a 2025 partnership between Brazilian Fish and the U.S.-based Center for Aquaculture Technologies to commercialize genetically edited tilapia, accelerating growth and disease resistance while improving sustainability.

Export-oriented expansion further boosts growth prospects. Brazil’s exports of aquaculture products doubled in volume in 2024 to 13,792 tons, valued at $59 Million, primarily destined for North America, notably the U.S. at 89%. Efforts to attain global certifications like ASC and GlobalG.A.P. facilitate market access. The favorable climate and land availability strengthen Brazil’s position as a competitive global seafood exporter, attracting foreign investment and enhancing profitability.

Brazil Aquaculture Market Segmentation

Fish Type:

- Freshwater Fish: This segment comprises fish species predominantly farmed in freshwater environments, representing the largest share of production, driven largely by tilapia cultivation.

- Molluscs: This category includes various mollusk species farmed within Brazil, contributing to the diversity of aquaculture products.

- Crustaceans: Encompasses species such as shrimp, an area of growing interest highlighted by recent research investments.

- Others: Other lesser-represented aquatic species cultivated in the Brazilian aquaculture market.

Environment:

- Fresh Water: Dominant environment for aquaculture production due to Brazil’s extensive freshwater availability, supporting species like tilapia.

- Marine Water: Aquaculture in saline ocean environments contributing to overall market growth.

- Brackish Water: Mixed saline and freshwater habitats used for farming specific aquaculture species.

Distribution Channel:

- Traditional Retail: Conventional market outlets facilitating consumer access to aquaculture products.

- Supermarkets and Hypermarkets: Modern retail formats increasingly distributing aquaculture products to meet consumer demand.

- Specialized Retailers: Niche market players focusing on aquaculture goods.

- Online Stores: Growing segment driven by e-commerce platforms expanding product availability.

- Others: Additional distribution channels servicing the market.

Regional Insights

The report covers major Brazilian regions including Southeast, South, Northeast, North, and Central-West. Brazil’s aquaculture market shows significant production growth, with the Southeast and South regions being particularly influential owing to their advanced infrastructure and favorable climatic conditions, facilitating sustainable expansion and export activities.

Recent Developments & News

In July 2025, HIPRA introduced immersion vaccination for Brazilian aquaculture, enhancing disease prevention in juvenile fish and boosting immunity and production efficiency, with robust local support in R&D and diagnostics. Moreover, in November 2024, Canadian firm Onda inaugurated a satellite facility in Brazil for whiteleg shrimp trials, aiming to optimize shrimp nutrition, growth, and survival, underpinning the rapidly expanding shrimp sector.

Key Players

- Brazilian Fish

- Center for Aquaculture Technologies (CAT)

- HIPRA

- Onda

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization:- https://www.imarcgroup.com/request?type=report&id=41472&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness