United States Clinical Trial Supplies Market Size, Share, Industry Trends, Growth Factors and Forecast 2025-2033

IMARC Group has recently released a new research study titled “United States Clinical Trial Supplies Market Size, Share, Trends and Forecast by Services, Phase, Therapeutic Area, End-Use Industry, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

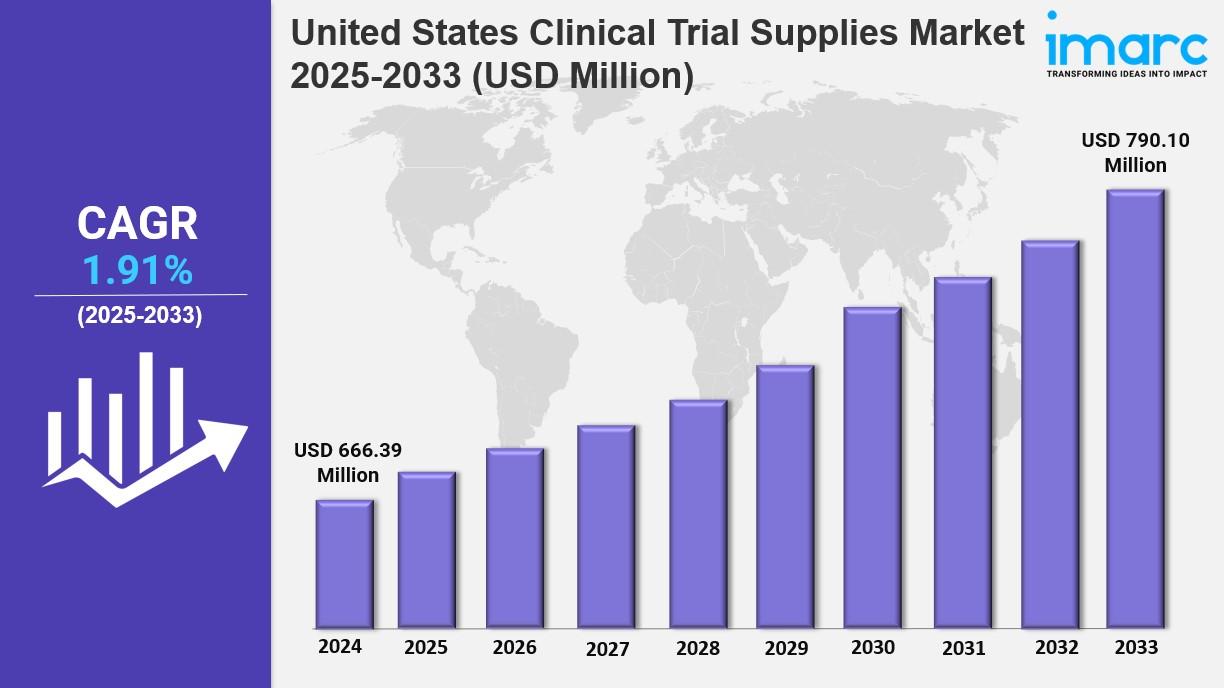

The United States clinical trial supplies market size was valued at USD 666.39 Million in 2024 and is expected to reach USD 790.10 Million by 2033, with a CAGR of 1.91% during the forecast period of 2025-2033. Advancements in medical research and drug development are primarily driving growth. Market dynamics favor efficient supply chain management focused on timely delivery, digital innovation, and localized infrastructure development.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

United States Clinical Trial Supplies Market Key Takeaways

-

Current Market Size: USD 666.39 Million in 2024

-

CAGR: 1.91% (2025-2033)

-

Forecast Period: 2025-2033

-

The growing complexity of clinical trials is driving a stronger focus on supply chain efficiency across the US.

-

Digital innovation, such as e-labeling and real-time data tracking, is improving trial accuracy and operational flexibility.

-

There is a strategic shift toward domestic manufacturing and infrastructure to ensure secure and scalable supply chains.

-

The Phase III segment accounts for 46.8% market share in 2024, reflecting significant late-stage trial activity.

-

The cardiovascular diseases therapeutic area led the market in 2024 with a 33.2% share.

Sample Request Link: https://www.imarcgroup.com/united-states-clinical-trial-supplies-market/requestsample

Market Growth Factors

The market growth is mainly driven by improved healthcare outcomes for patients in the United States, due to numerous advancements in drug development and medical research. As the report states, clinical trials grow in complexity so sponsors ensure delivery is timely, tracking is real-time, and product temperature is controlled. Advanced logistics solutions as well as greatly improved packaging technologies help to improve cost efficiency. They do also reduce waste so this supports the overall market for expansion.

Digital innovation transforms clinical trial supply processes crucially. The integration of e-labeling with automated systems for ordering and the real-time tracking of data are streamlining operations and minimizing errors made manually. They also improve communication among sponsors and trial sites. AI-powered analytics are used since they support demand forecasting and optimize inventory, particularly in hybrid and decentralized trial models, and since they improve trial accuracy, speed, and compliance while they increase operational flexibility.

Toward localized clinical trial supply, the growing calculated shift is another important growth driver. Pharmaceutical company investments are growing in US trial supply facilities to reduce import dependency. These facilities are enabling of a faster distribution and also help to meet expectations of a regulatory kind for supply chain transparency. For example, AstraZeneca announced back in 2025 a USD 50 Billion investment for establishing some new clinical trial supply sites for the reinforcement of local capabilities. Government supports with pharma's momentum accelerates development of secure, consistent, scalable US supply infrastructure.

United States Clinical Trial Supplies Market Segmentation

Services:

-

Product Manufacturing

-

Packaging, Labeling and Storage

-

Logistics and Distribution

The logistics and distribution segment led with a 28.6% market share in 2024, driven by the need for efficient supply chain solutions managing temperature-sensitive drugs and ensuring regulatory compliance across decentralized trials.

Phase:

-

Phase I

-

Phase II

-

Phase III

-

Others

Phase III dominated with 46.8% share in 2024, reflecting the demand for complex supply logistics, high-volume distribution, and longer-term storage for large late-stage trials.

Therapeutic Area:

-

Oncology

-

Cardiovascular Diseases

-

Respiratory Diseases

-

Central Nervous System (CNS) and Mental Disorders

-

Others

Cardiovascular diseases led the market with a 33.2% share in 2024, fueled by the prevalence of heart conditions requiring large-scale, long-term clinical trials and specialized packaging and monitoring.

End-Use Industry:

-

Medical Device Industry

-

Biopharmaceuticals Industry

-

Pharmaceuticals Industry

-

Others

The pharmaceutical industry accounted for 48.1% market share in 2024, driven by increasing trial complexity, large-scale multi-therapeutic area trials, and demand for advanced supply chain services.

Region:

-

Northeast

-

Midwest

-

South

-

West

Regional Insights

The Northeast region holds a strong position due to high concentrations of research institutions, hospitals, and biopharmaceutical companies. States like Massachusetts and New York contribute to consistent trial activity backed by proximity to regulators and well-established logistics networks. This makes the Northeast a priority zone for sourcing and distributing clinical trial materials efficiently, contributing robustly to market growth.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20636&flag=C

Recent Developments & News

-

June 2025: Oracle enhanced its Randomization and Trial Supply Management (RTSM) solution with drug pooling and interoperability advancements, improving efficiency and clinical trial execution.

-

April 2025: Suvoda and Greenphire merged, creating a unified platform to streamline clinical trials and improve patient outcomes under the Suvoda name.

-

February 2025: Selkirk Pharma launched ClinFAST to expedite clinical trial fill/finish processes, reducing production timelines while ensuring quality and scalability.

-

September 2024: PCI Pharma Services invested USD 365 Million in US and EU facilities for assembly and packaging drug-device combination products.

-

July 2024: MedPharm merged with Tergus Pharma to form an end-to-end CDMO focused on topical and transdermal pharmaceutical production.

Key Players

-

AstraZeneca

-

Siemens Healthineers

-

Oracle

-

Suvoda

-

Greenphire

-

Selkirk Pharma

-

PCI Pharma Services

-

MedPharm

-

Tergus Pharma

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- United_States_Clinical_Trial_Supplies_Market

- United_States_Clinical_Trial_Supplies_Market_Size

- United_States_Clinical_Trial_Supplies_Market_Share

- United_States_Clinical_Trial_Supplies_Market_Growth

- United_States_Clinical_Trial_Supplies_Market_Trends

- United_States_Clinical_Trial_Supplies_Market_Demand

- United_States_Clinical_Trial_Supplies_Market_Outlook

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness