Saudi Arabia Bottled Water Market 2025 | Size, Share, Trends, and Players to 2033

Saudi Arabia Bottled Water Market Overview

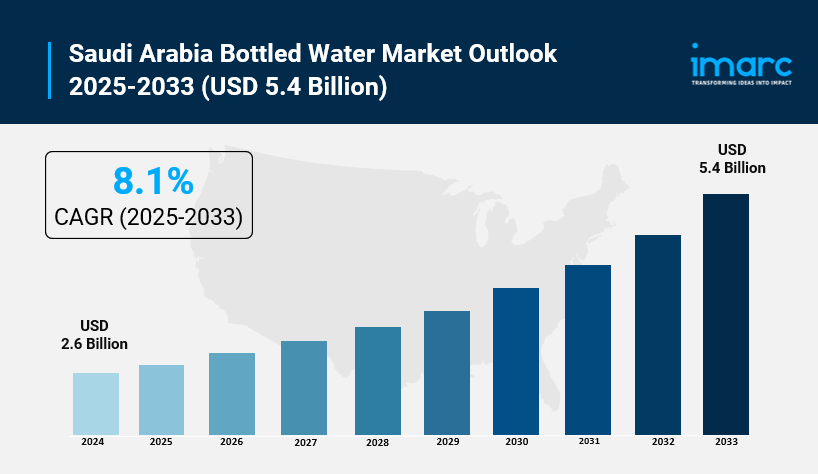

Market Size in 2024: USD 2.6 Billion

Market Size in 2033: USD 5.4 Billion

Market Growth Rate 2025-2033: 8.1%

According to IMARC Group's latest research publication, "Saudi Arabia Bottled Water Market Size, Share, Trends and Forecast by Type, Distribution Channel, Packaging Size, and Region, 2025-2033", The Saudi Arabia bottled water market size was valued at USD 2.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2033, exhibiting a CAGR of 8.1% from 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-bottled-water-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Bottled Water Market

- AI-powered quality control systems enhance water purity testing in Saudi bottling plants, ensuring safer products and reducing contamination risks.

- The government’s AI programs support smart water management technologies, improving resource efficiency in bottled water production and distribution.

- AI-driven demand forecasting helps companies like Almarai optimize supply chains, reducing waste and meeting consumer needs accurately.

- Personalized marketing powered by AI tailors bottled water product recommendations to Saudi consumers’ health preferences and lifestyle trends.

- AI-enabled automation increases production speed and packaging accuracy, boosting operational efficiency in Saudi Arabia’s bottled water industry.

Saudi Arabia Bottled Water Market Trends & Drivers:

Saudi Arabia bottled water market growth is propelled by the country’s arid climate and limited natural water sources, making bottled water a vital, safe hydration option. Rapid urbanization and a growing population increase demand for convenient bottled water, especially in cities like Riyadh and Jeddah. Government investments, such as the allocation of $80 billion towards water projects, support improved water quality and infrastructure that complement market growth. Rising disposable incomes also encourage consumers to prefer premium and functional bottled water varieties, creating a dynamic market with expanding opportunities.

Health consciousness is another key driver boosting bottled water consumption in Saudi Arabia. Consumers increasingly opt for mineral-enriched, vitamin-fortified, and sports-focused waters as part of a healthier lifestyle. Market leaders like Agthia Group are expanding production capacities for premium bottled water, responding to consumer demand for quality and wellness benefits. Sustainability is gaining traction too; companies such as Nova Water have launched 100% recycled bottles to reduce environmental impact, aligning product innovation with consumer preferences and government sustainability goals.

The rapidly growing tourism sector and increasing expatriate population also fuel bottled water demand. Pilgrimage cities like Makkah and Madinah see high bottled water consumption to ensure safe hydration for millions of visitors. Retail expansion, including e-commerce growth, improves distribution and availability across urban and rural areas. Large-scale acquisitions, like Almarai’s purchase of Pure Beverages for SR1.04 billion, highlight industry consolidation and strategic moves to broaden market reach. Together, these trends indicate a robust bottled water market offering diverse products and wide accessibility.

Saudi Arabia Bottled Water Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

- Still Water

- Sparkling Water

Breakup by Distribution Channel:

- Retail Channels

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Others

- Home and Office Delivery

- Foodservice

Analysis by Packaging Size:

- Less Than 330 ml

- 331 ml - 500 ml

- 501 ml - 1000 ml

- 1001 ml - 2000 ml

- 2001 ml - 5000 ml

- More than 5001 ml

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Bottled Water Market

- 2025 August: Major bottled water companies announce expansion of sustainable packaging initiatives in Saudi Arabia, introducing 100% recyclable bottles and implementing circular economy principles in production processes.

- 2025 July: Saudi Food and Drug Authority introduces new quality standards for bottled water production, promoting advanced filtration technologies and enhanced quality control systems across domestic manufacturers.

- 2025 June: Vision 2030 sustainability initiatives drive investment in local water source development and domestic production capabilities, reducing import dependence and supporting economic diversification goals.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness